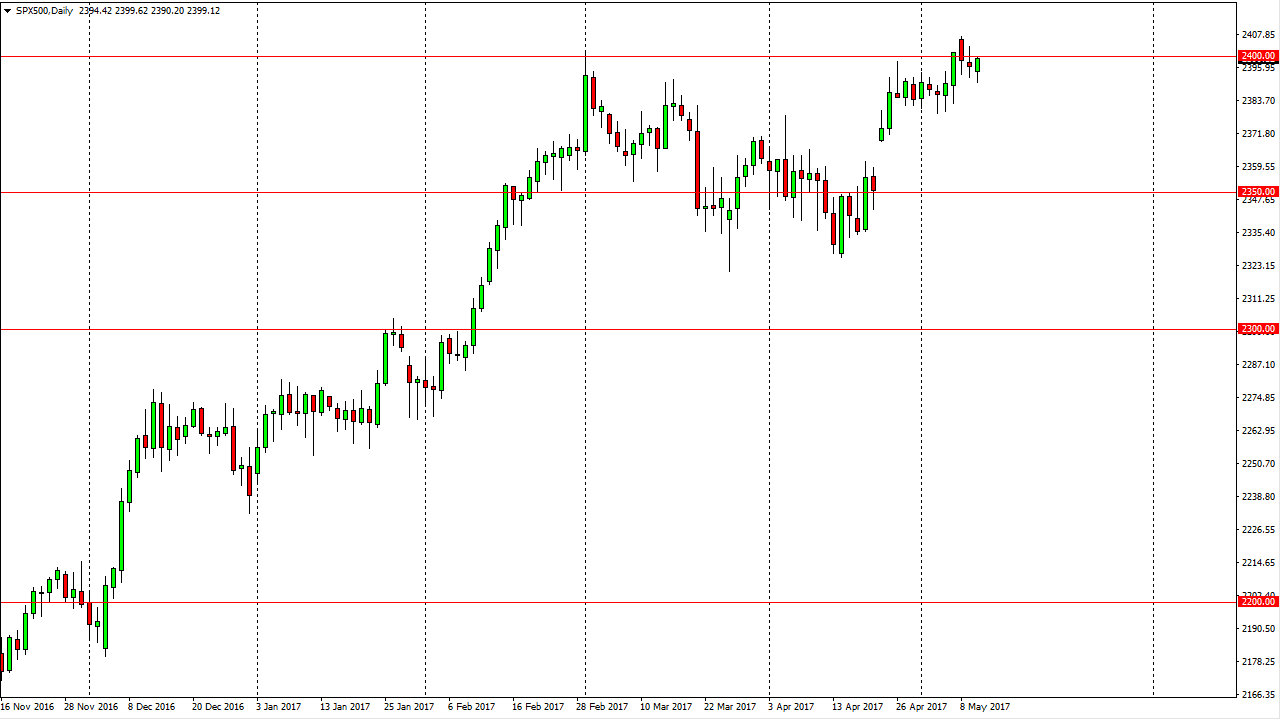

S&P 500

The S&P 500 initially fell slightly during the day on Wednesday, but turned around to form a bullish candle. The 2400 level offered bit of resistance, and as we had initially gapped higher a couple of sessions ago. This should send this market to the upside, which of course we have seen quite a bit of bullish pressure anyway. I am a buyer this market and I think that it’s only a matter of time before we reach towards the 2500 level above. I think the gap underneath should continue to offer massive support as well, so even if we break down from here it’s very likely that the buyers will jump back into this market and push towards the psychologically important 2500 level above. I believe that the 2350 level underneath should continue to be the “floor” in the market.

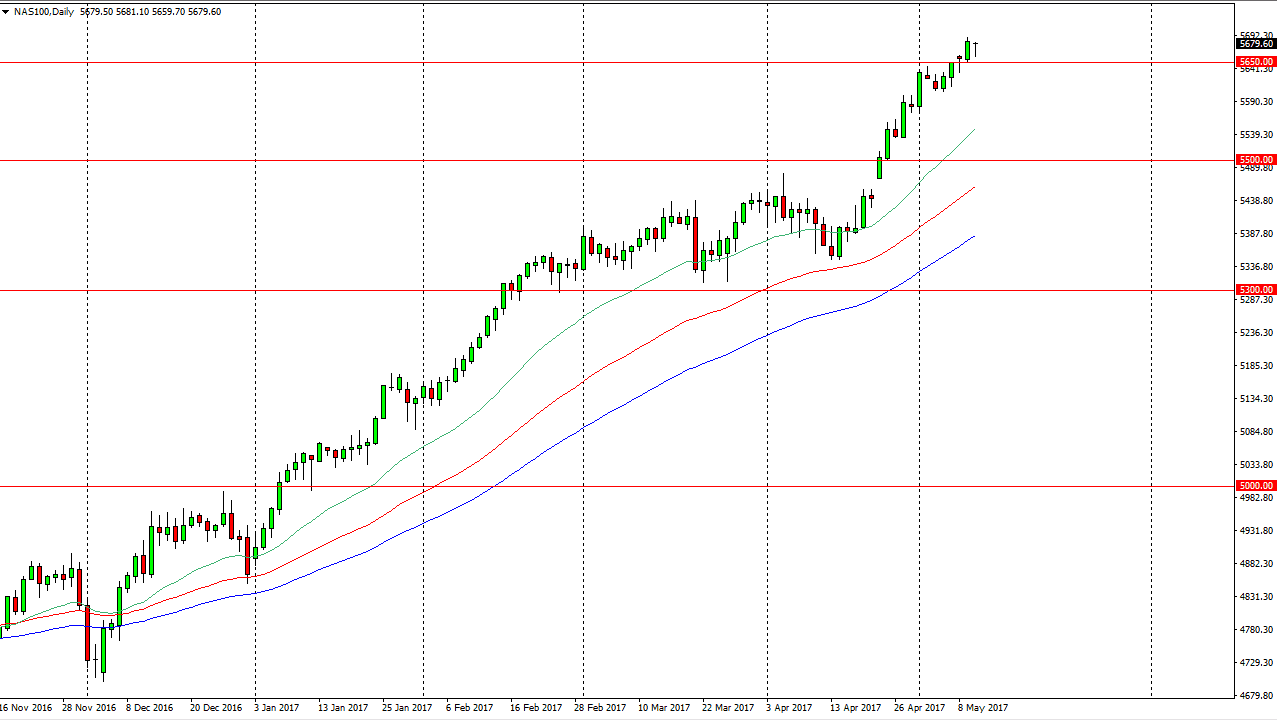

NASDAQ 100

If the S&P 500 looked bullish at the end of the day, the NASDAQ 100 looks even more so. We pulled back initially but found enough support at the 5650 level to find buyers. I think that the market is ready to go much higher, and a break above the top of the candle for the day sends this market looking for the 5700-level next. This is a longer-term uptrend and therefore I don’t have any interest in fighting it. Given enough time, I believe that the market will not only reach the 5700 level, but go much higher. I have no interest in selling, every time we pull back in form a supportive candle, I’m willing to pick up this market based upon value. It looks at this point in time that the NASDAQ 100 should continue to go higher over the longer term, and more importantly Drive the rest of the US indices higher as well.