Gold prices edged lower on Monday as investors took profits from a recent rally that pushed the market to the highest level in five months. U.S. stock markets reversed some of the steep losses witnessed last week, making gold less attractive. Gold’s surge last week was fueled by heightened geopolitical risks and President Donald Trump’s comments on both the strong dollar and interest rates. Of course, Trump has no control over the Fed’s policy, and the central bank is still expected to hike interest rates in June.

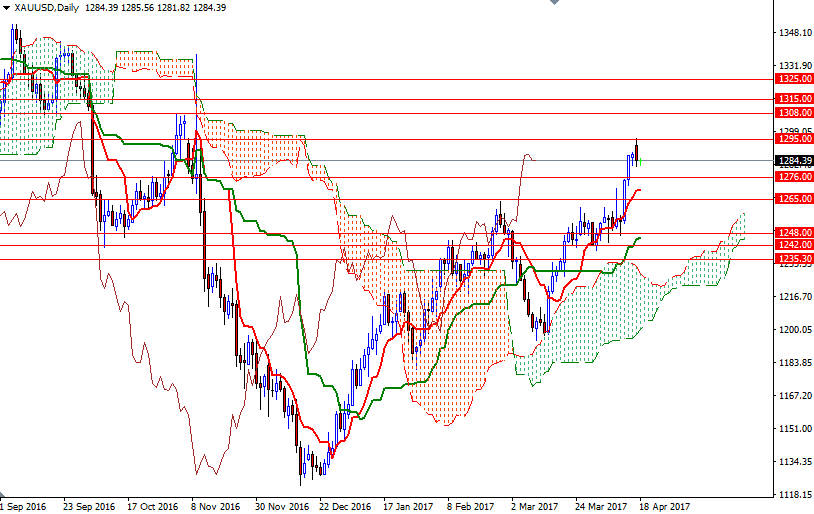

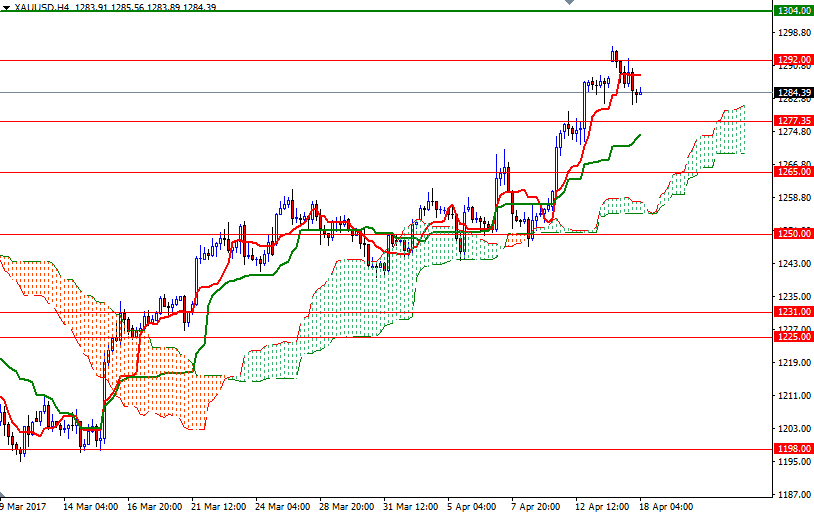

Prices are residing above the daily and the 4-hourly charts; plus we have positively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) lines.

The market is likely to continue to benefit from the bullish medium-term outlook, but shorter term charts suggest that a test of 1277.35-1276 is likely if long-side profit taking continues today. The XAU/USD pair is below the cloud on M30. In addition, there are negative Tenkan-Sen/Kijun-Sen crosses on both H1 and M30 time frames.

Also keep in mind that there is a minor support at around 1281, so XAU/USD needs to break below there to visit 1277.35-1276. If this area fails to hold, then the market will have a tendency to retest the supports at 1272 and 1269. The bears have to drag the market below 1269 in order to challenge 1265/1. To the upside, the bulls will need to break through the intra-day resistance at 1289 so that they can proceed to the 1295/2 area. If the market convincingly penetrates 1295, we may see an extension towards 1308/4.