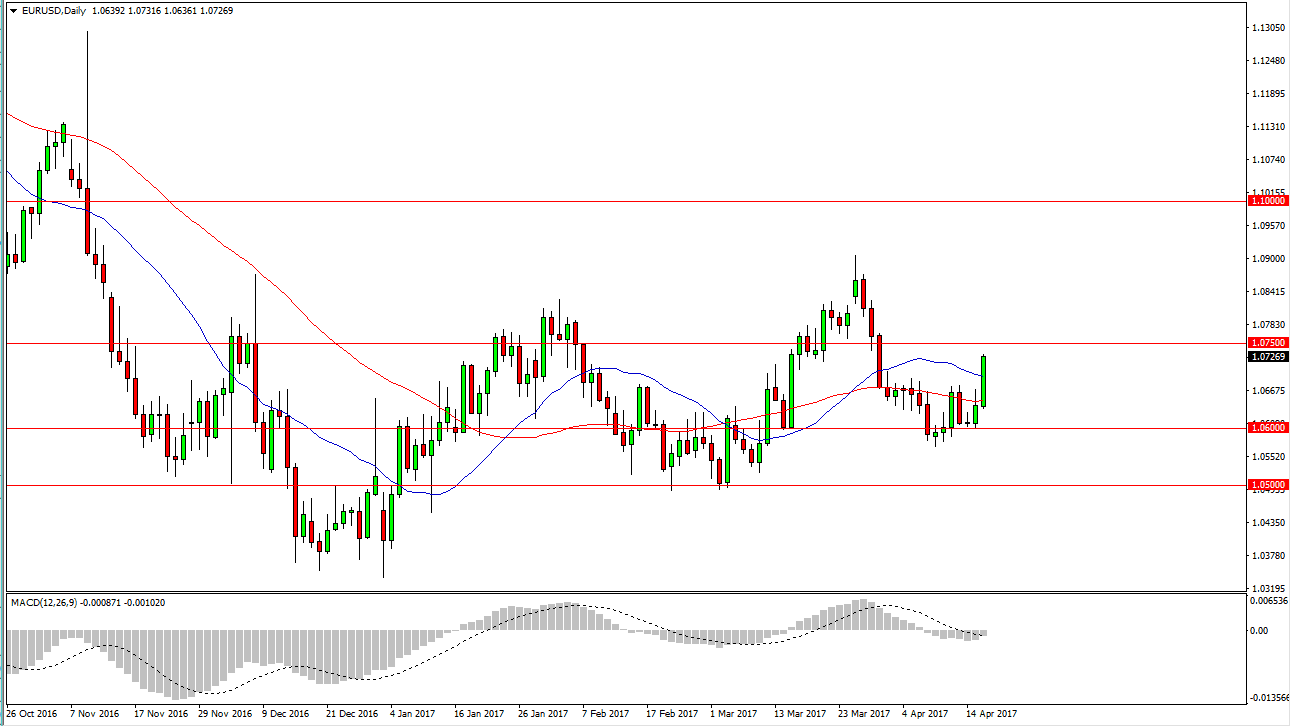

EUR/USD

During the session, the EUR/USD pair rallied and broke above the 1.07 level. It now looks as if the market is going to test the 1.0750 level, and possibly continue higher. We can make an argument for an uptrend channel, and the fact that we broke out during the day suggests that the channel will continue. Because of this, I’m looking to pullbacks as buying opportunities as the US dollar is most certainly on the back foot. With that being stated, I believe that we will see quite a bit of volatility but the buyers seem to be very interested.

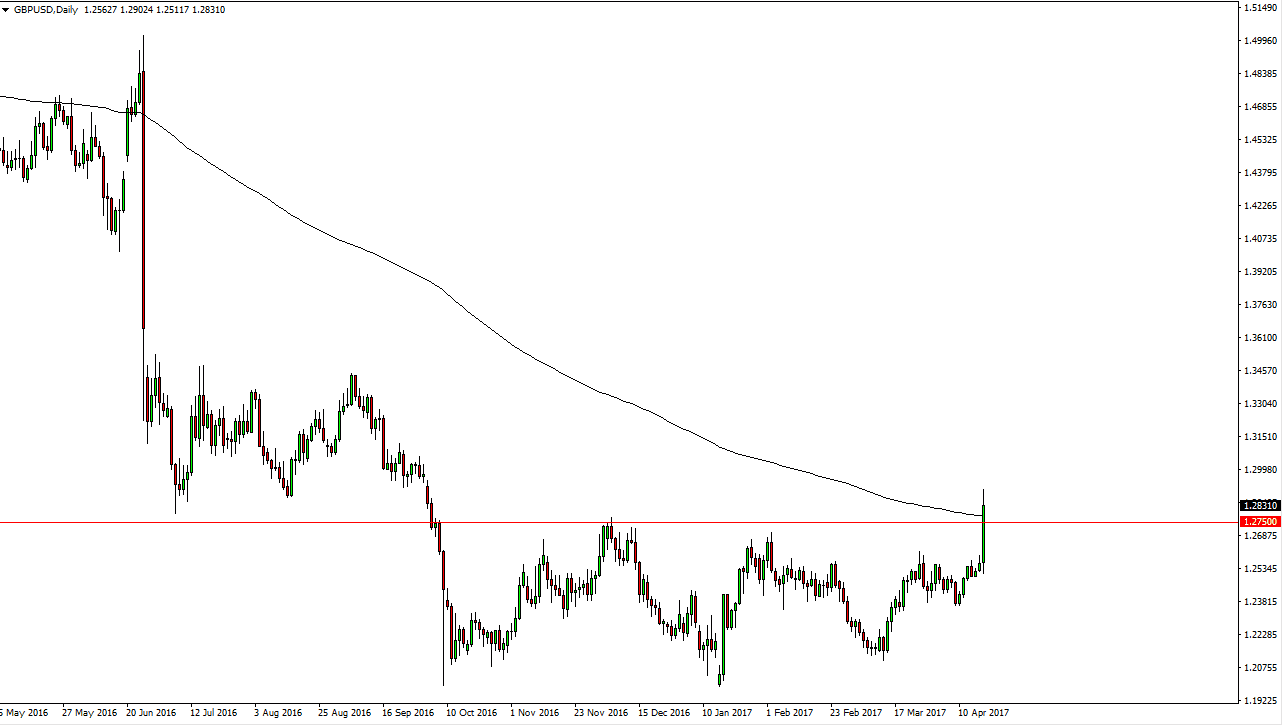

GBP/USD

This is without a doubt one of the most compelling charts for a turnaround that I have seen in a long time. I believe that by breaking the 1.2750 level solidly, and the super spike that happened in the afternoon during American trading, that a lot of the bearish pressure has been blown out and the British pound is now changing its trend. I think that it might be choppy from time to time, but quite frankly this could end up being a longer-term “buy on the dips” type of opportunity. The market broke above the 200-day exponential moving average in a massive move of the day.

Teresa May, the British prime minister has suggested that a snap election is coming, and that should only bolster the attempt and negotiating strength of Great Britain when leaving the European Union. Because of this, the British pound gained everywhere and it looks as if that will continue to be the case. The impulsive candle’s like this don’t happen all the time, and I think at this point we have seen the absolute bottom and the British pound, and that we will more than likely reach towards the 1.3450 level over the next several sessions, if not weeks.