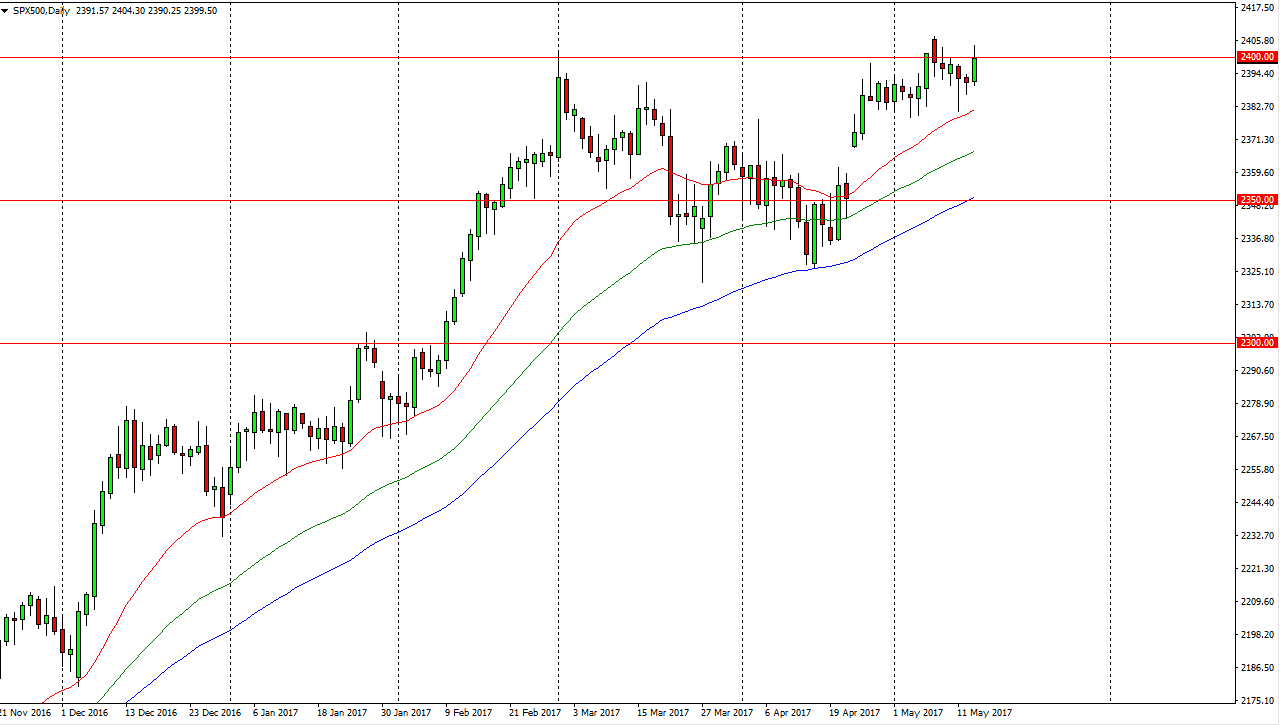

S&P 500

The S&P 500 rallied during the session on Monday, breaking above the 2400 level. That is a very bullish sign, so therefore think the buyers will continue to drive this market higher. There’s a gap just above there, so that could offer resistance but I think it’s only a matter of time before we breakout above there. Because of this, I think that pullbacks will continue to offer value the people take advantage of, as the S&P 500 has been so bullish. Once we break above the gap, the market should then go to the 2450 handle. That’s my longer-term target, and I believe that we will continue to find plenty of reasons to get there. After all, earning season wasn’t bad at all, and now the market should be free to go higher as they want to.

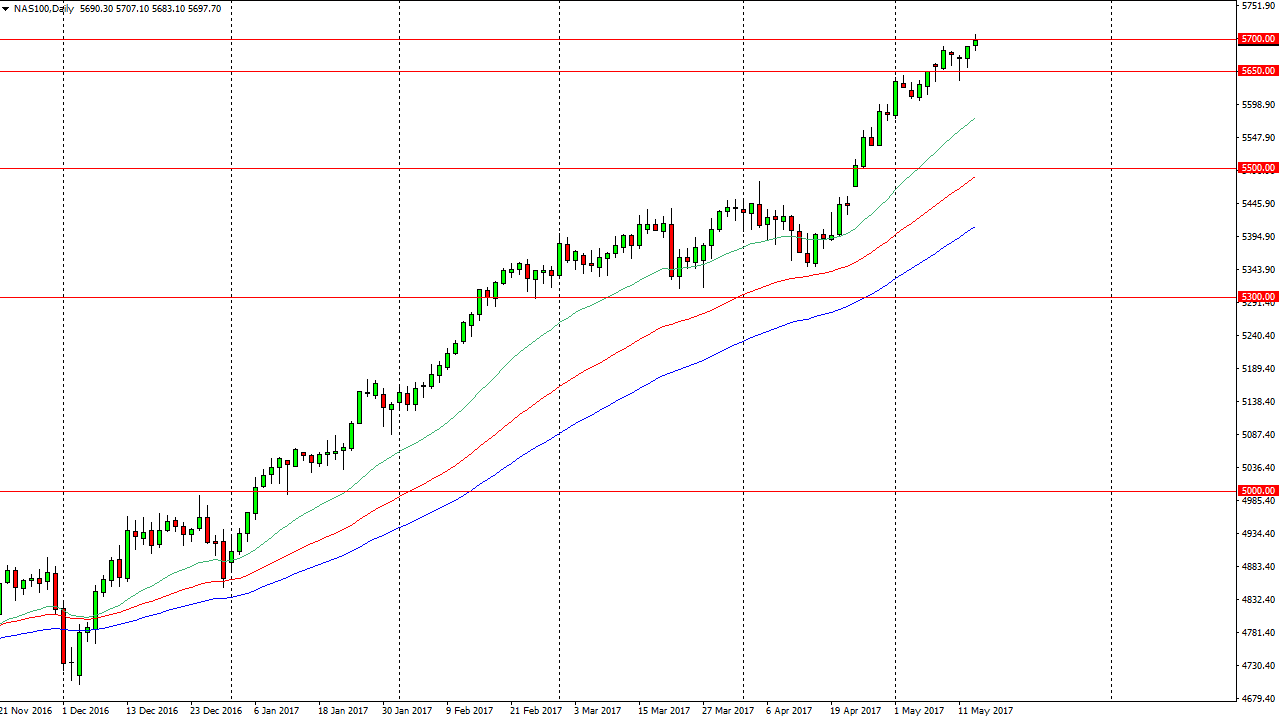

NASDAQ 100

The NASDAQ 100 rallied on Monday, breaking above the 5700 level. That of course is a bullish sign as well, and I believe that a break above the top of the candle should send this market looking for the 5750 handle. I have no interest in shorting, and I believe that the 5650-level underneath is massively supportive. That is essentially the “floor” in the market as far as I can see, and pullbacks continue to offer value. The NASDAQ 100 has lead the way for other indices to go higher over the longer term, and I believe that will continue to be the way. If this index is going higher, it’s likely that the markets in other indices will rise as well. Ultimately, selling is all but impossible and I choose not to do so. With earning season pretty much gone and our way, we should continue to go much higher. Once we do, I will be targeting the 5750 level, followed by the 5800 level.