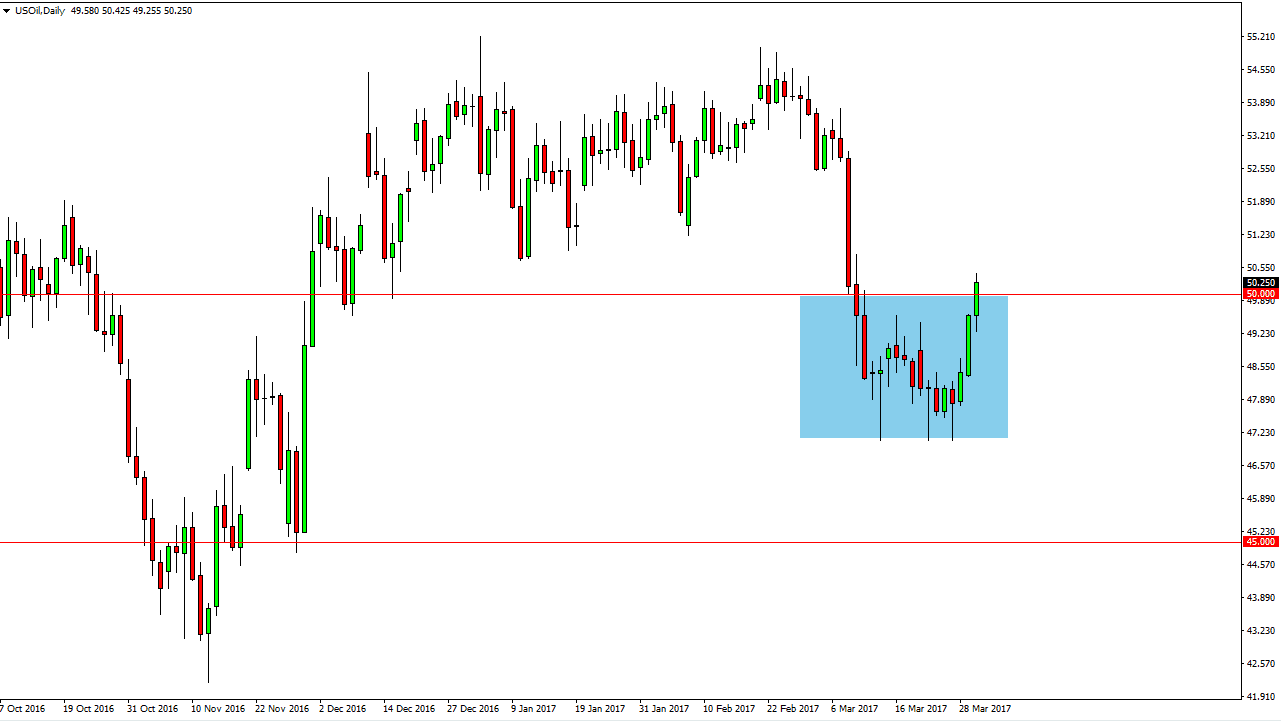

WTI Crude Oil

The WTI Crude Oil market initially fell slightly during the day at the open on Thursday but then surged through the $50 level as it was learned Goldman Sachs is trying to squeeze the price differential between Brent and WTI markets. The question now is whether we can continue to go higher but I should suggest that as long as we can hold above $50, a supportive candle will more than likely be a nice buying opportunity. A break below the $49.50 level would be a very negative sign. I think that as we enter the driving season, we will more than likely see bullish pressure for a while. Given enough time, it’s only a matter of time before oversupply becomes an issue, but in the short term it looks as if the buyers are in control.

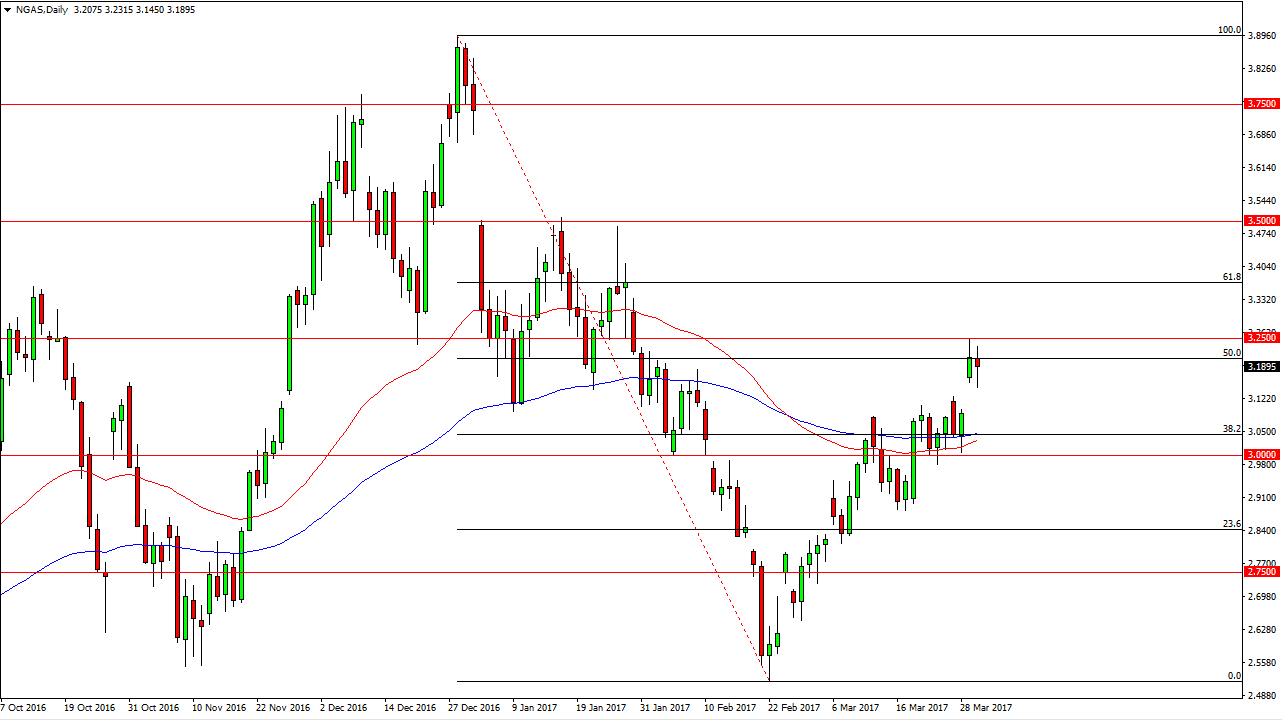

Natural Gas

Natural gas markets continue to look bullish, as we went back and forth during the Thursday session. The 3.25 level above should be resistive, and because of this I think that the market breaking above there would be a very bullish sign. We do have a gap below though, so it’s likely that we should fill that given enough time. Ultimately, I think that there is an oversupply issue and natural gas but lately numbers have been encouraging. Perhaps the drillers stepped away long enough to wear down some of the inventory, but longer-term we still are going to have issues.

With this being the case, I like buying on a break above the 3.25 level for short-term smash and grab type of trade. Alternately, if we filled the gap and formed a supportive candle that could be a nice buying opportunity as well. As for selling is concerned, I should reassess the entire situation because although I do think that we go lower longer-term, right now that certainly isn’t going to be the case anytime soon.