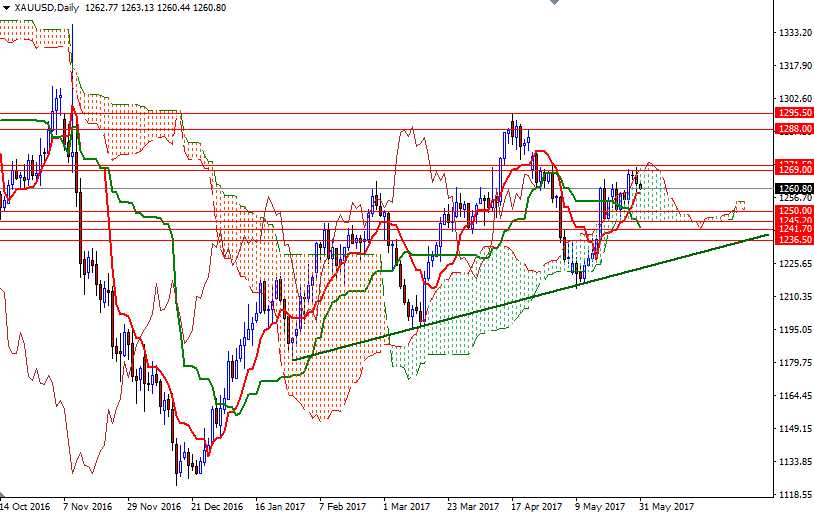

Gold prices ended Tuesday’s session moderately lower as lack of bullish fundamental developments prompted some investors to lock in gains from a recent rally to a four-week high. The failure to pass through $1271.50-$1269 also weighed on the market. XAU/USD failed to break through this barrier for the third time in a row, and this fueled downside momentum. The market looks as if it will revisit the support right below at $1259, where the daily Tenkan-sen (nine-period moving average, red line) sits, today.

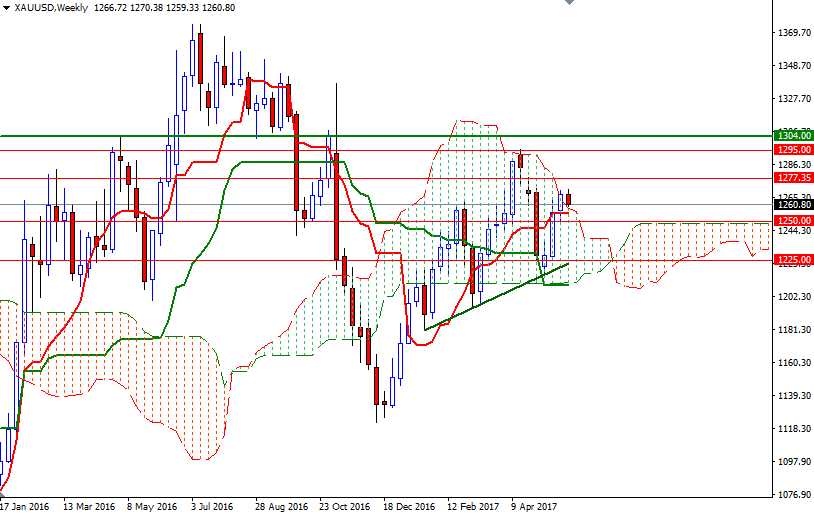

We have bullish Teknan-sen - Kijun-sen (twenty six-period moving average, green line) crosses on the weekly, daily and 4-hourly time frames. In addition to that, the market is residing above the Ichimoku clouds on the weekly and 4-hourly charts, indicating that the bulls still have the medium-term technical advantage. However, as I pointed out earlier, the upside potential will be limited unless the resistance in the 1271.50-1269 area is broken. XAU/USD has to anchor somewhere above 1271.50 in order to tackle the resistance in the 1277.35-1276 zone. A clean break out above the 1277.35 level would signal a further extension towards 1283/2.

If the market drops through 1259, the market will probably retreat to 1256.50. The top of the 4-hourly Ichimoku cloud stands at 1254, so we need to get down below there to make a move to the 1251/0 zone. Eliminating this support is essential for a continuation towards the key support at 1245, the bottom of the daily cloud.