WTI Crude Oil

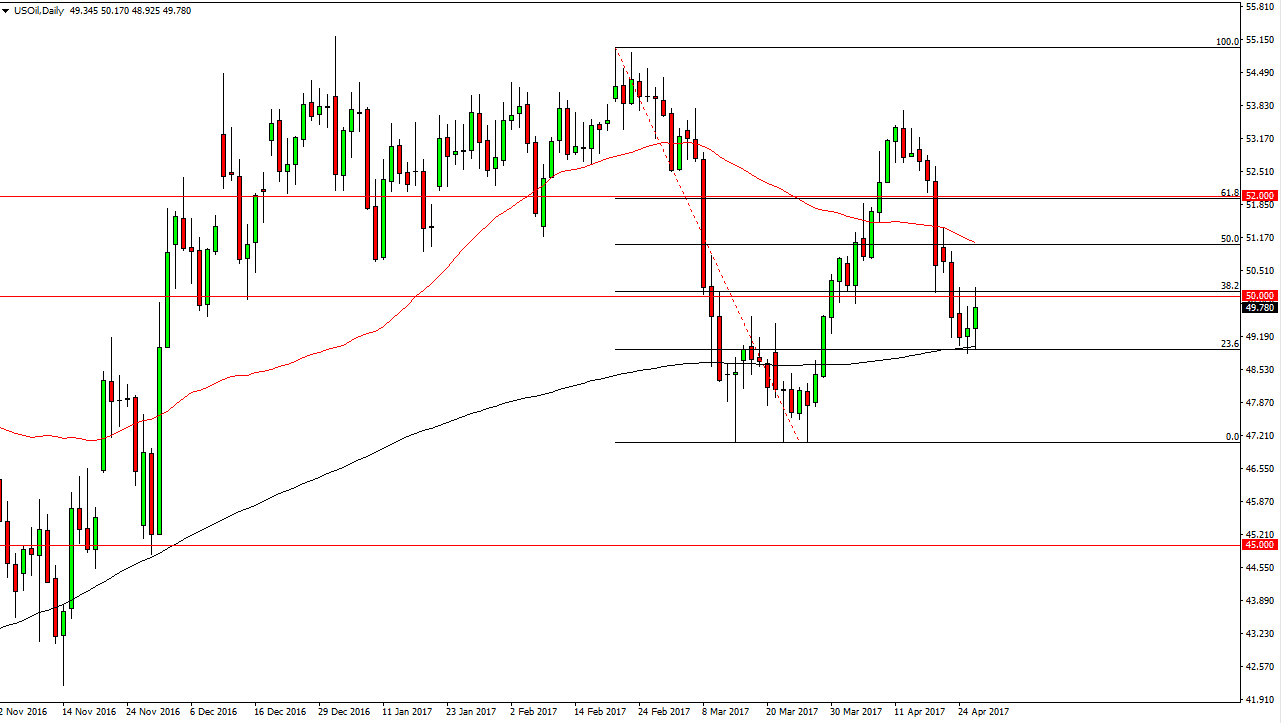

The WTI Crude Oil market had a positive session after getting a bullish inventory number out of the United States. However, the $50 level offered enough resistance to turn things around and form a less than the stellar candle. At this point, I believe it’s probably best to let the market pick a direction, and simply follow. I’m going to do this by going long on a break above the top of the range for the session on Wednesday, or shorting on a break of the lows. If we break down, I feel that the market should then go looking for the $47.25 level underneath which offered support previously. Alternately, if we break above the top of the candle for the session on Wednesday, the market will more than likely go looking towards the $51.25 level above.

Natural Gas

The natural gas markets gapped higher at the open, as we continue to see quite a bit of volatility in this market. The $3.25 level above has been tested as resistance, an area that’s been resistive in the past. If you are not involved in this market to the upside now, it’s very difficult to get involved here because you would simply be “chasing the trade.” Pullbacks that come back to fill the gap might be buying opportunities, just as a break to a fresh, new high would be. I don’t have any interest in trying to fight the move, I believe that this market is probably one that you should let calm down a little bit before putting any real money to work. It currently looks as if the natural gas markets are going to go higher, and at this point in time it’s going to be almost impossible to short this market.