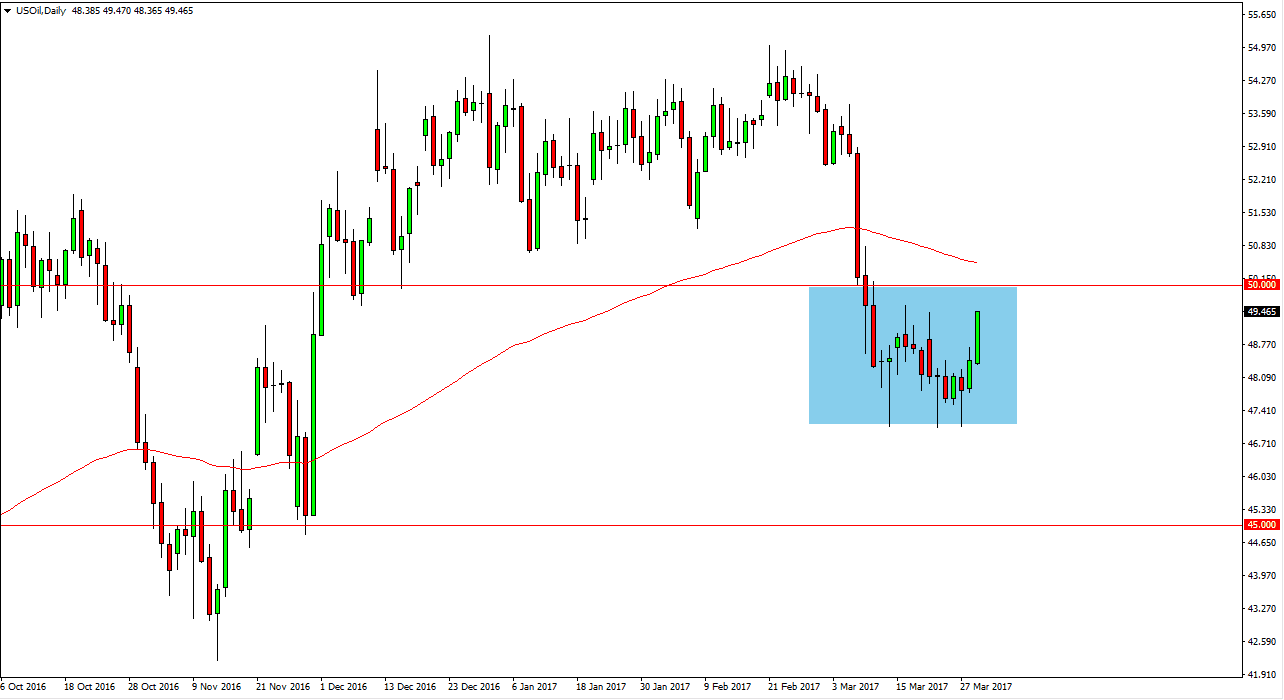

WTI Crude Oil

The WTI Crude Oil market rallied during the day on Wednesday as the Crude Oil Inventories announcement was “less bad” than originally expected. However, I still see a significant amount of resistance at the $50 handle so I’m waiting to see if we can get an exhaustive candle that I can start selling. That would give us an opportunity to start shorting a market that has been very consolidated. On the other hand, if we manage to break above the $50 level on a daily chart and close more important, then I believe that the market will continue to go higher. Ultimately, this is a market that should continue to be very choppy and volatile. However, it should be noted that the Crude Oil Inventories announcement was still a positive build.

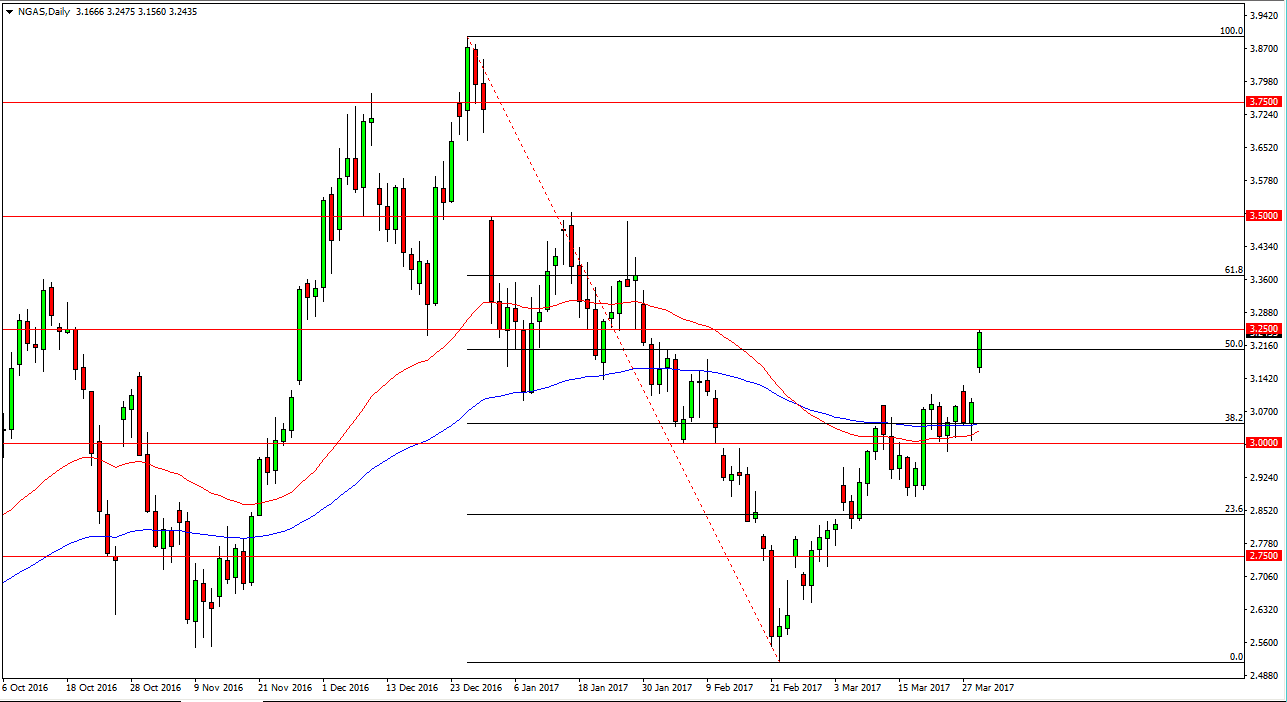

Natural Gas

Natural gas market participants pushed the price all the way to the $3.25 level during the day on Wednesday, in a severe sign of strength. We have the Natural Gas Inventories announcement coming out today as well, so that could be even more fuel for the fire of volatility. I think given enough time, the market will try to fill this gap that we just created, but currently it looks as if the buyers are well in control. I think that given enough time the sellers were returned, but you cannot fight this type of move. There is a lot of noise all the way to the $3.50 level, so it will be choppy trading. However, if we can get above the $3.25 level for a couple of hours, it’s probably a buy signal. I believe that longer-term the oversupply of natural gas will catch up with the market yet again, but it appears that we are going to continue going higher for the meantime. Remember, it’s not what makes sense, it’s where the market goes that matters.