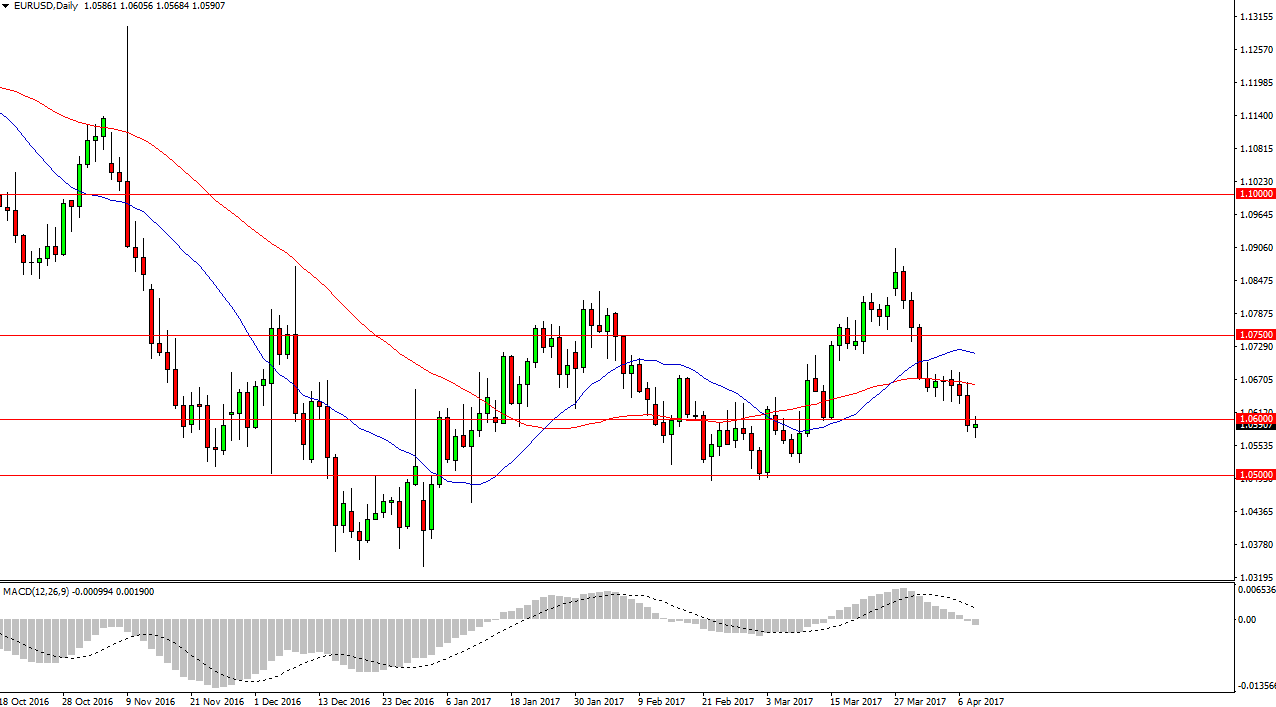

EUR/USD

The EUR/USD pair formed a less than stellar candle during the Monday session as we continue to grind lower. The 1.06 level has been broken and now has been tested again on Monday. With this being the case, if we can break down below the bottom of the range I feel that the market will probably reach towards the 1.05 handle below. It seems to me that the downward pressure is increasing, and that the US dollar is starting to pick up a little bit of momentum overall. The MACD has been showing negative pressure as well, so I feel that the downward move is more than likely what we will see over the next couple of sessions.

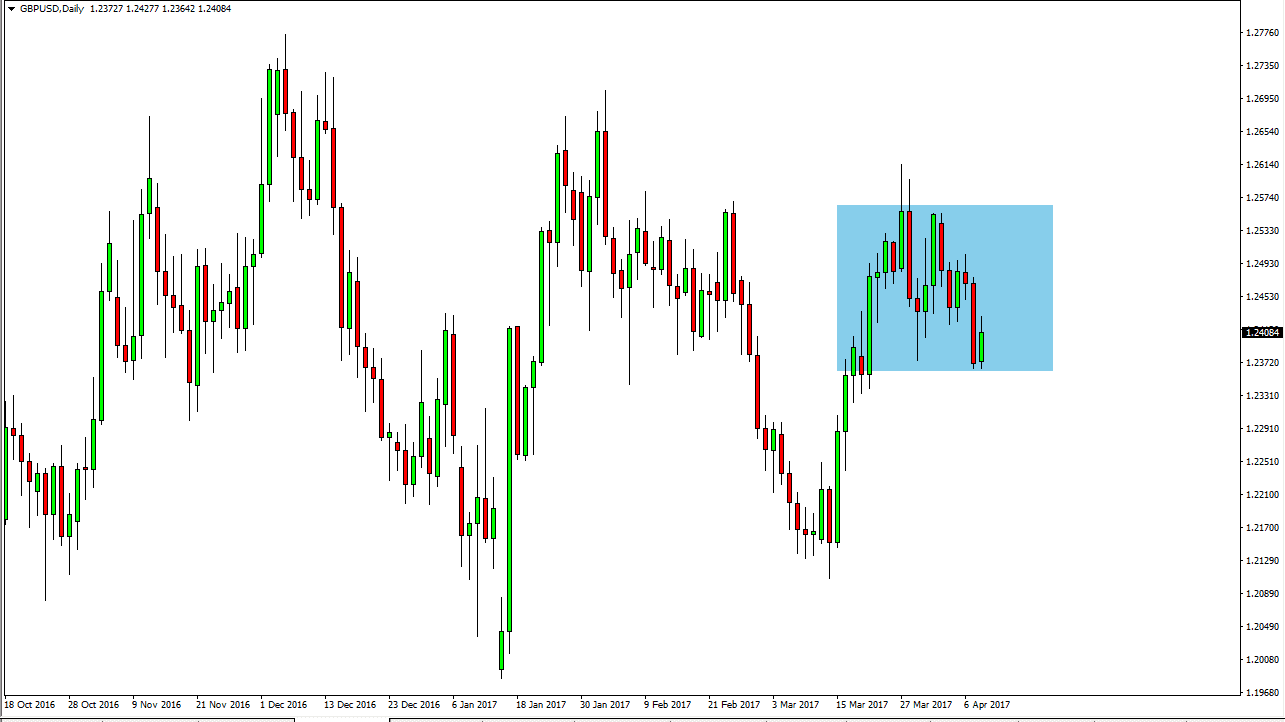

GBP/USD

This pair continues to grind sideways overall, and currently I think that unless you have the ability to treat short-term charts, it’s probably all but impossible to be involved with. I think that the 1.26 level above is offering quite a bit of resistance, while the 1.2350 level underneath continues to offer significant support. I believe that short-term trading is probably as good as it gets right now but longer-term I do have a bullish outlook for the British pound, but I recognize that there are a lot of headlines out there that cause issues. Increasing inflation seems to be sneaking into the British economy, and that should be good for the British pound over the longer term.

Having said this, I believe that the market offers quite a bit of opportunity for the longer-term trader, but the short-term trader is going to have to be nimble. If we can break above the 1.27 level, that should be the signal to go long in this market more of a longer-term type of trade. If we do breakdown below the 1.2350 level, the market will then start to look towards the 1.21 handle underneath.