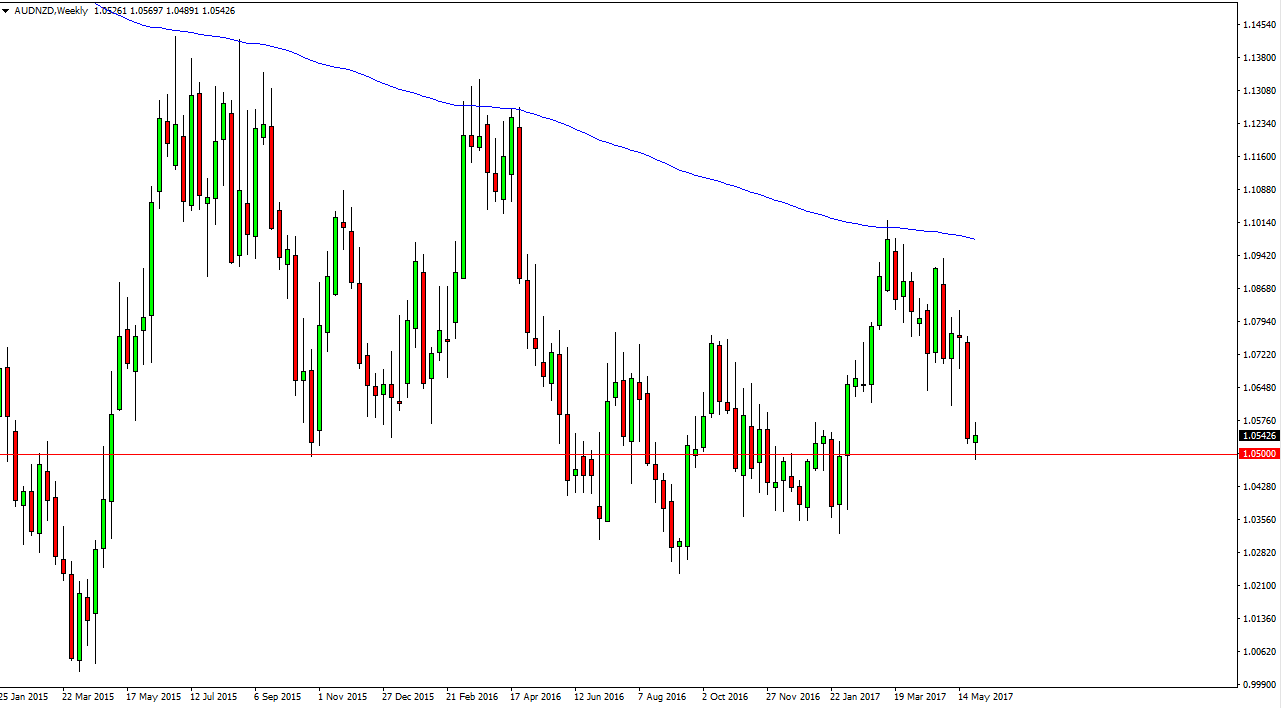

The AUD/NZD pair had a negative month of May, reaching towards the 1.05 level. This is an area that should attract a lot of attention, but I also think that the 1.03 level could attract a lot of attention as well, perhaps bringing support back into the market. A break above the top of the last week of the month could be a buying opportunity near the 1.0580 level. Ultimately, the market should then reach towards the 1.0950 handle, and then the 1.10 level after that. Alternately, the market breaking down below the 1.03 level would be very negative, perhaps sending this market down to the parity handle.

The 200-week moving average

The 200-week moving average has offered resistance several times, and we have fallen every time we have tested it. Because of this, I would not be surprised to see weakness in this market, and that’s especially apparent when you look at the AUD/USD and the NZD/USD pairs. While the kiwi dollar isn’t exactly strong, it has been stronger against the US dollar than the Aussie dollar. That is essentially what this pair represent, relative strength between the 2 currencies. Ultimately, I believe that a breakdown is probably likely, perhaps reaching towards parity yet again. Ultimately, I will follow with the markets do but it seems to me as if the kiwi dollar should continue to show signs of strengthening but we may initially find a bit of a bounce in order to have sellers jump into the market again. Again though, if we break above the 1.075 handle, the market could continue to go higher. I expect Rocky trading conditions but it certainly seems as if we are in a downtrend, so it should be easier to sell than by this month as it comes to this currency pair.