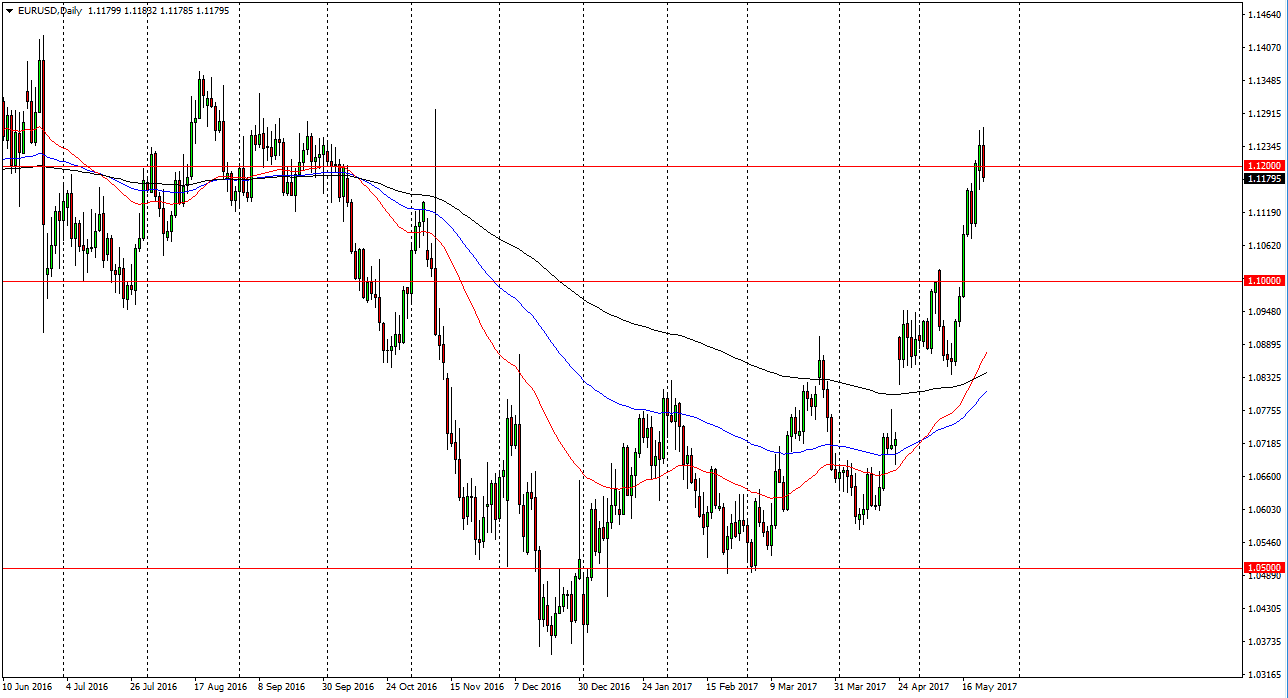

EUR/USD

The EUR/USD pair pulled back from the 1.12 level, as we have been a bit overbought as of late. It makes quite a bit of sense, and although I still feel that the market has quite a bit of bullish pressure, it makes sense that we could drop as far as the 1.10 level. Remember, most of the surge happened after Angela Merkel suggested that the value was too low. Quite frankly, that’s not enough of a reason to go long, but the knee-jerk reaction certainly helped. I believe that a supportive candle underneath should be a nice buying opportunity on the daily timeframe to continue the move towards the 1.15 level above, which is the top of the most recent consolidation area on the weekly charts. I don’t have any interest in selling, I believe that the bullish sentiment is obvious and therefore I feel that most of the market will follow that.

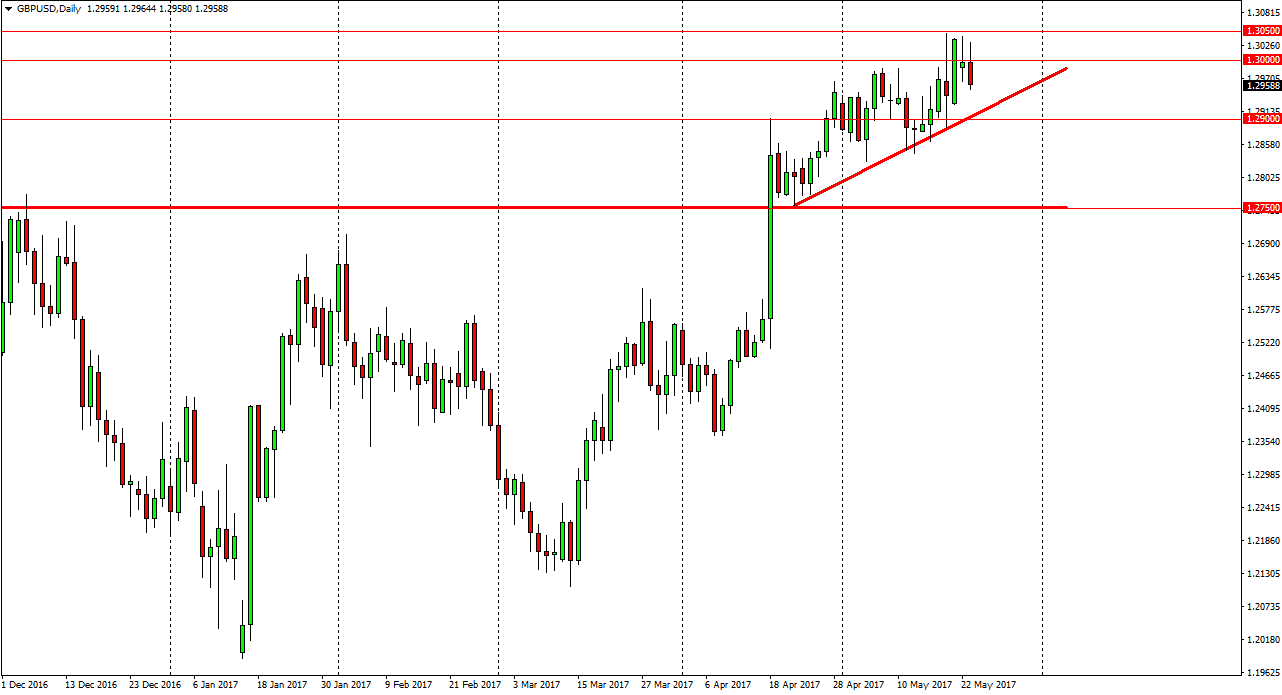

GBP/USD

The British pound initially rally during the day on Tuesday but found the area above the 1.30 level to be a bit resistive, as we fell again. The market continues to grind sideways overall, but has an uptrend line underneath that has been supporting the market. I believe supportive candle should be buying opportunities going forward, and that we will eventually break above the 1.3050 level, allowing the market to grind its way towards the 1.3450 level above which has been my longer-term target for some time. I believe that even if we break the uptrend line, the market should then find plenty of support near the 1.2750 level. I don’t have any interest in selling currently, and would not do so until we break down below the 1.2750 level, something that doesn’t look likely to happen anytime soon. Keep in mind there will be headlines coming out of Britain regarding the exit from the European Union that could cause volatility.