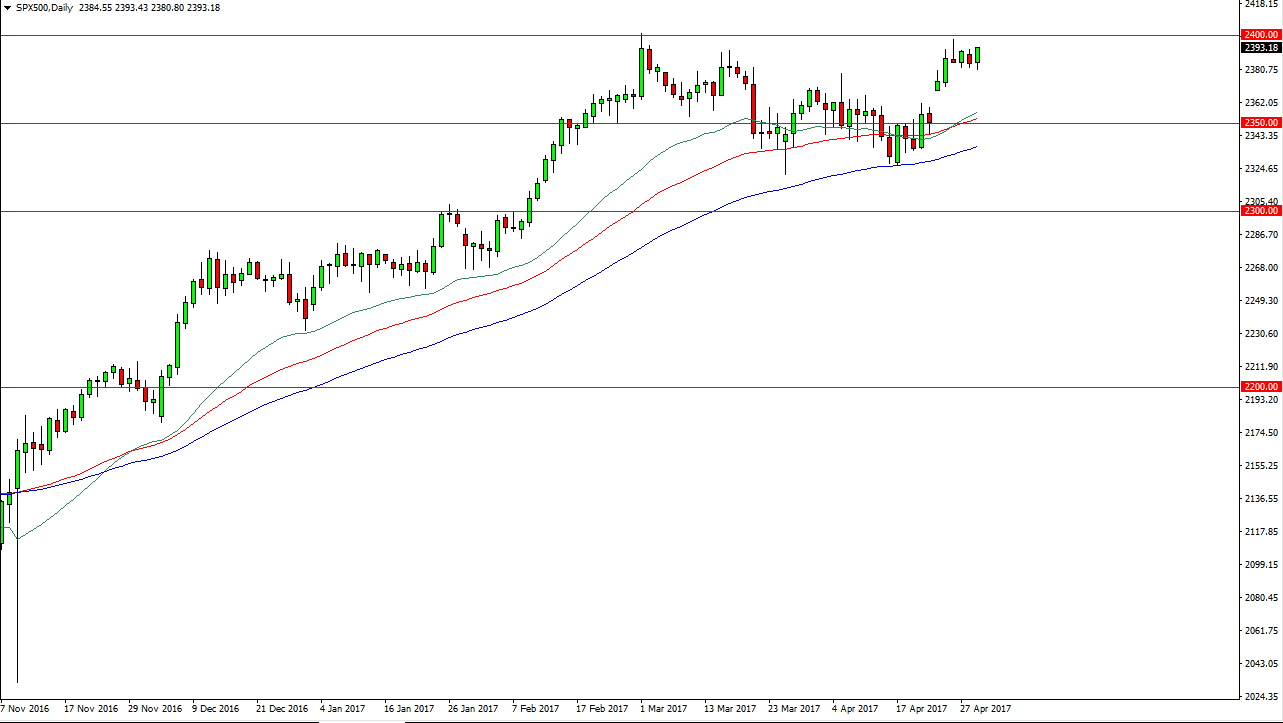

S&P 500

The S&P 500 rallied during the session on Monday, testing the 2400 level. I believe this area is rather resistive, so we can break above there I expect the market to take off to the upside. Alternately, we could have a pullback from here to fill the gap below, but at that point I think there should be plenty of buying pressure as well. In other words, even though we could drift a little bit lower I have no interest in shorting this market. I believe that the S&P 500 will continue to find buyers underneath, and with this being the case I think that buying is the only thing you can do. If you can find a short-term pullback that show signs of support, that might be reason enough to go long.

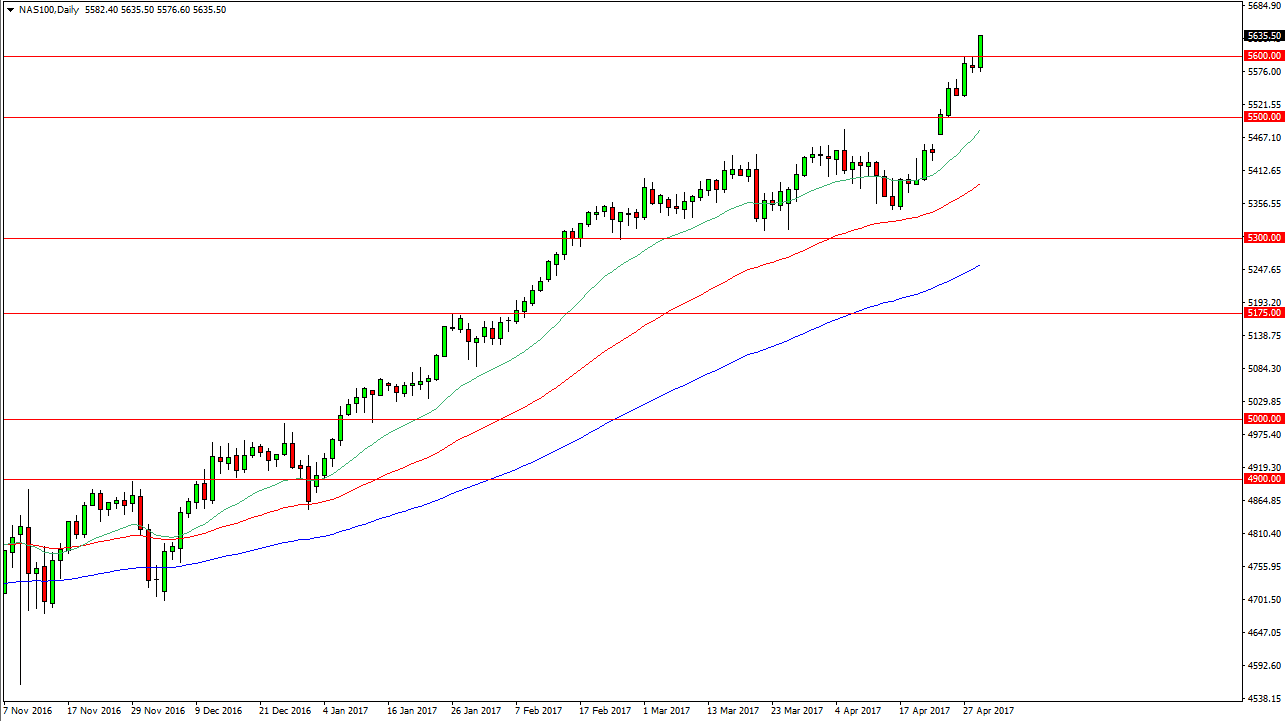

NASDAQ 100

The NASDAQ 100 broke out during the Monday session, clearing the 5600 level. This market looks very supportive, and it seems as if we are going to continue to see quite a bit of bullish pressure. Now that we have cleared the psychologically important level, I would have to think that short-term pullback should be buying opportunities. The 5600 level should now be support, as it was once resistance. The 5700 level above the should cause a little bit of psychological resistance, but we are obviously in a nice uptrend. I think any pullback at this point should be thought of as value and I believe that most traders that deal with the NASDAQ 100 would agree. We could drop all the way down to the 5500 level before I would consider this market even remotely in trouble. Because of this, I believe that the NASDAQ 100 continues to lead everything else higher, and therefore can be used as a bit of a barometer for the other stock indices.