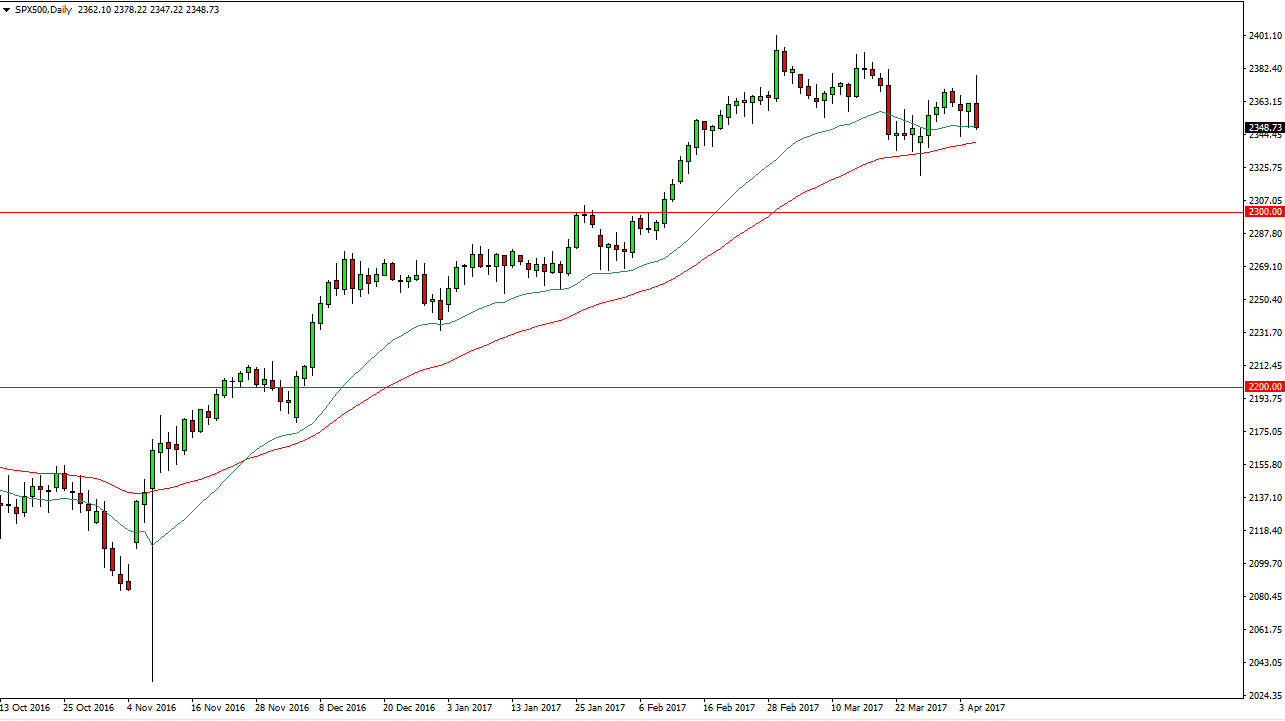

S&P 500

The S&P 500 tried to rally most of the day on Wednesday, and made quite a bit of headway. However, the market turned right back around as the FOMC Meeting Minutes seem to have spooked the market a bit. There is a significant amount of support just below though, so I think once the dust settles this will end up being a buying opportunity. I don’t know that I would buy it today, but I would be looking for a supportive daily candle to take a short-term buying opportunity. I believe that the absolute floor is somewhere near the 2300 level, and as long as we can stay above there I’m going to sit on the sidelines and wait for opportunities to go long.

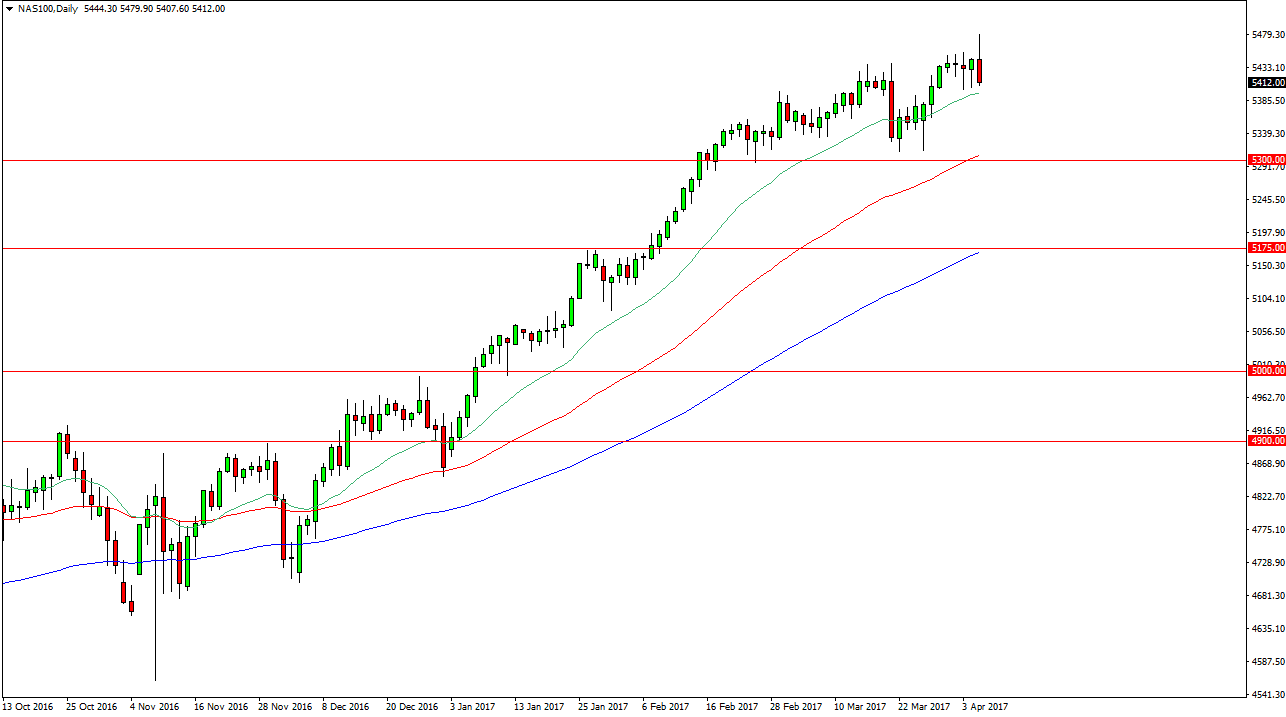

NASDAQ 100

The NASDAQ 100 initially trying to break out and actually continue the massive uptrend that we have been in. However, we had formed a very ugly candle, and I think the market needs to pull back a little bit in order to find enough support to go higher. I still believe that we will eventually reach towards the 5500 level, but this market may have gotten a bit ahead of itself. I believe that supportive daily candles will be needed in order to start buying, and in the meantime, I believe that this is a market that’s probably best state away from. The type of volatility that we saw during the day shows just how skittish some of the long traders are, so I would rather let other people jump into the market ahead of me, and simply follow along. If we broke down below the 5300 level, that would be a very sign and I would have to rethink the entire situation. However, even with the ugly candle during the day on Wednesday, the longer-term prognosis has not change quite yet.