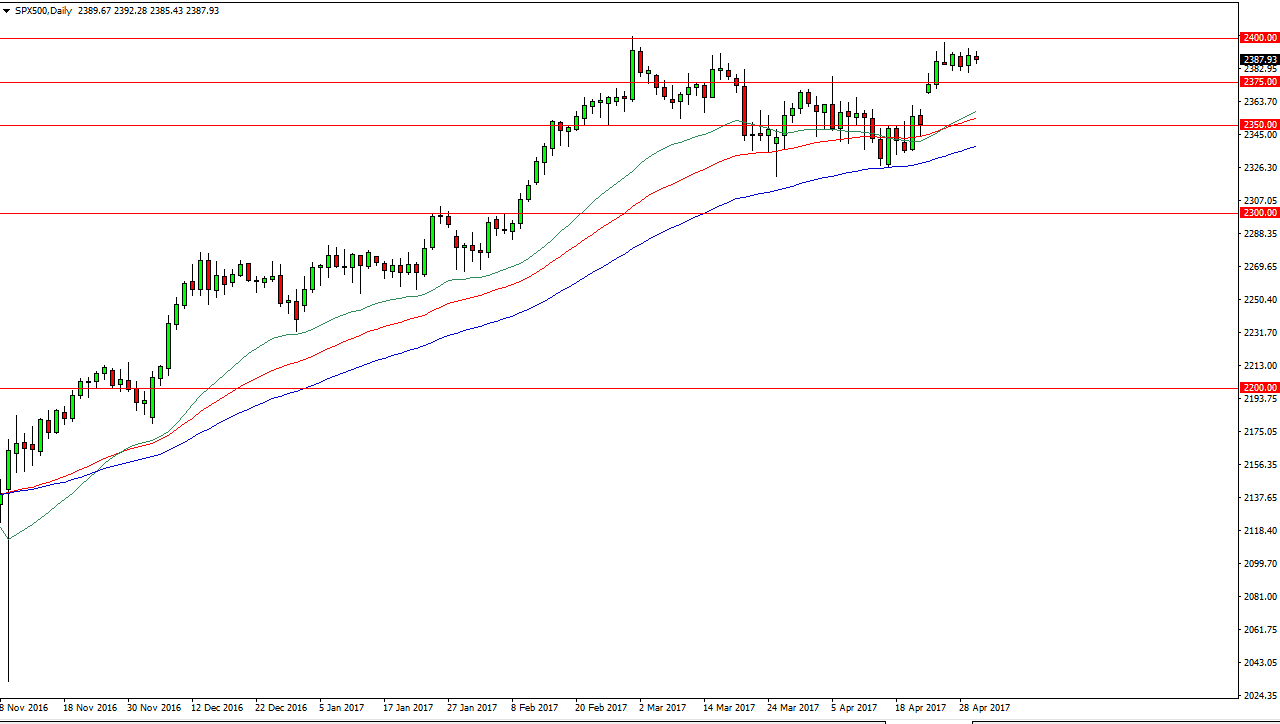

S&P 500

The S&P 500 had a relatively flat day with a slightly negative close during Tuesday’s trading hours. It looks currently that were stuck between 2375 on the bottom, and 2400 on the top. As soon as we can break above the 2400 level, I think that the market is ready to go much higher. This recent action has seen a gap, followed by consolidation. It typically means that we will eventually see some type of continuation of the move, and that’s essentially what I’m relying on. Pullbacks on short-term charts should continue to be buying opportunities and of course the breakout certainly will be as well. I still have a target of 2500 and am still very encouraged by what we have seen as of late.

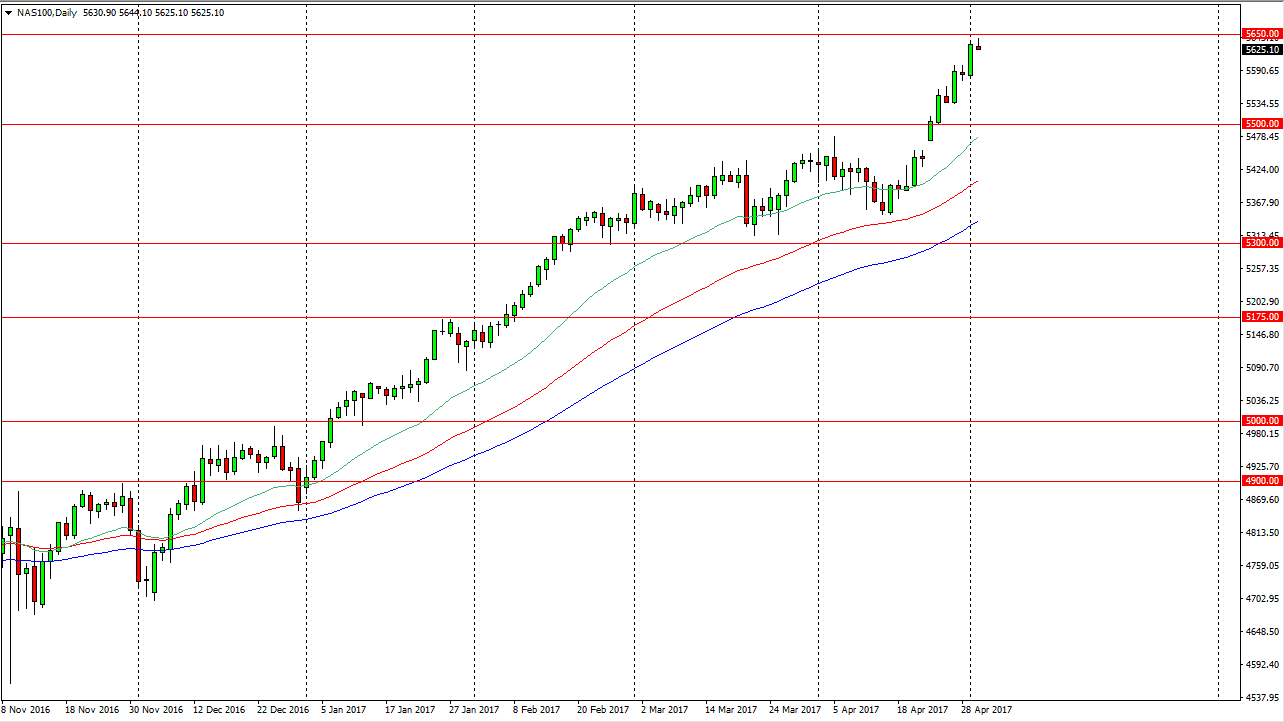

NASDAQ 100

The NASDAQ 100 reached towards the 5650 level but turned around during the day to form a bit of a shooting star. Having said that, with probably more important is the fact that Apple released its earnings after the bell rang, and they were a slight disappointment. That tends to weigh heavily upon the NASDAQ itself, so I think that we could get a little bit of a pullback. Nonetheless, that pullback is a positive thing as we have been a bit overextended. I would expect to see a lot of support at the 5500 level, and therefore have no interest in selling. Instead, I would rather wait for some type of significant pullback that I can take advantage of and use as value. This is a market place the quite frankly has lead the way for other indices and therefore I don’t want to bet against it. Alternately, we could break above the 5650 handle and that would of course be a buying opportunity as well. Nonetheless, I do prefer the pullback as it offers a better entry.