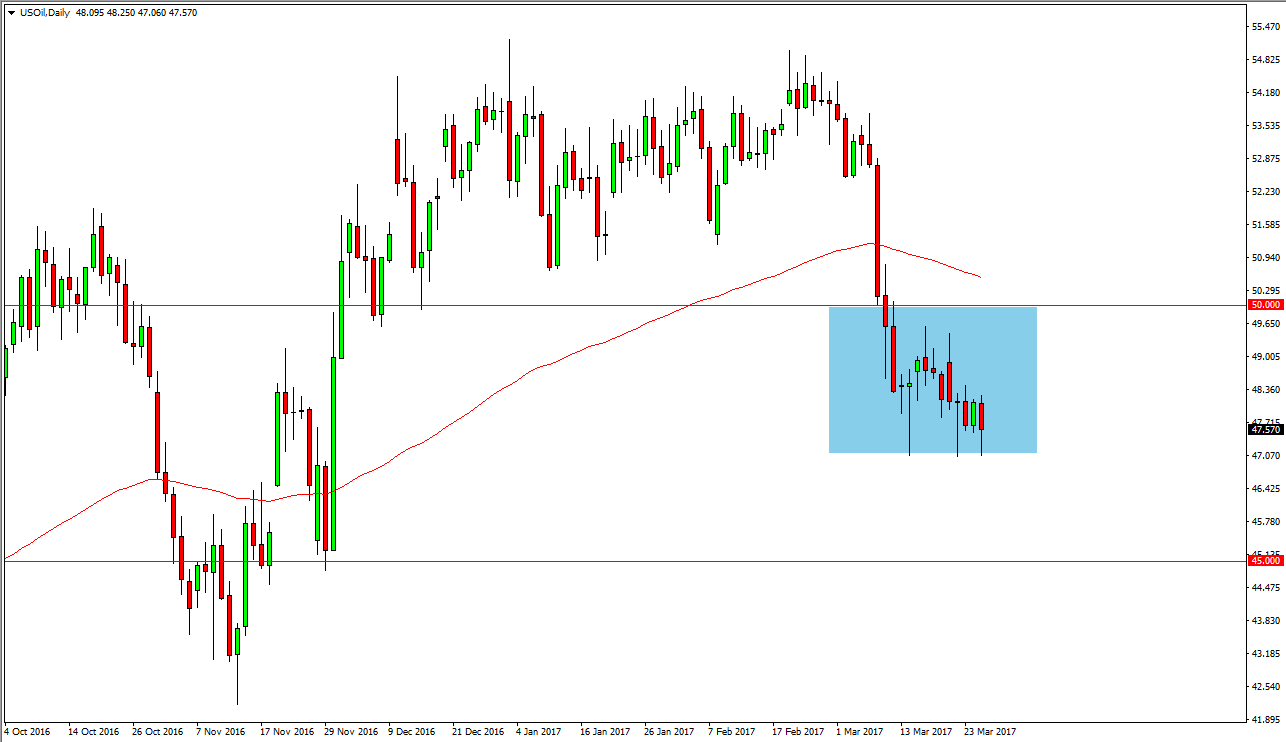

WTI Crude Oil

The WTI Crude Oil market fell during the day on Monday, testing the $47 level again. However, we found support at that level again, and with this we ended up forming a bit of a hammer. If we can break down below the bottom of a hammer, that is a strong cell signal and I would start shorting and reaching towards the $45 level below. If we can break above the top of the hammer, that’s a bullish sign but I think there is a significant resistance above at the $50 handle to keep the market bearish. In the meantime, expect a lot of volatility and choppy trading on short-term charts. Consolidation seems to be the overall tone, but given enough time I believe that the sellers will return due to oversupply.

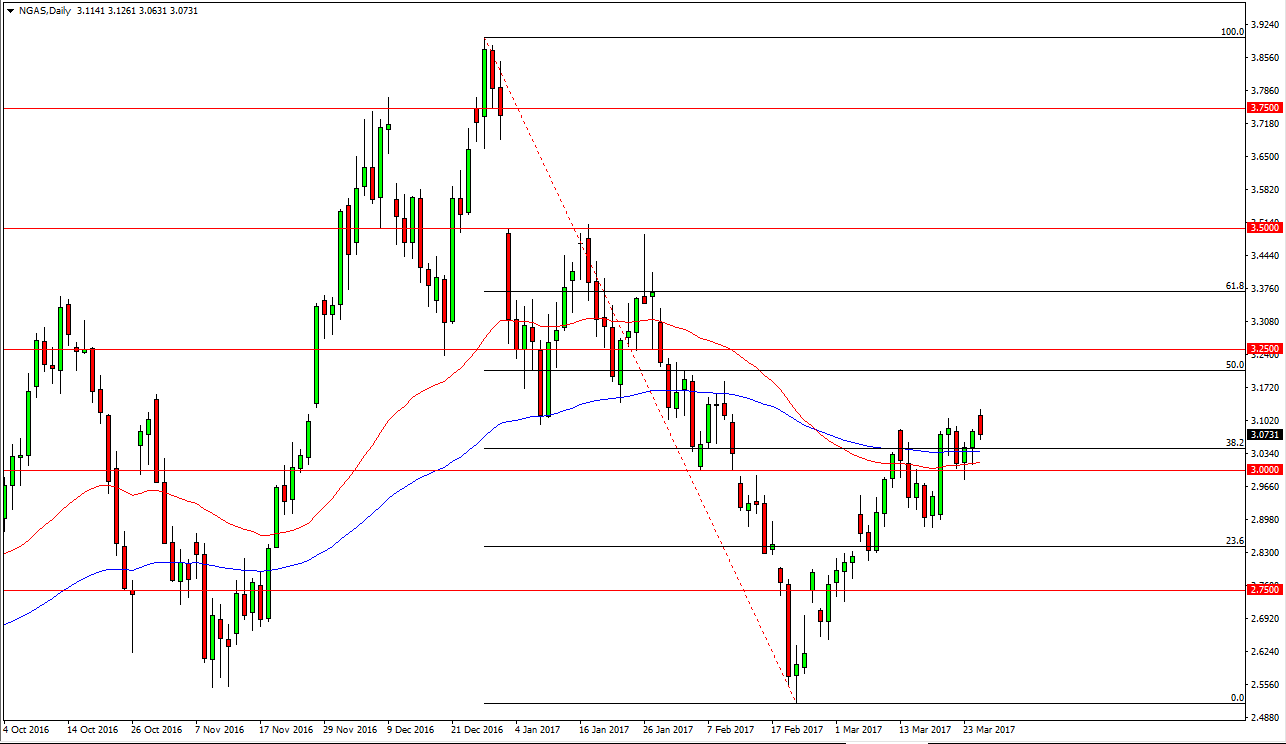

Natural Gas

Natural gas markets initially gapped higher at the open on Monday, but fell significantly to not only filled the gap, but go even lower. I think that the $3 level below is going to offer a significant amount of support, so if we can break down below there it’s likely that the market will fall apart and reach towards the $2.90 level. Rallies of this point are still selling opportunities as far as I can see, and although we have seen a significant amount of bullish pressure, the reality is that the longer-term fundamental problems are going to cause issues such as the oversupply of natural gas for the markets in general and of course the lowering demand that we are continuing to see as the warmer temperatures start reaching the United States.

If we can break down below the $2.90 level, I believe that we then reach to the $2.75 level underneath that. Longer-term I’m still very bearish of this market and even though we have had a significant bounce, we only reached the 38.2% Fibonacci retracement level.