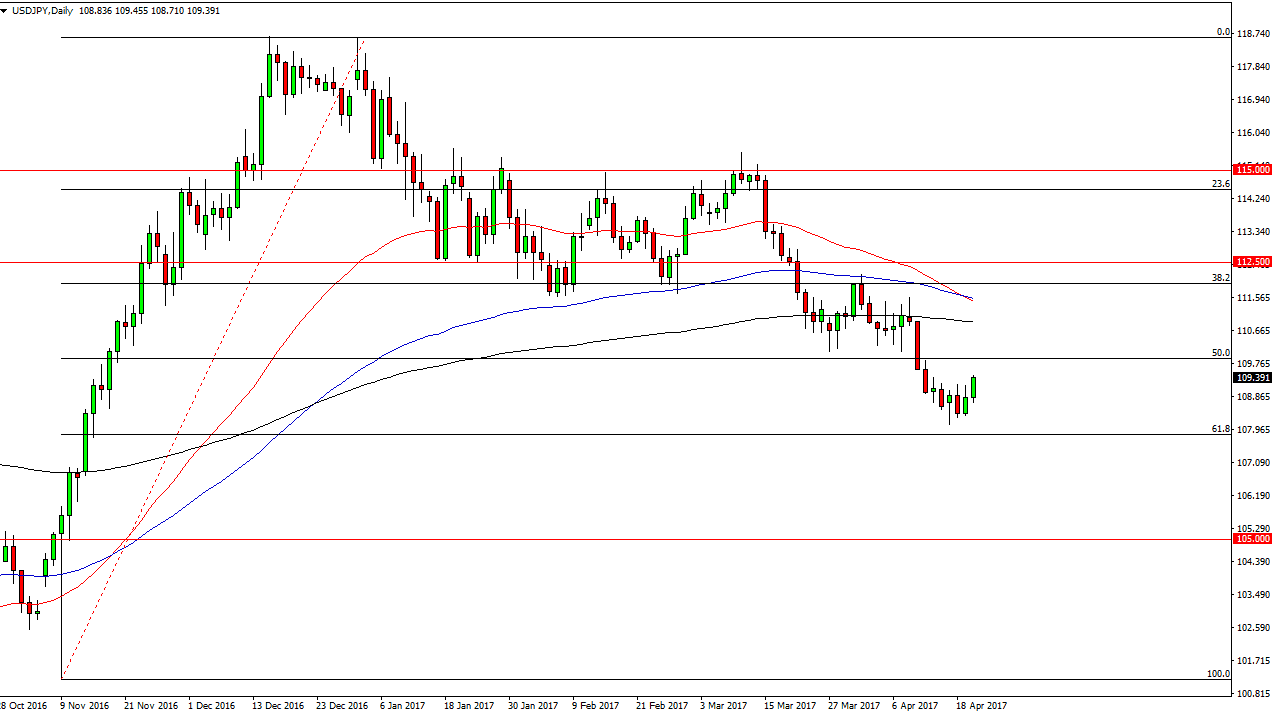

USD/JPY

The USD/JPY pair broke higher during the session on Thursday, clearing the 109 handle. Because of this, I think that the market is probably going to reach towards the 110 handle above, but should find a bit of resistance in that area. If we can break above there, the market should then go into the previous consolidation area. Either way, this is a market that will be volatile, so I am a bit hesitant to put too much money to work, but I think that the buyers are starting to make a bit of a statement as the 61.8% Fibonacci retracement had caused enough interest by longer-term traders to get involved. Nonetheless, this is going to be very volatile and difficult to trade.

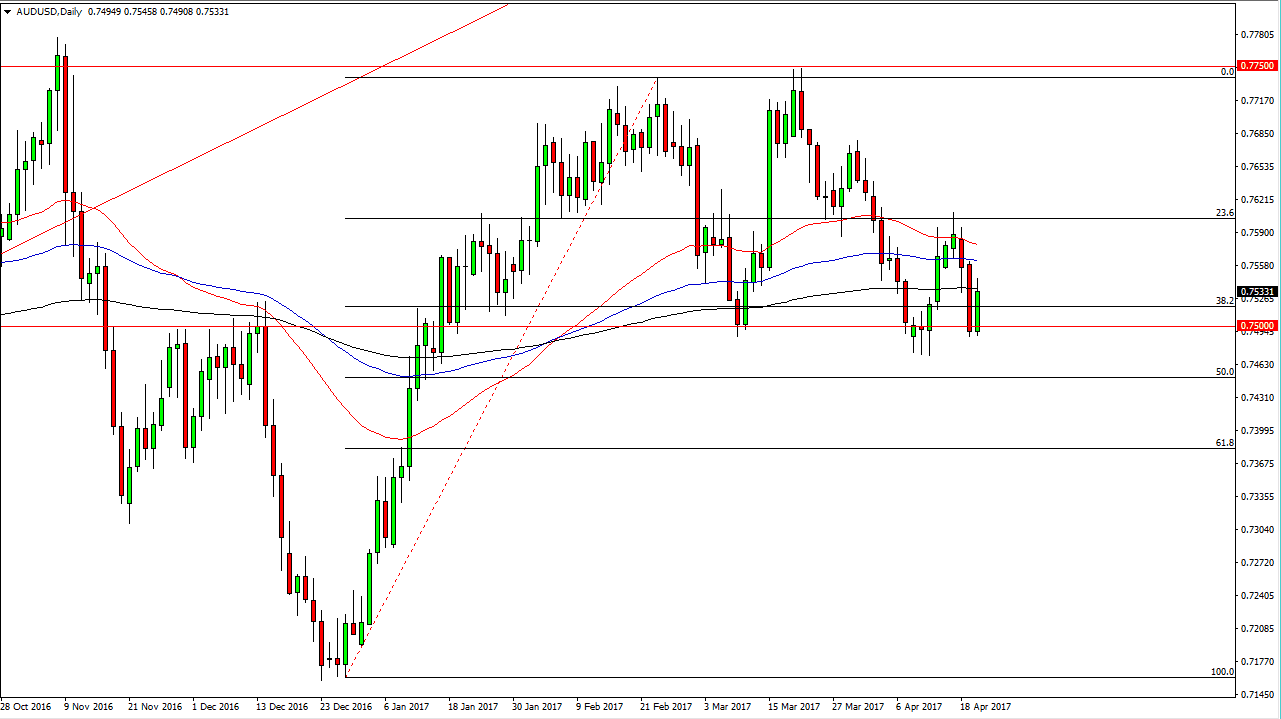

AUD/USD

The Australian dollar rallied during the day on Thursday, breaking higher and at one point above the 200-day exponential moving average. I believe that if we can break above the top of the candle for the session on Thursday, the market should then reach towards the 0.76 handle above, which will be resistive. Ultimately, the gold markets should continue to dictate where we go, and they look as if they are trying to find buyers recently. If we can break above the top of the shooting star from Monday, the market should continue to go higher, perhaps reaching towards the 0.7750 level above.

I believe that there is significant support below at the 0.75 handle and that it extends down to the 0.7450 level at the very least. Because of this, pullbacks that show signs of support and bouncing could be buying opportunities in a market that has a lot of noise underneath that area. Because of this, the market more than likely will continue to chop around but sooner rather than later we should see some type of impulsive candle that we can follow.