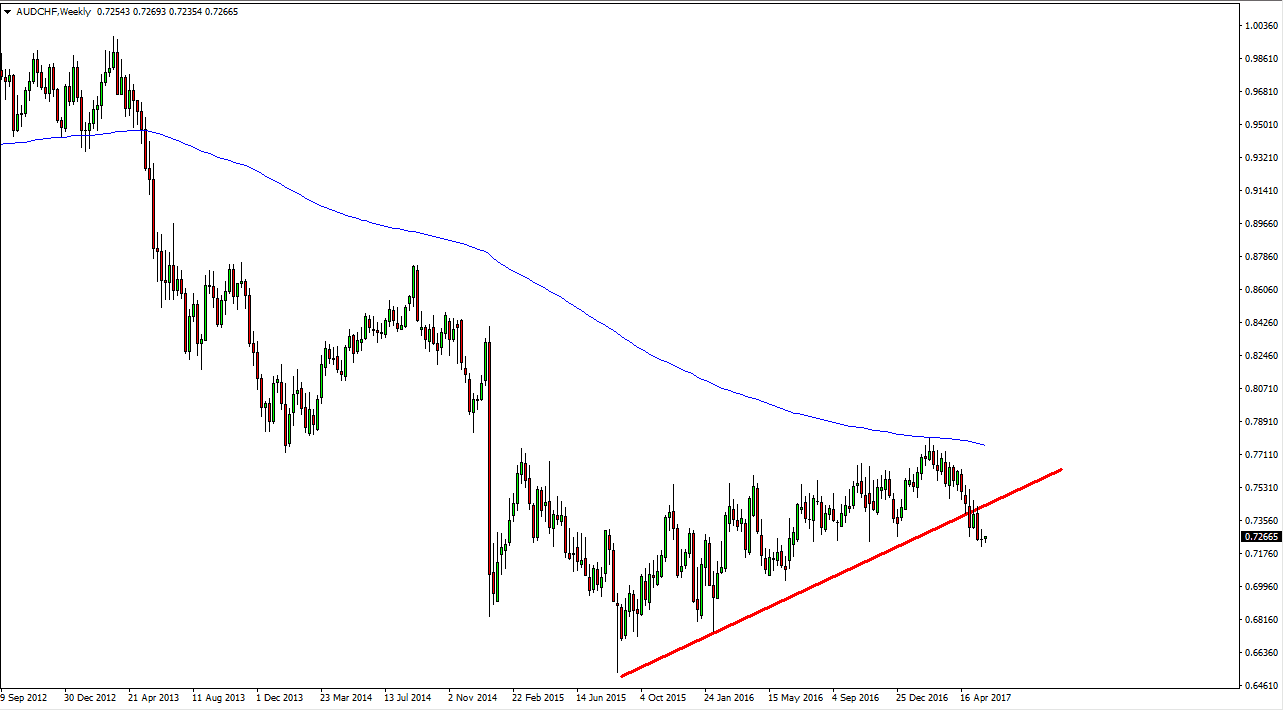

The Australian dollar has sold off against the Swiss franc during the month of May, as we have broken an uptrend line. The fact that we have done that suggests to me that perhaps we will continue to go lower, as the market is highly sensitive to risk appetite. If we break down below the 0.72 level, the market should continue to go lower, especially if we have some type of trouble in the equity markets around the world. Keep in mind that this pair is a measurement between a “risk on” currency, and a “risk off” currency in the form of the Swiss franc. Because of this, it tends to mimic a lot of equity markets and of course futures markets as we get the ability to play risk appetite in the currency markets.

Selling bounces

I believe that we could sell bounces, if we stay below the 0.75 handle. That should keep this market underneath the uptrend line that was broken, and that shows that the downward pressure continues. As you can see on the chart, I have the 200-week exponential moving average marked in blue, and it has offer dynamic resistance recently. Because of this, I believe the downtrend continues, but we may get a little bit of a bounce early in the month. That bounce, as long as we stay below the uptrend line, could be a nice selling opportunity as the Swiss franc has been very stubborn and keeping gains for some time now, despite with the Swiss National Bank is trying to do. The Australian dollar itself looks fairly weak, so it makes sense that we would continue to see a downward move in this market. Alternately, if we find ourselves above the 0.77 handle, at that point I’m willing to concede that we may be seeing a trend change. That is the least likely of scenarios though.