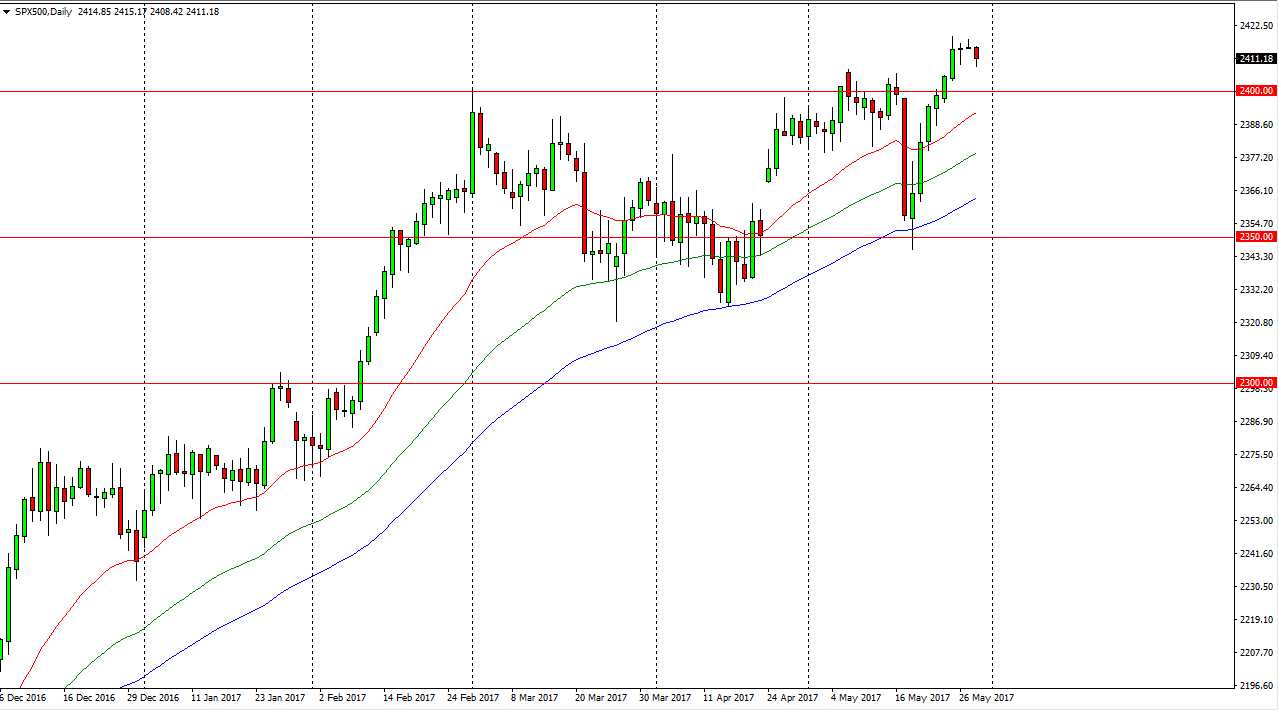

S&P 500

The S&P 500 fell a bit during the day on Tuesday, but found enough support at the 2410 level to turn things around and form a bullish looking candle. This is because we have seen support every time we pull back, and the 2400 level now is just below and it should be massively supportive. The market should continue to go higher, perhaps reaching towards the 2450 level above. Ultimately, this is a market that should go looking for the 2500 level above, but in the meantime, I expect a significant amount of volatility to continue showing up in the market. The recent bullish move of course is a sign that we should continue to see buyers, but a pullback is only healthy and should be value just waiting to happen.

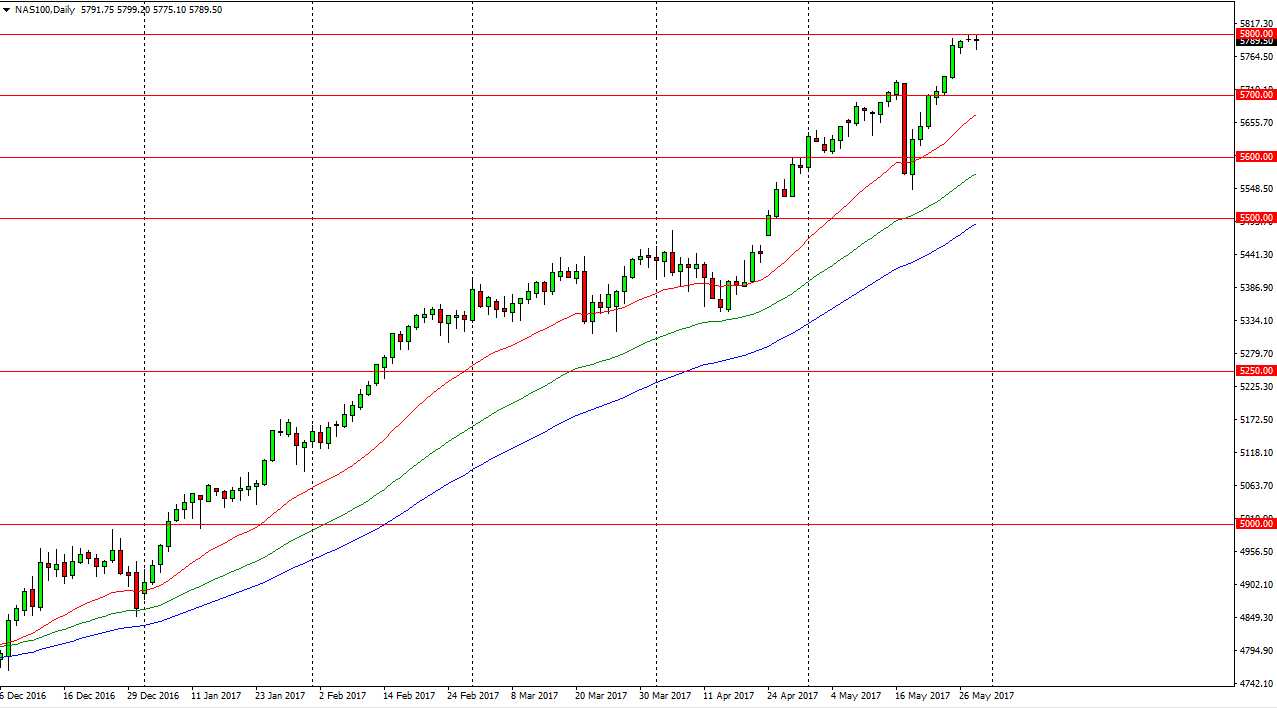

NASDAQ 100

The NASDAQ 100 fell slightly during the day on Tuesday, but turned around to bounce back towards the 5800 level. We could not breakout, but I believe it’s only a matter of time, especially considering that we have seen a bit of support. A break above the 5800 level should continue to send this market higher, perhaps reaching towards the 5900 level. A pullback from here should see plenty of support, especially near the 5700 level, which is a large, round, psychologically significant number. The 6000 level is the longer-term target as far as I can see, so therefore I have no interest in trying to short this market as the buyers should return on signs of pullbacks that offer value. I believe that the S&P 500 and the NASDAQ 100 both will continue to go higher, there’s no reason to short this market, and that being the case it’s likely that the market participants will continue to get involved and that the overall risk appetite should continue to be very strong.