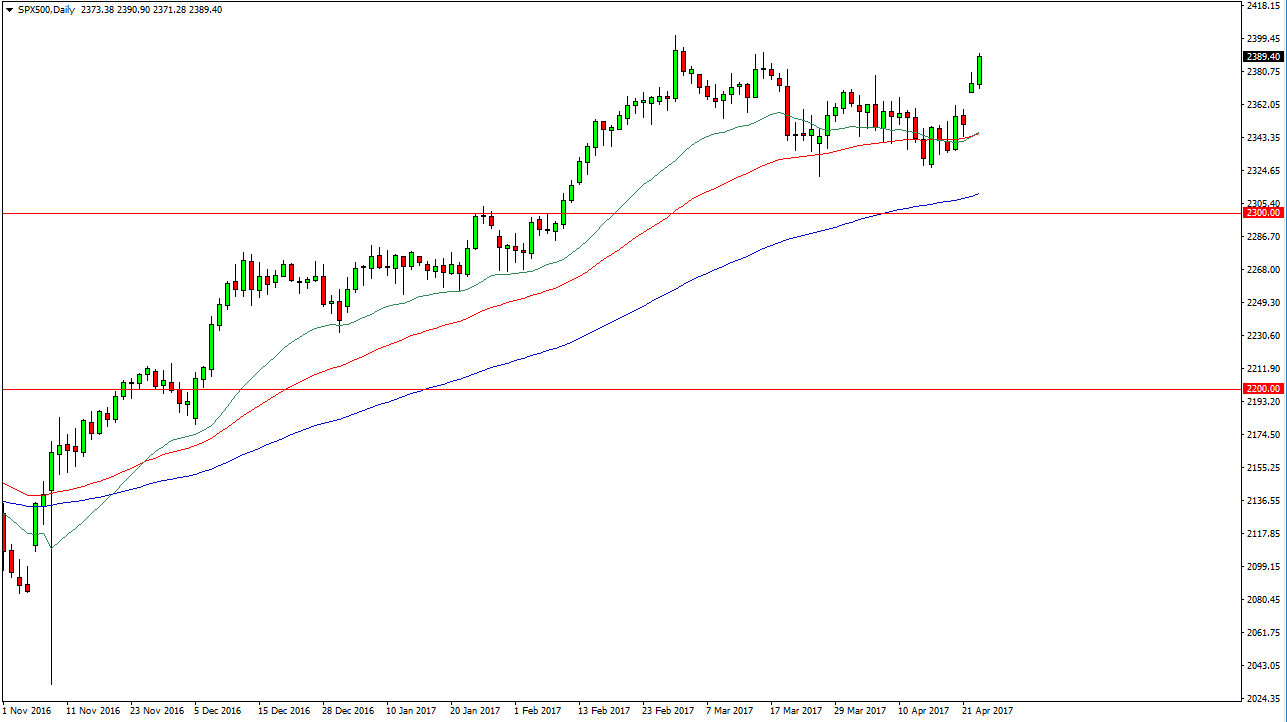

S&P 500

The S&P 500 rallied during the day on Tuesday, as we continue to see buying in the market. I believe that the gap below will continue to offer quite a bit of support, and that the 2400 level could offer enough resistance to turn the market around and have a go looking for that. Nonetheless, that would only be a buying opportunity underneath on signs of support as far as I can see. If we broke above the 2400 level, then I think the market goes to the 2500 level. The way, I have no interest in selling this market it has been very strong for quite some time.

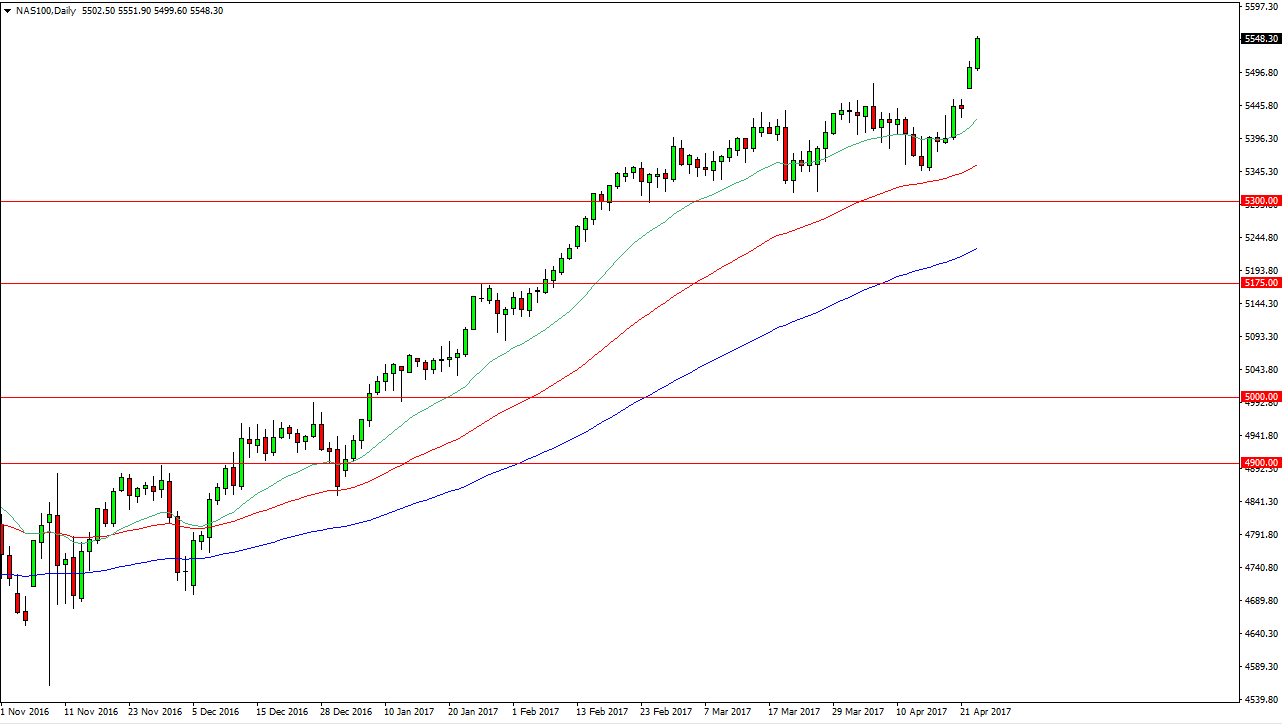

NASDAQ 100

If the S&P 500 is bullish, the NASDAQ 100 is explosive. We broke above the 5500 level, and now looks set to continue the longer-term uptrend. I think pullbacks at this point offer value that you can and should take advantage of. I believe that the gap near the 5450 level should offer support, and be the “floor” in the market. Ultimately, I believe that some type of supportive candle will present itself that we can take advantage of, perhaps near the 20-day exponential moving average, pictured in green, or the 50-day exponential moving average pictured in red. Either way, I have no scenario in which a willing to sell and I believe that the NASDAQ 100 will continue to lead other indices much higher. In fact, the NASDAQ 100 is a bit of a harbinger for other indices, and as long as it is strong, stock markets in general should be also.

I believe that the 5400 level is essentially the “floor” in this market now, as the 5300 level had been previously. Ultimately, I’m looking for a “buy on the dips” type of situation that I can get involved in.