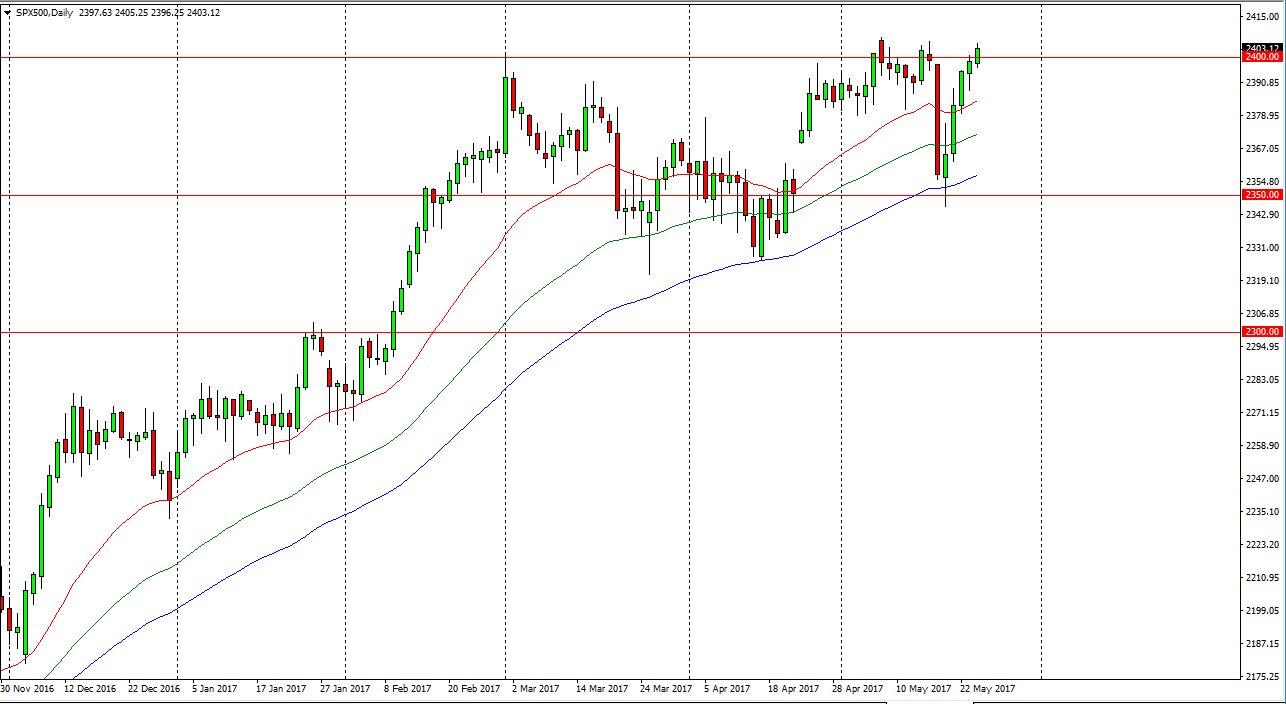

S&P 500

The S&P 500 rallied during the day on Wednesday, as we are trying to test the top of the recent range. If we can break above the 2406 level, the market should continue to go much higher, perhaps reaching towards the 2450 handle. Pullbacks of this point in time should continue to see buying opportunities based upon value, as we have a massive amount of buying pressure underneath. This has been a strong uptrend for some time, and therefore I believe that it’s only a matter of time before we not only find buyers underneath, but the market should continue to go much higher. I have a longer-term target of the 2500 level in the S&P 500. I have no interest in shorting, and believe that value hunters continue to return time and time again as the markets influence behavior based upon recent resiliency.

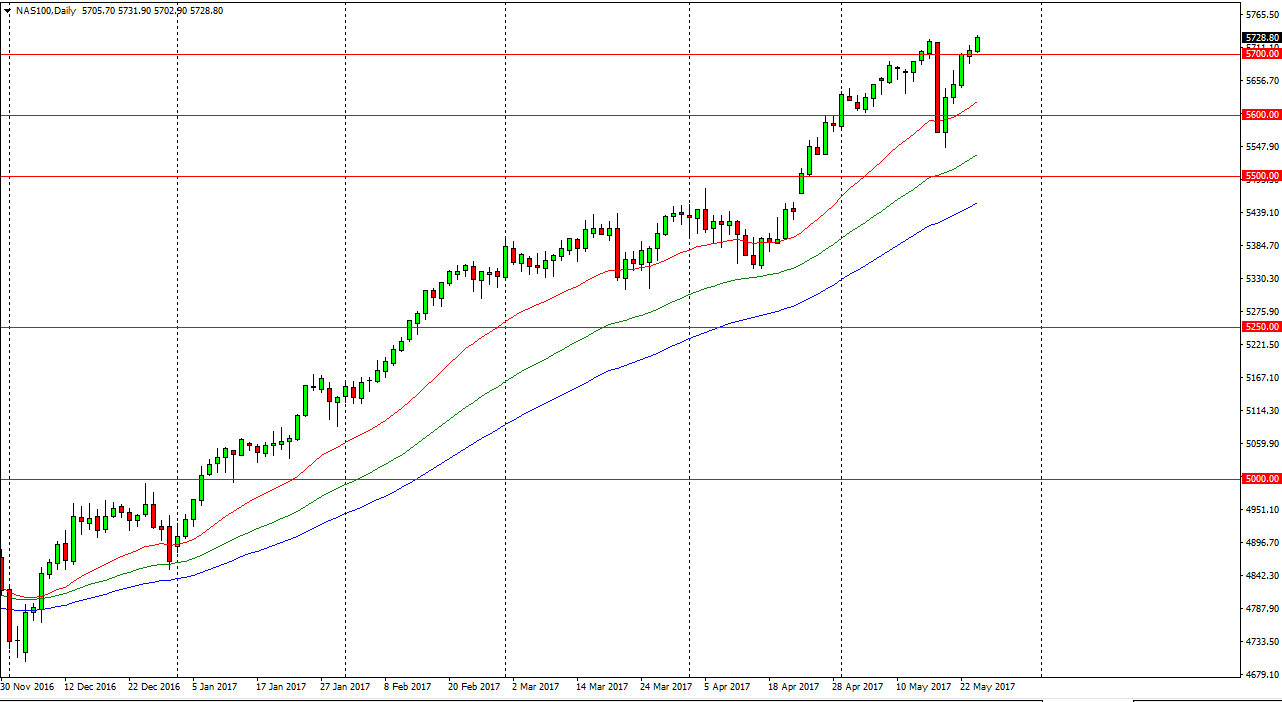

NASDAQ 100

The NASDAQ 100 rose during the session on Wednesday as well, and even made a fresh, new high. The market looks as if it is ready to continue climbing, and I now believe that we are reaching towards the 5800 level over the longer term. Even more long-term than that, I have a target of 6000. I believe the pullbacks will continue to be supported underneath, and that there should be a bit of a hard floor in this market near the 5600 level. Look at supportive candles and pullbacks as value that can be purchased in what is a very strong uptrend that continues to favor not only investors, but the short-term “buy on the dips” type of traitor.

The NASDAQ 100 continues to lead the way for other US indices, and I think that shorting is all but impossible to do as any pullback will more than likely attract a lot of attention from people who have missed most of the rally.