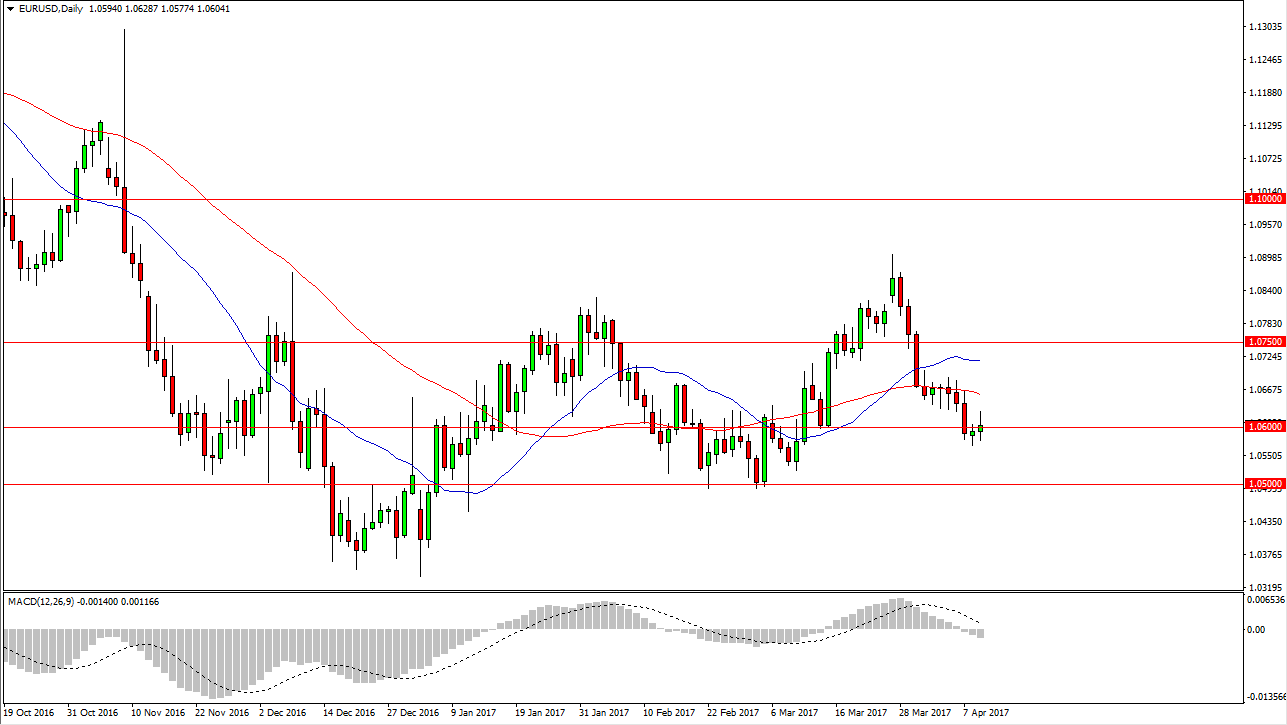

EUR/USD

The EUR/USD pair rallied initially during the day on Tuesday but ran into a significant amount of trouble above the 1.06 handle. A breakdown below the bottom of the candle could send this market looking for the 1.05 level underneath. There are a lot of concerns about geopolitical risk now, and because of this I think it’s only a matter of time before the US dollar picks up a bit anyway. Nonetheless, it is a market that will be choppy. I believe that we are going to continue to see sellers, simply because the US dollar will become a safety currency. I don’t know if we can break down below the 1.05 handle, but until we break above the 1.07 level, I know that I don’t want to buy this pair.

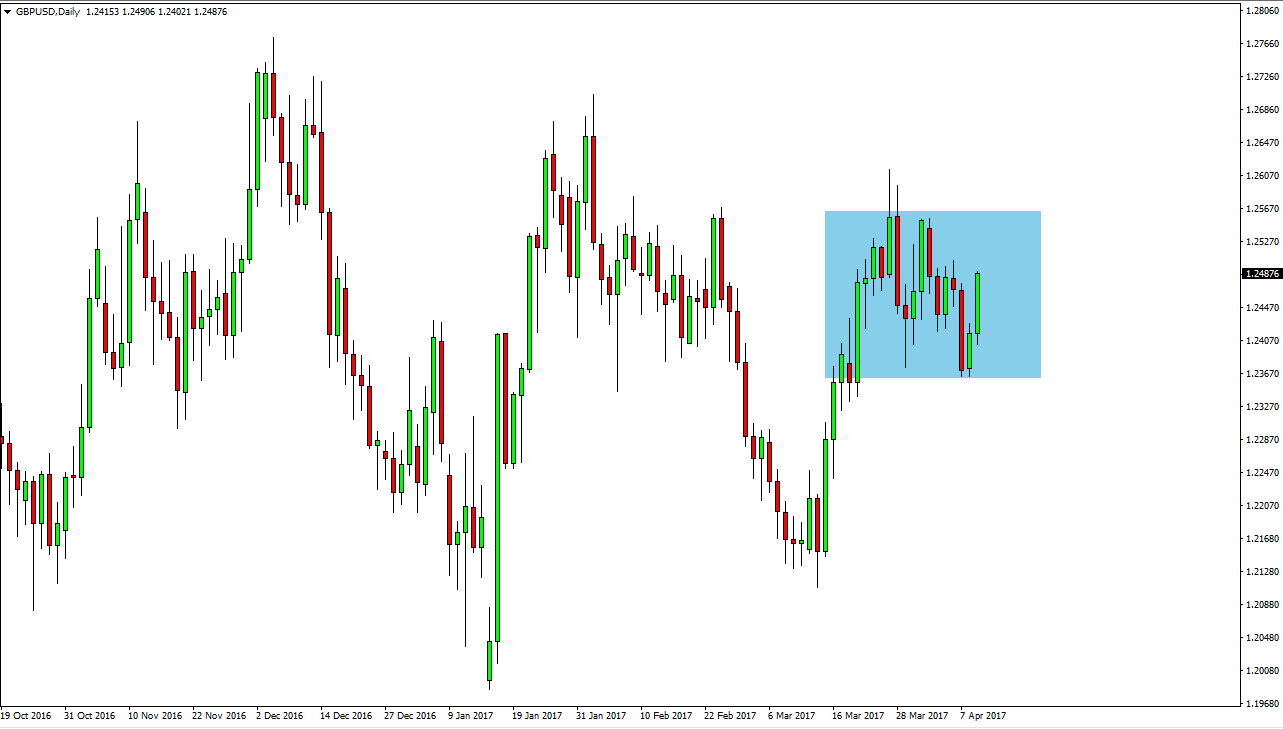

GBP/USD

The British pound broke higher during the day on Tuesday, testing the 1.25 region. Nonetheless, I think the real battle is above at the 1.26 handle, as we have been consolidating for some time. The pair has been rather choppy and that makes sense because the CPI numbers were very strong during the day on Tuesday for the United Kingdom, but we also have a lot of headline risk out there when it comes to the British pound due to the United Kingdom leaving the European Union. I do believe that inflation is starting to pick up in the United Kingdom and that the British pound should continue to go higher longer-term, but I recognize that there is a significant trading area that we have been stuck in over the last several weeks, and as a result I must respect that. Longer-term, I’m a buyer, but in the meantime, I think that we continue to go back and forth between the 1.2350 level on the bottom and the 1.2650 level on the upper and.