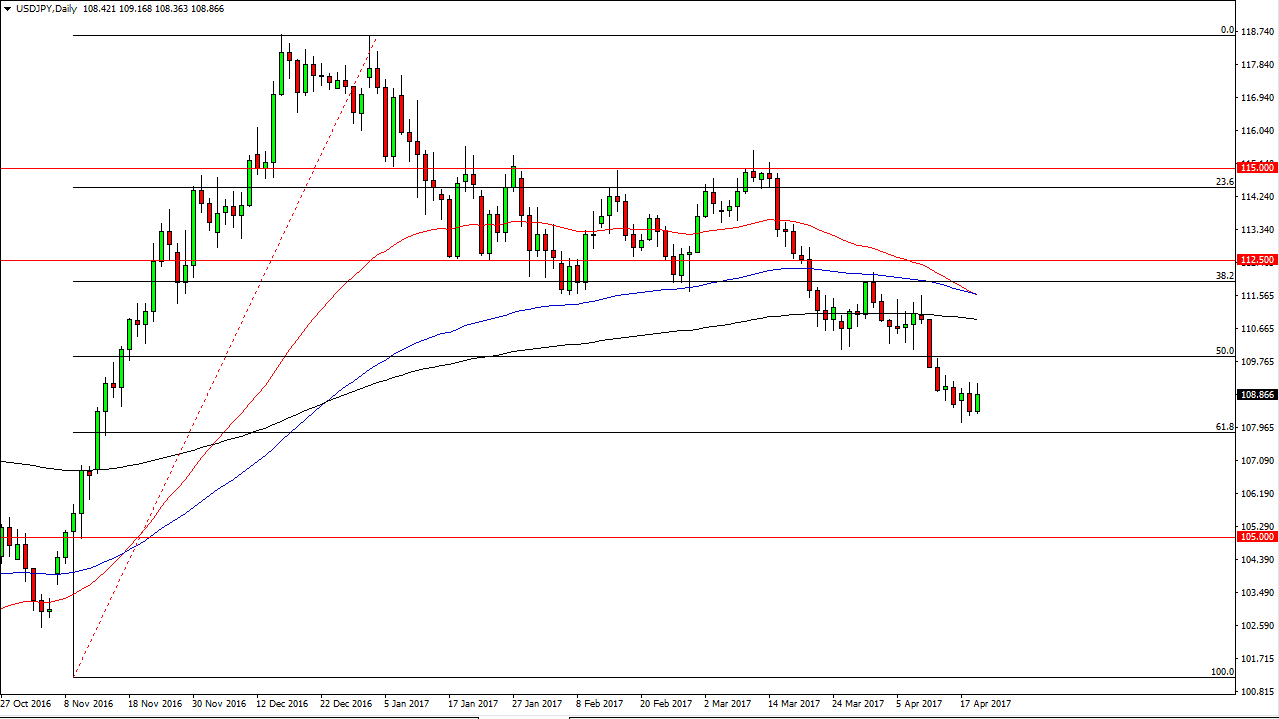

USD/JPY

The USD/JPY pair rallied on Wednesday, bouncing yet again as we continue to consolidate just above the 108 handle. This is the 61.8% Fibonacci retracement level from the massive move higher last year, and because of this I suspect there will be a certain amount of support in this area. However, I don’t see anything in this chart that’s compelling me to buy and hold. I think that we are entering a consolidation area between the 108 level on the bottom and the 110 level on the top. With this, I am looking for short-term range bound trading to be the attitude of the market. If we broke down below the 107.80 level, the market should then reach towards the 105-level underneath.

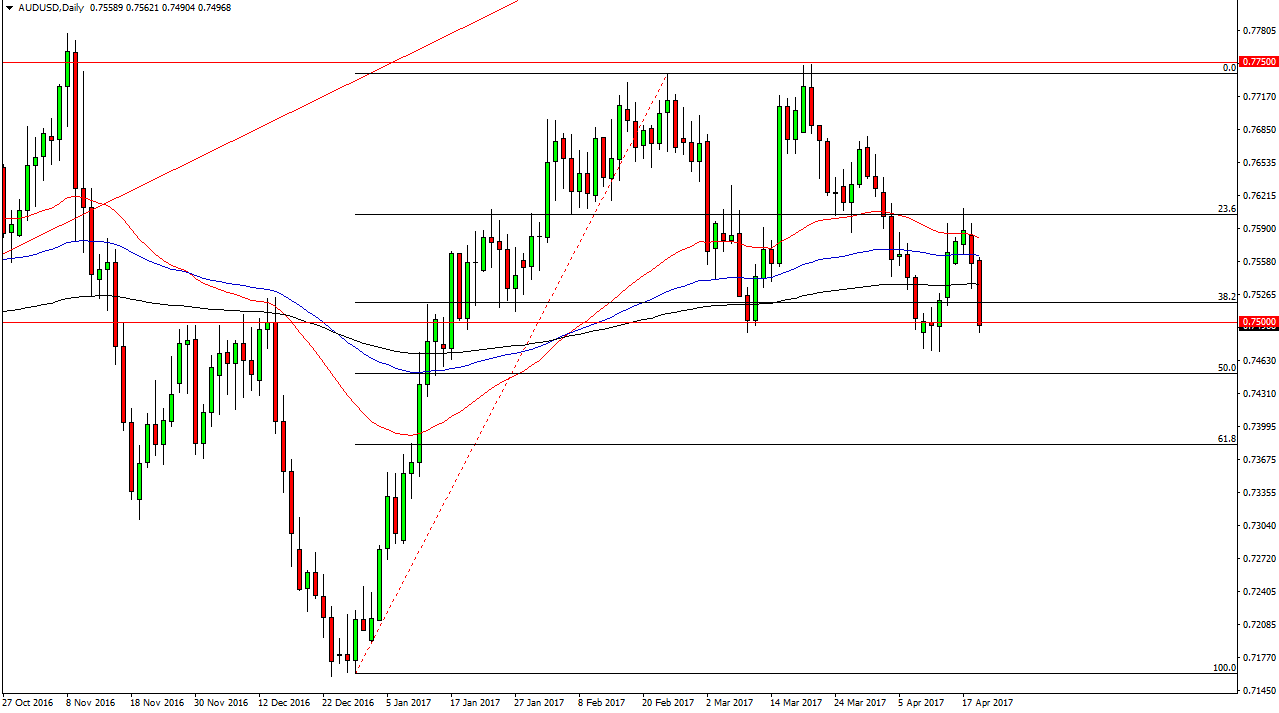

AUD/USD

The Australian dollar fell during the day on Wednesday, testing the 0.75 level. There is a significant amount of noise just below so I am a bit hesitant to start selling. If we break down below the 0.7450 level, I might be tempted to short this market and reach towards the 0.74 handle. If we rally from here, I believe that selling rallies that show signs of exhaustion will be the way to go going forward. Pay attention to the gold markets, because if they can rally, that should be reason enough for this market to bounce. If we did somehow bounce a break above the top of the Monday shooting star, I believe that the market would then go to the 0.7750 level above. Either way, I believe that the market will be choppy and volatile, as there are so many moving pieces when it comes to the forces affecting the Aussie currently.

The candle for the session of course was rather negative, but with this being the case I still I’m not convinced because of the significant amount of choppiness that we have seen in the area just below.