The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 9th April 2017

Last week, I predicted that the best trades for this week were likely to be long the Japanese Yen and Silver, and short of the U.S. Dollar. These trades did not work out so well overall, unfortunately, due to the fall in Silver. The USD/JPY fell slightly, by 0.28%; yet Silver in USD fell quite substantially, by 1.43%, giving an average negative move of 0.58%.

The Forex market is in an unsettled mood. The U.S. Dollar has gained ground everywhere, even though there was disappointing U.S. economic data in the shape of weak Non-Farm Payroll numbers. The U.S. military strike on the Syrian government caused a spike into “safe-haven” currencies, which may resume conflict grows in the Middle East or Korea, so there is an element of uncertainty to the fore.

The most bearish currency in general against a long-term basket of currencies remains the New Zealand Dollar, while the most bullish is the Japanese Yen. This can be seen by comparing charts of all the major U.S. Dollar pairs which show clear turns in favor of the greenback, while USD/JPY Is more muted. Therefore, I suggest that the best trade of the coming week will be long the Japanese Yen, and short of the New Zealand Dollar. It also looks as if the U.S. Dollar will advance against the British Pound, Swiss Franc and Euro.

Fundamental Analysis & Market Sentiment

The major element affecting the market right now is nervousness over military confrontation. This has led to some strength in the greenback despite disappointing data. Due to the unpredictable nature of events, it is hard to say what will influence the major currencies this week.

Technical Analysis

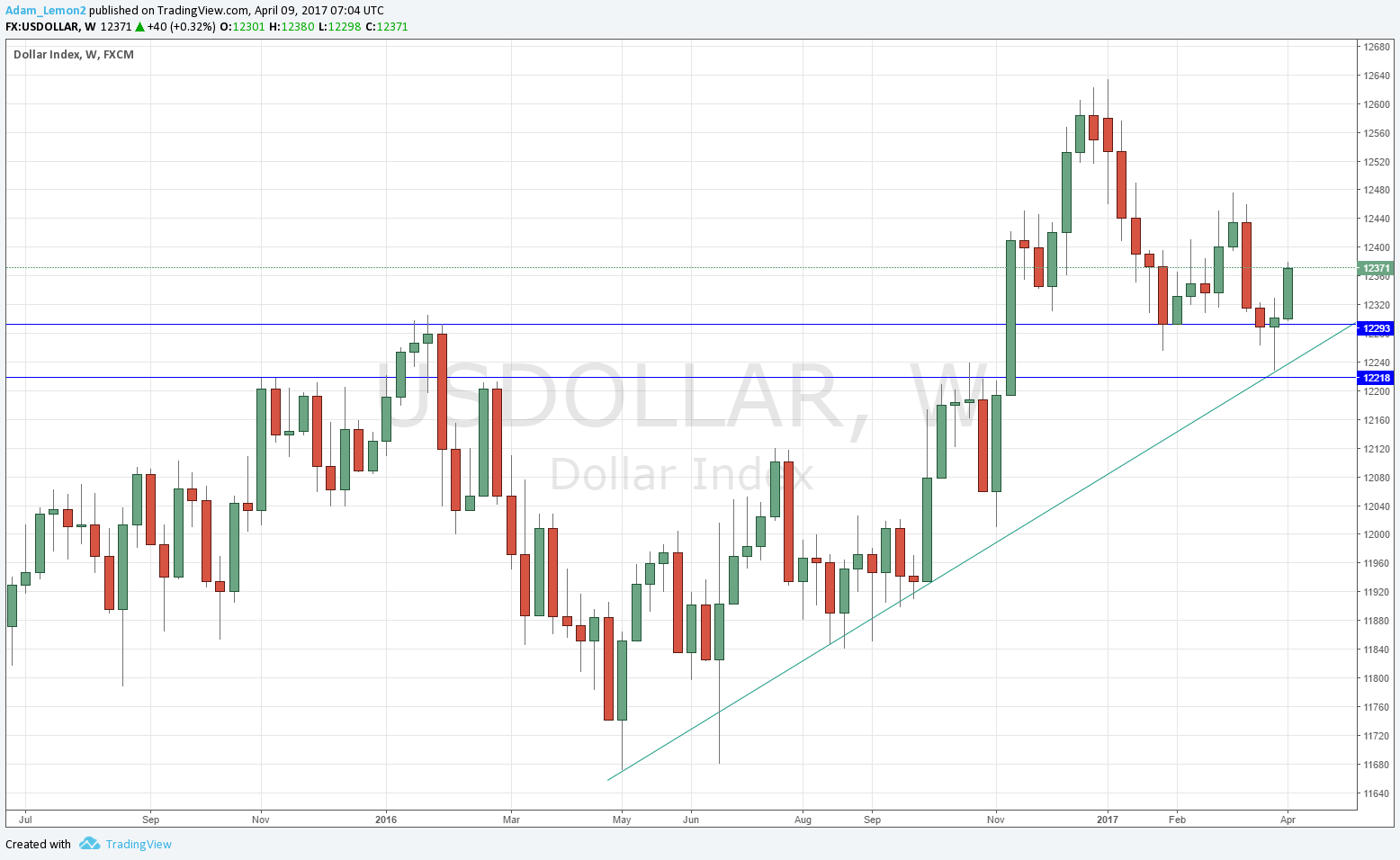

USDX

The U.S. Dollar printed a strongly bullish candle this week, closing hard on its high, with a long real body. A new bullish trend line can be drawn supporting the price over recent months, which is a bullish sign. The price is also clearly rejecting an area I had identified as supportive, shown by the blue lines in the chart below. The only contrary indication is that the price still below its level from 3 months back.

