The return of Hard BREXIT, due to the EU leaders’ endorsement of new separation terms towards the UK in the Brussels summit on Saturday led to increased fears the BREXIT will face difficulties as initially expected. Easy BREXIT would mean separation calls from the EU, which is something Germany, and the EU as a whole will not accept, so that the EU does not collapse. The GBP/USD gains at the beginning of this week went up to 1.2948, before the pair pulled back towards 1.2871 at the time of writing. The continuous worry and fears towards any new update regarding BREXIT would pause the GBP advance, which has made strong gains after the UK PM suddenly announced snap elections in the country to support the political stability in the country in the post BREXIT stage.

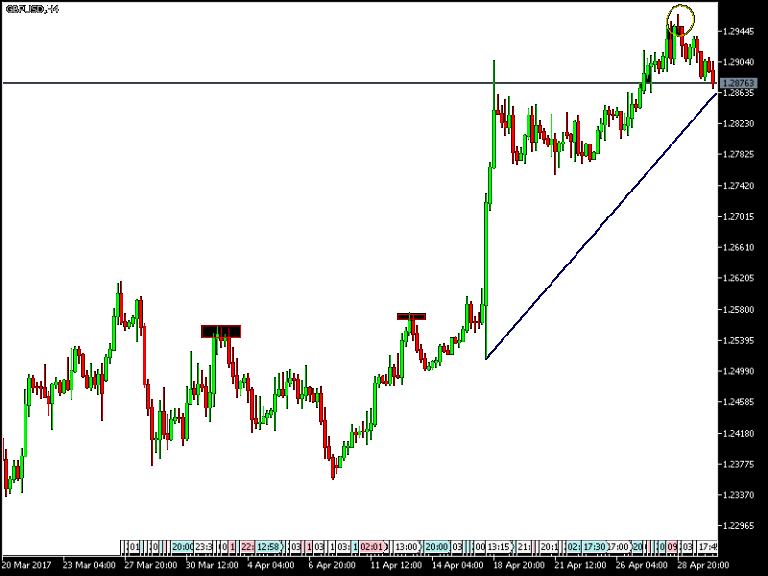

Technically: The GBP/USD is still in an upward range, and the bounce above the resistance at 1.2900 would support the momentum for a move to achieve more gains, the nearest of which would be the psychological top at 1.3000. On the bearish side, the near support areas currently are 1.2830 and 1.2770, any movement below the later would threaten the current bullish move.

On the economic data front: Today’s agenda shows that there will be no significant announcement expected today. From the UK, the focus will be on the announcement of the Manufacture PMI. The pair is waiting for the Federal Bank meeting to decide on the monetary policy tomorrow, amid strong expectations that the interest rate will remain as is at 1.00%.