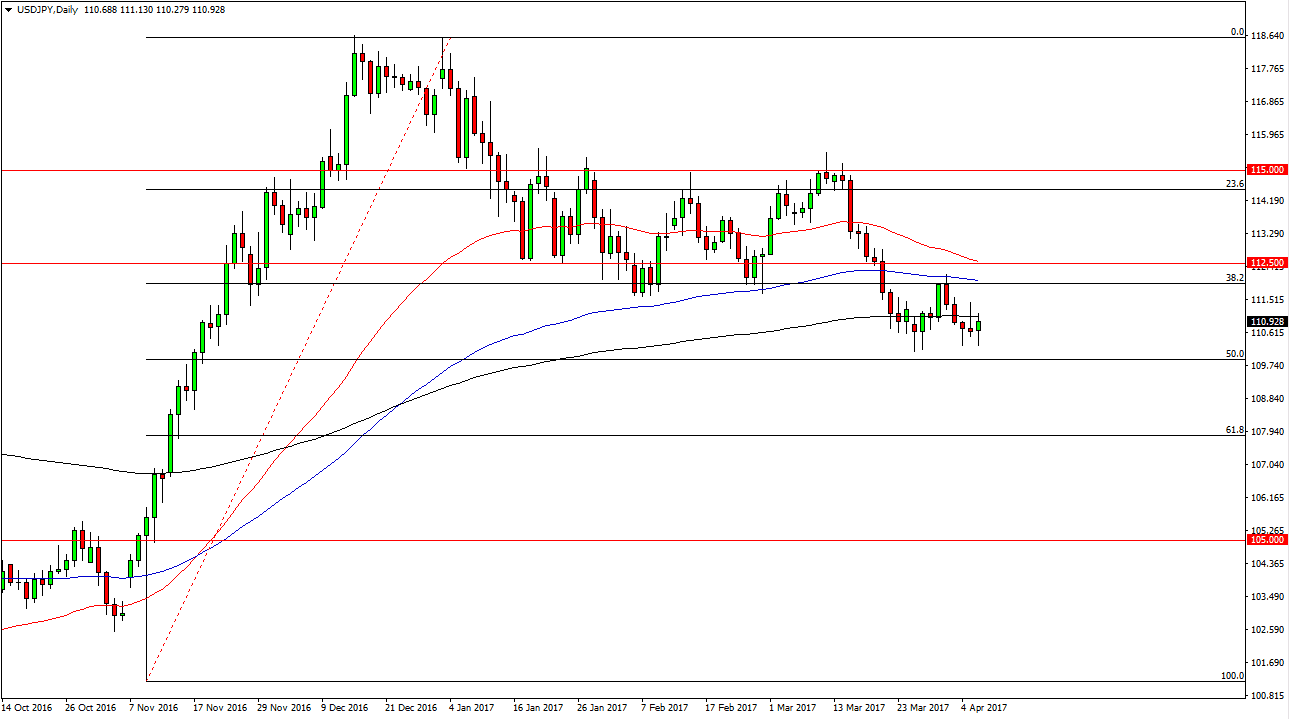

USD/JPY

The US dollar fell initially during the day on Thursday, finding support at the same region that we have found it previously, and as a result we ended up forming a hammer. The hammer is a bullish sign, but I think this is simply the market retracing a lot of the losses from the previous session ahead of the jobs number. We are bouncing around between the 110 level on the bottom, and the 112 level on the top. With the jobs number expected to be an addition of 175,000 jobs for last month, keep that in mind when the announcement comes out. Typically, if the announcement is better-than-expected, this pair rises and of course vice versa. If we can break out to the upside and above the 112.50 level, we could make serious headway to the upside. Alternately, if we break down below the 110 level, the market will more than likely reach towards the 61.8% Fibonacci retracement level below at the 108 handle.

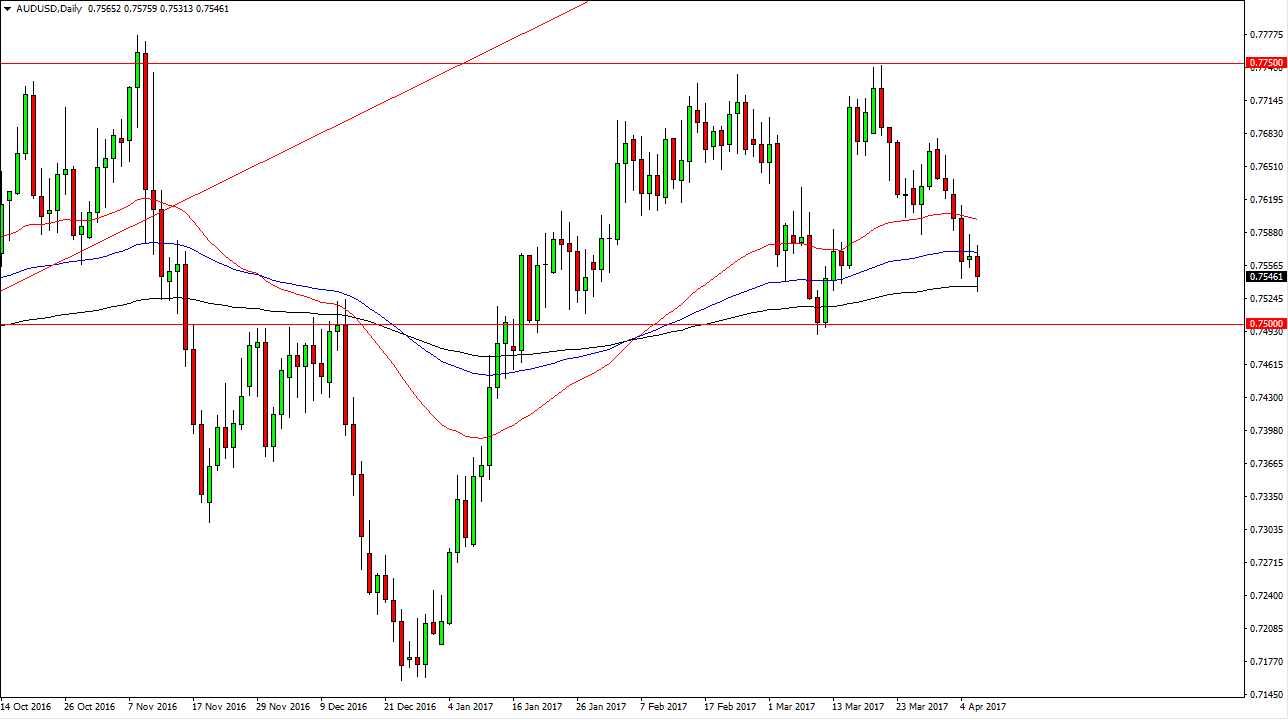

AUD/USD

The Australian dollar initially tried to rally on Thursday but then fell all the way down to the 200-day exponential moving average below. The 0.75 level underneath also offer support, so it’s likely that the buyers will return sooner rather than later. Obviously, gold needs to rally to help this market, and currently it’s chomping around as well. If gold can stay above the $1240 level, I think there is a nice opportunity to go higher from here. If we can break down below the 0.75 level however, that would be a very bearish sign if we can close below that vital level. A supportive candle in this area is a nice buying opportunity, and that should continue to be the best case scenario as there is a significant amount of previous influence on the market at that level.