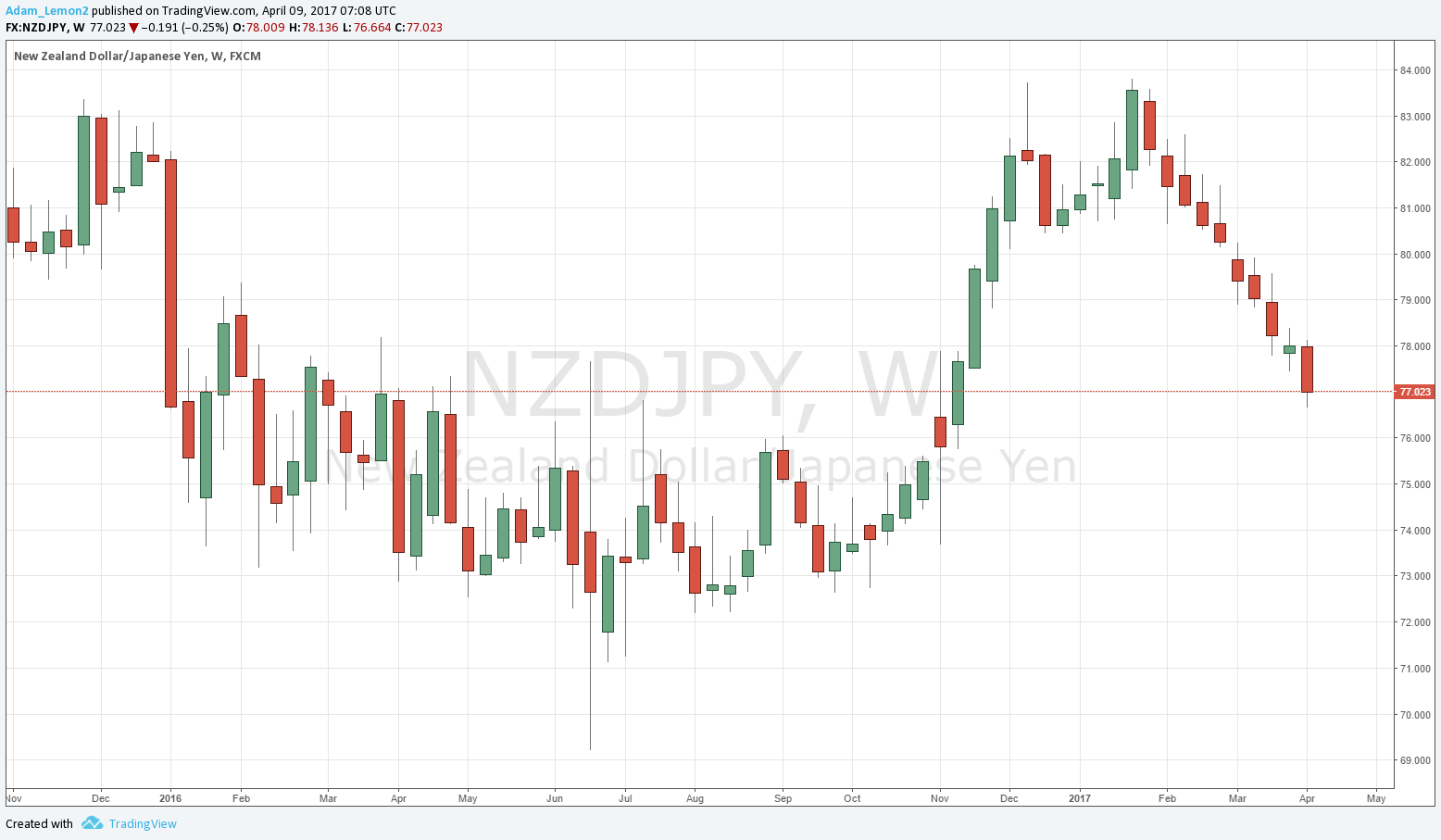

NZD/JPY

The weekly chart below shows that this currency cross is in a strong downwards trend, printing another strongly bearish candle which closed near its low. The price is also well below its recent historical levels. Crosses are usually harder to forecast from charts, but as USD/JPY is in a long-term bearish trend and a technical downwards price channel, and as the NZD/USD has been falling for longer and more strongly than any other major USD pair, it looks like the best weekly forecast available in the market right now.

Conclusion

Bullish on the Japanese Yen; bearish on the New Zealand Dollar.