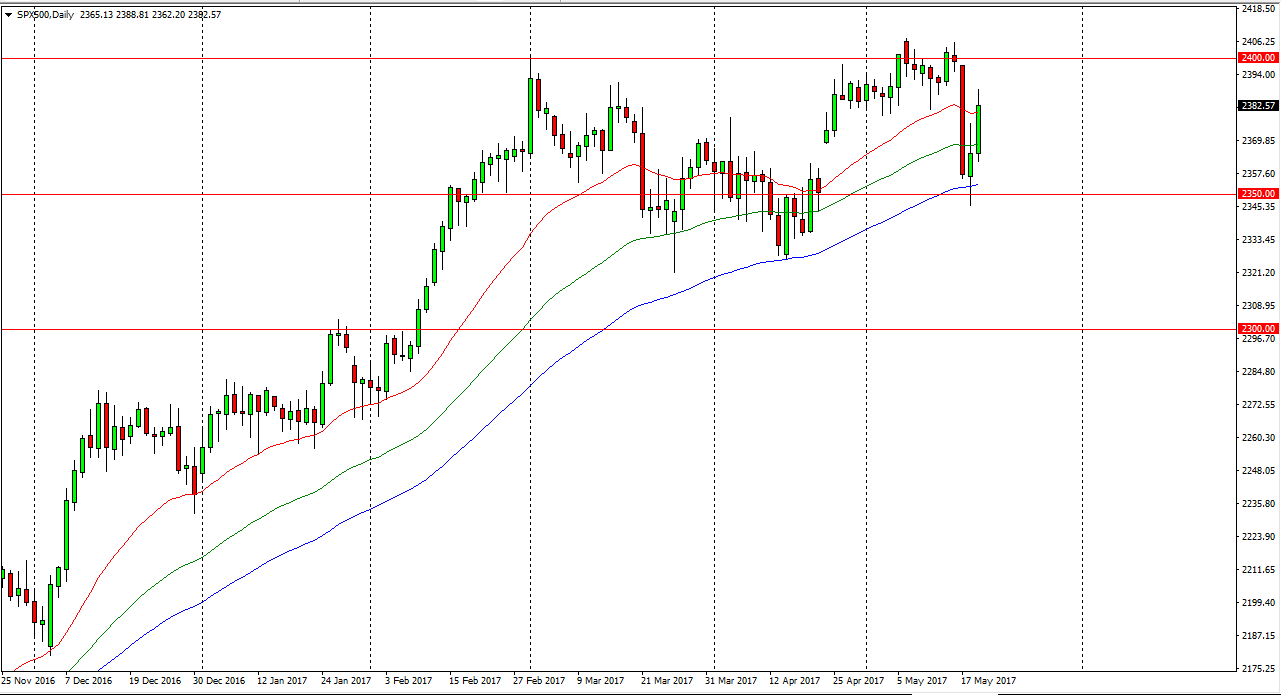

S&P 500

The S&P 500 had a bullish session on Friday, breaking above the top of the range from Thursday after the massive selloff on Wednesday. The 2350 level offered enough support to turn things back around, and reach towards the highs again at the 2400 level. I think going forward, buying short-term dips will be the way to go forward, and that the market will try to break above the 2405 level after that. Once we do, the market is much more comfortable going higher for the longer term. I don’t have any interest in shorting this market, and I believe that the trading environment will continue to favor short-term dips that offer value. I don’t have any interest in shorting this market, even though we have seen a significant amount of volatility.

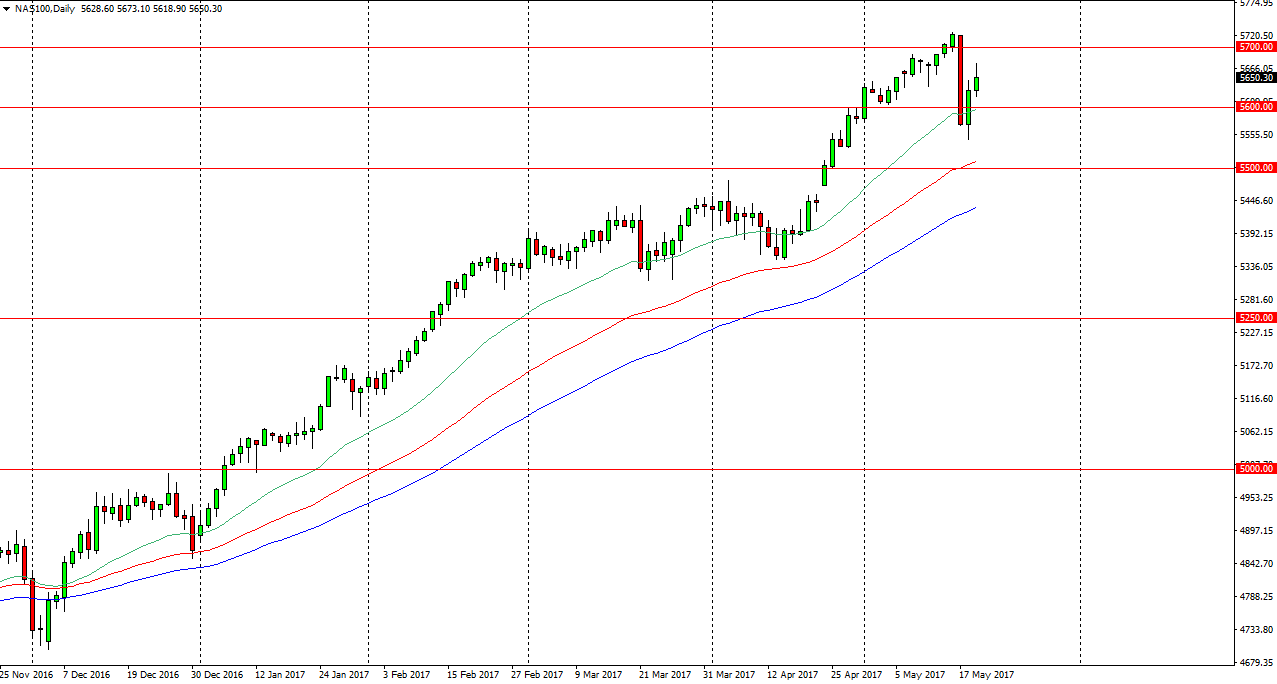

NASDAQ 100

The NASDAQ 100 also rallied on Friday, but turned around to form and exhaustive candle. This candle suggests that we may have to pull back, but I think the 5600 level will offer a significant amount of support. If we can break above the top of the candle on the other hand, we should then go to the 5720 handle. A break above there extends the longer-term rally. I believe that the actual “floor” in this market is closer to the 5500 level, so I don’t have any interest in shorting for any real length of time. I do recognize that short-term traders will more than likely be able to make a bit of profit to the downside, but I don’t have any interest in trying to fight the overall trend, and therefore taking a little bit of a break and waiting to have the market to the which direction to go, namely higher, will be a prudent way to trade a market that’s an extraordinarily strong uptrend.