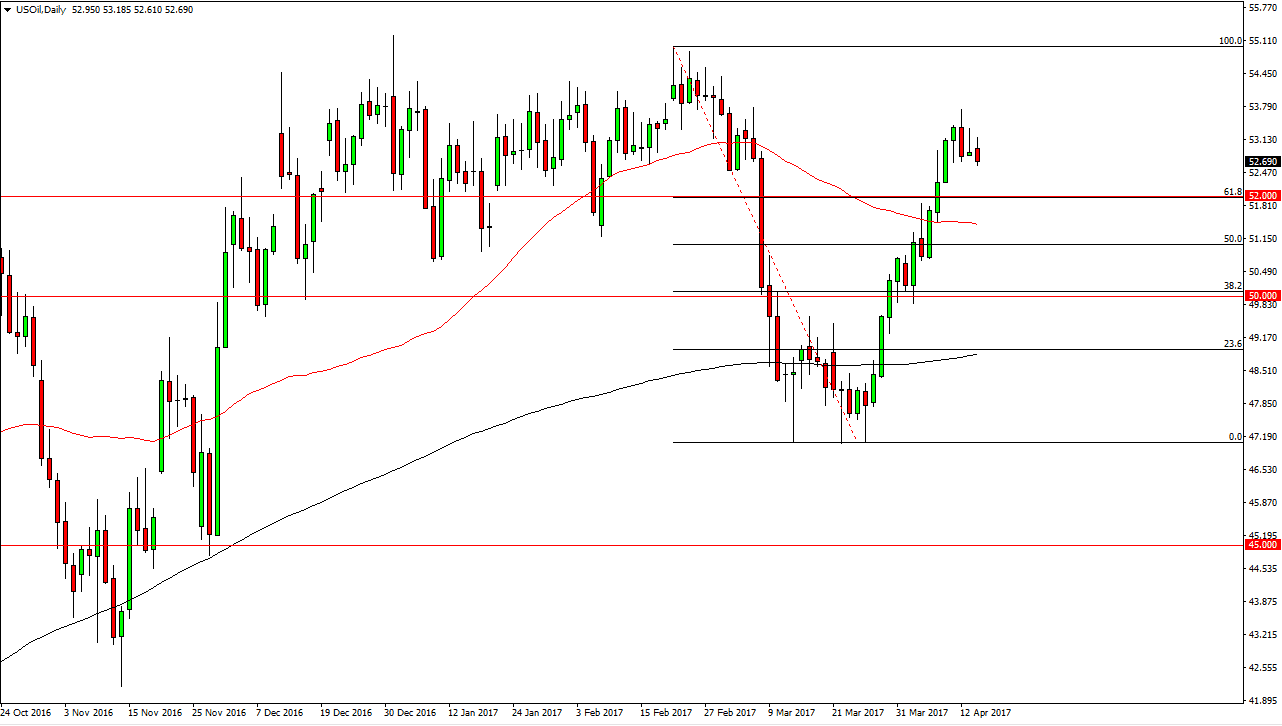

WTI Crude Oil

The WTI Crude Oil market initially tried to rally on Monday but rolled over slightly. I still think there’s plenty of support below, but it’s likely that we may have to pull back in order to find enough support to extend the longer-term moved to the upside. I think the $52 level as the first area where we will find buyers, and then perhaps the $51 level after that. A supportive candle should send this market looking towards the $55.50 level above, as that has been my longer-term target for some time and has previously offered resistance. Currently I’m not interested in selling this market, although I do recognize that the pullback probably needs to happen, I prefer to trade with the strengthening uptrend.

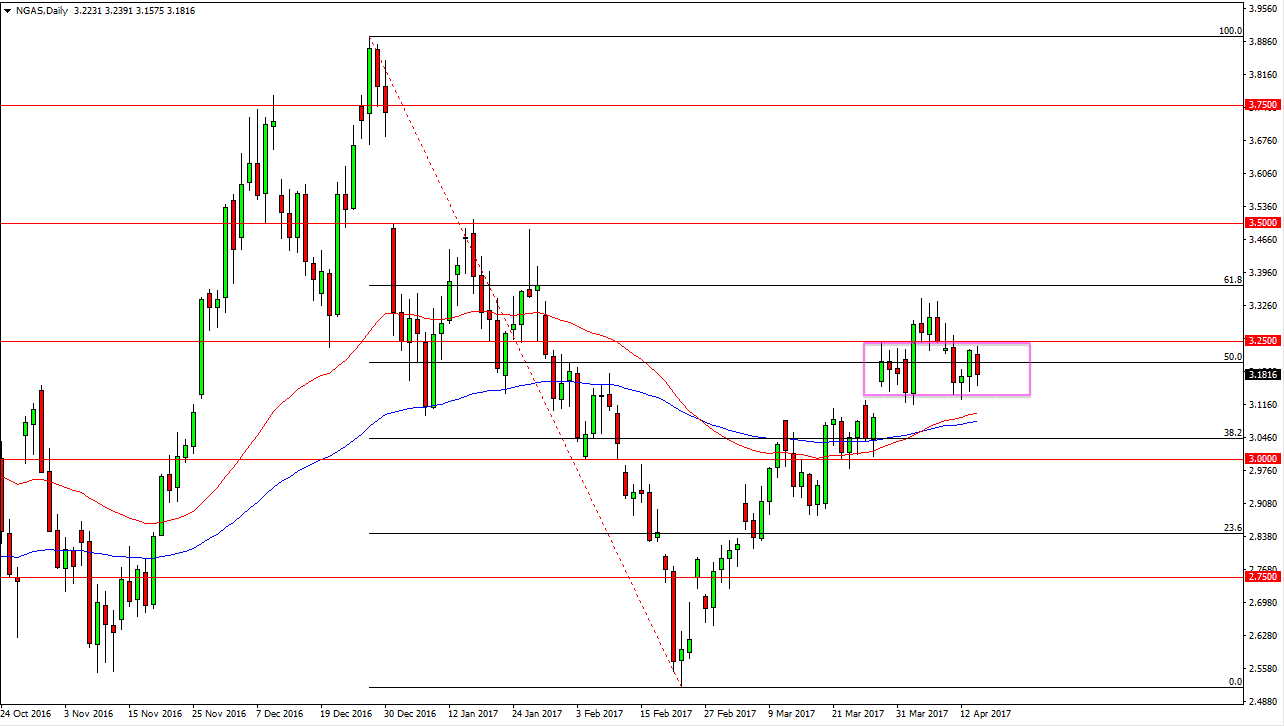

Natural Gas

Natural gas markets fell during the day as the $3.25 level has offered enough resistance to keep the market down. However, you can see that the low was higher than the previous couple of sessions, highlighted by a hammer from the Thursday session. That is right on top of the gap that has shown so much strength in this market. The 50-day exponential moving average has broken above the 100-day exponential moving average just below there, so I believe that there are plenty of reasons to think that the market is going to continue to go higher. The market then it should go to the $3.33 level above, which is massively resistive. If we can break above there, then the market is free to go to the $3.50 level above there.

I don’t have any interest in shorting this market until we break down below the moving averages, the gap, and even the $3 level underneath. I believe that the market will continue to find buyers on dips in general, so with this I believe the rally continues.