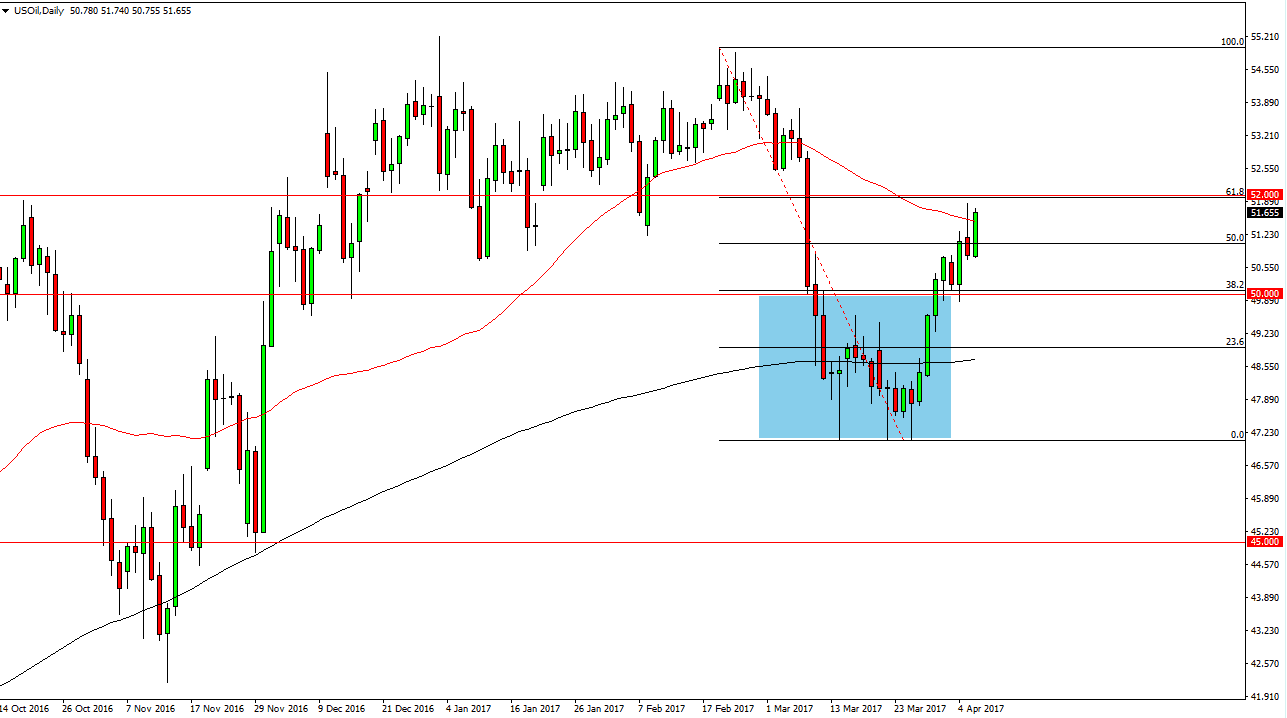

WTI Crude Oil

The WTI Crude Oil market rallied during the day on Thursday, reaching towards the top of the shooting star from the previous session. The $52 level of course is a large, round, psychologically significant number, but more importantly it’s the 61.8% Fibonacci retracement level from the selloff. Because of this, I believe that today is going to be a crucial session, and it’s simple at this point, if we can break above the $52 level, the market should continue to go higher. Alternately, if we turn around and form a negative candle again, or even a resistive one, we could see the market dropped towards the $50 handle below. Nonetheless, expect quite a bit of volatility.

Natural Gas

Natural gas markets went back and forth during the day on Thursday, as we had an extraordinarily volatile session. The $3.25 level continues to be supportive, but a breakdown below the bottom of the candle should send this market down to the $3.10 level underneath. If we can break above the top of the shooting star from the Thursday session, the market will then challenge the 61.8% Fibonacci retracement level at the $3.35 level. If we can break above there, then the target is $3.50 above there. If we managed to break below the $3 level, the market should go much lower. I think that fundamentally the natural gas markets still have a lot of issues, and with the jobs number coming out today there could be quite a bit of volatility. Either way, I think you’re going to have to purchase from a longer-term perspective, no matter what your bias is. That means using a small position and allowing for the almost certainty of choppy conditions. Currently, it looks as if the market at an inflection point, and will be making a longer-term decision soon.