The EUR/USD is holding on to its gains above 1.09 with the USD continuing to be under pressure with the Federal Reserve starting the two days meeting on Tuesday. The Fed should announce its decision and the final monetary policy tomorrow, amid expectations that the bank will maintain its monetary policy as is, with the interest rate staying at 1.00%. However, the wait will be for the monetary policy statement post the decision to estimate the appropriate time for the next move of the Federal Reserve to take more steps towards raising rates. Yesterday’s movements were relatively calm due to Labor’s Day Holiday, and the Euro will focus today on the announcement of EU Manufacturing PMI, as well as the unemployment rate in the Eurozone.

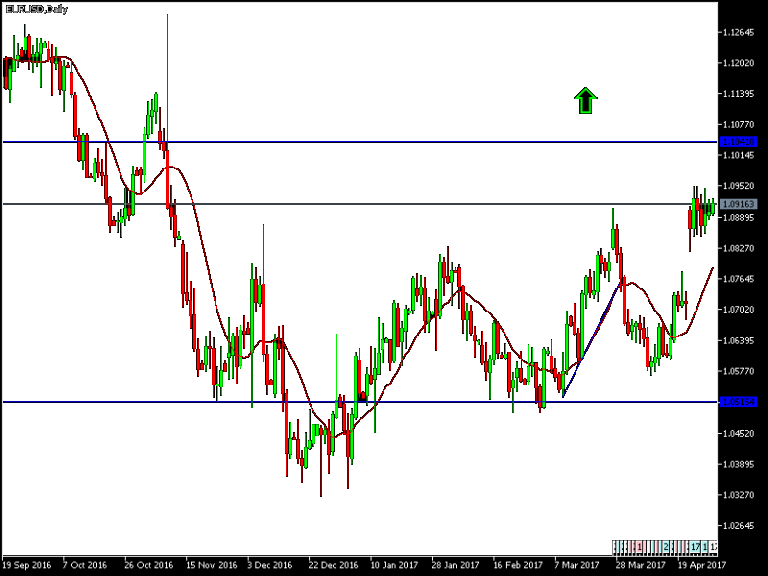

Technically: The EUR/USD is still in an upward move, which will be stronger if the pair managed to climb beyond the resistance at 1.0960 and 1.1000, and breaking above the later would establish current bullish move of the pair. On the bearish side, the nearest support levels are 1.0880 and 1.0800.

On the economic data front: The economic agenda today has no significant data announcements expected from the US. As for the Eurozone, there will be an announcement of the Manufacturing PMI from Spain, Italy, Germany and the Eurozone, as well as the unemployment rate. The Euro is still supported by the results of the first round of the French Elections, and would await for the second and final round results of these important elections next Sunday.