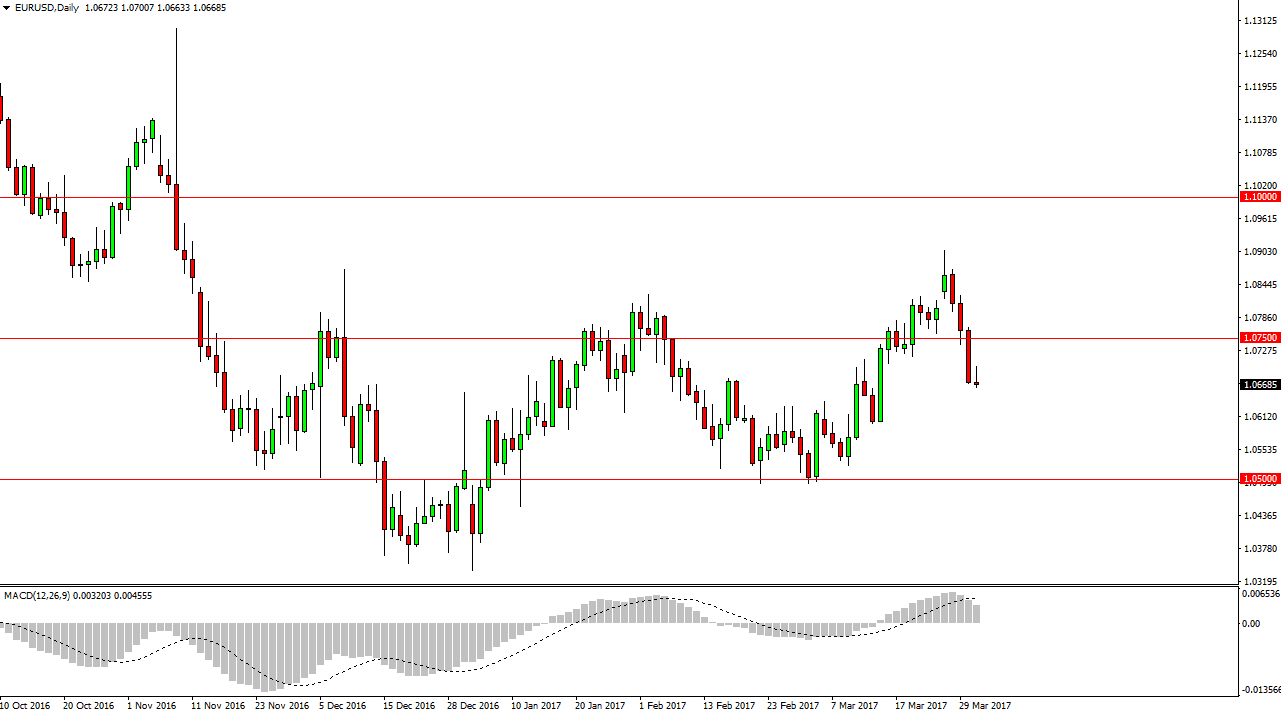

EUR/USD

EUR/USD

The EUR/USD pair initially tried to rally during the session on Friday, but found enough resistance to turn things around and form a shooting star. The shooting star of course is a negative sign, especially considering it is at the bottom of a significant fall. Because of this, I believe that a break below the candle sends this market looking for the 1.06 level, and then possibly even the 1.05 handle. I think that this market continues to suffer significant volatility, but I would be the first to admit that it would be time to start buying again if we can break above the top of the shooting star as it would show significant strength. You are going to have to be nimble, as the volatility will more than likely only continue.

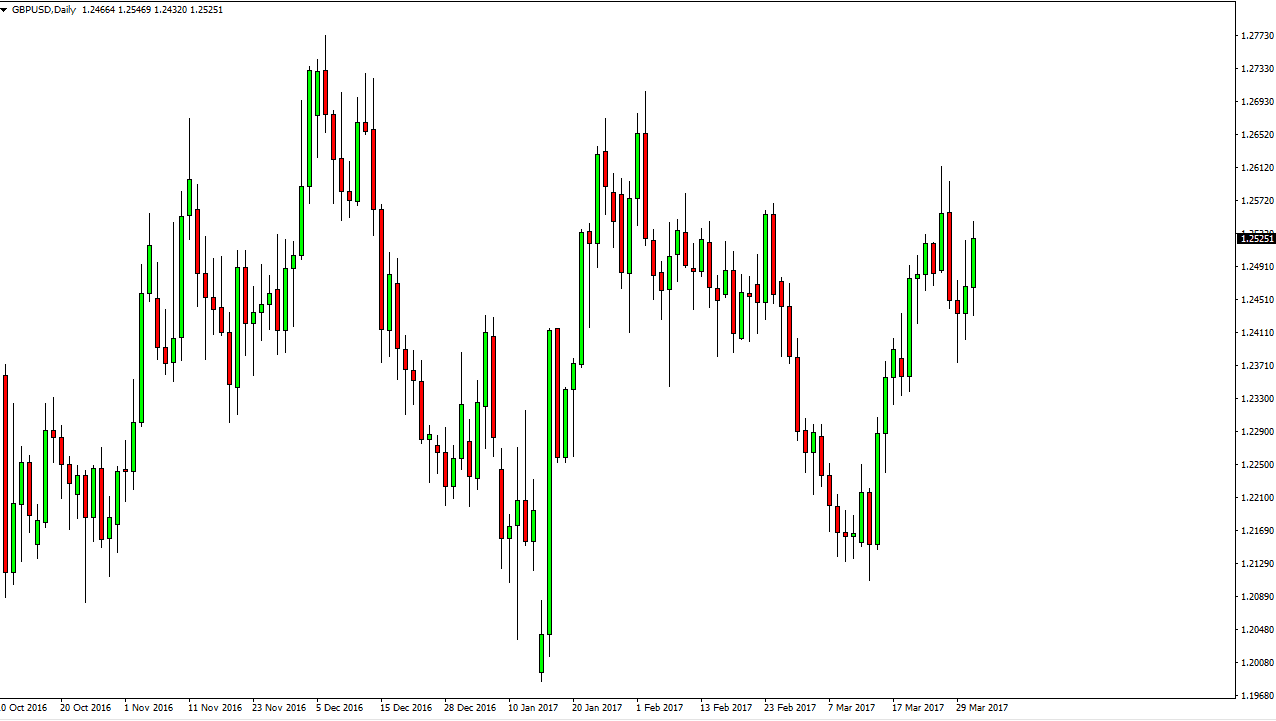

GBP/USD

The GBP/USD pair initially fell on Friday, but found enough support to turn things around and form a large green candle. We are above the 1.25 level again, and it is more than likely only a matter of time before we not only go higher, but test the 1.26 level, and possibly the 1.27 level. If we can break above there, then it’s a longer-term moved to the upside. Pullbacks will probably be frequent, but should only offer value at this point. I understand that there will be a lot of volatility due to the Article 50 being triggered, but quite frankly I think that most of the negativity is already priced into this market.

British inflationary numbers have been stronger than anticipated, and with that being the case it’s likely that the British pound will continue to attract buying. Once we break above the 1.27 level, the market should then be free to go much higher, and that is my longer-term thesis. However, we are not ready to do that yet, so having said that patients will be needed to the upside. As far as selling is concerned, I’m not interested in doing so until we break below the 1.2350 level.