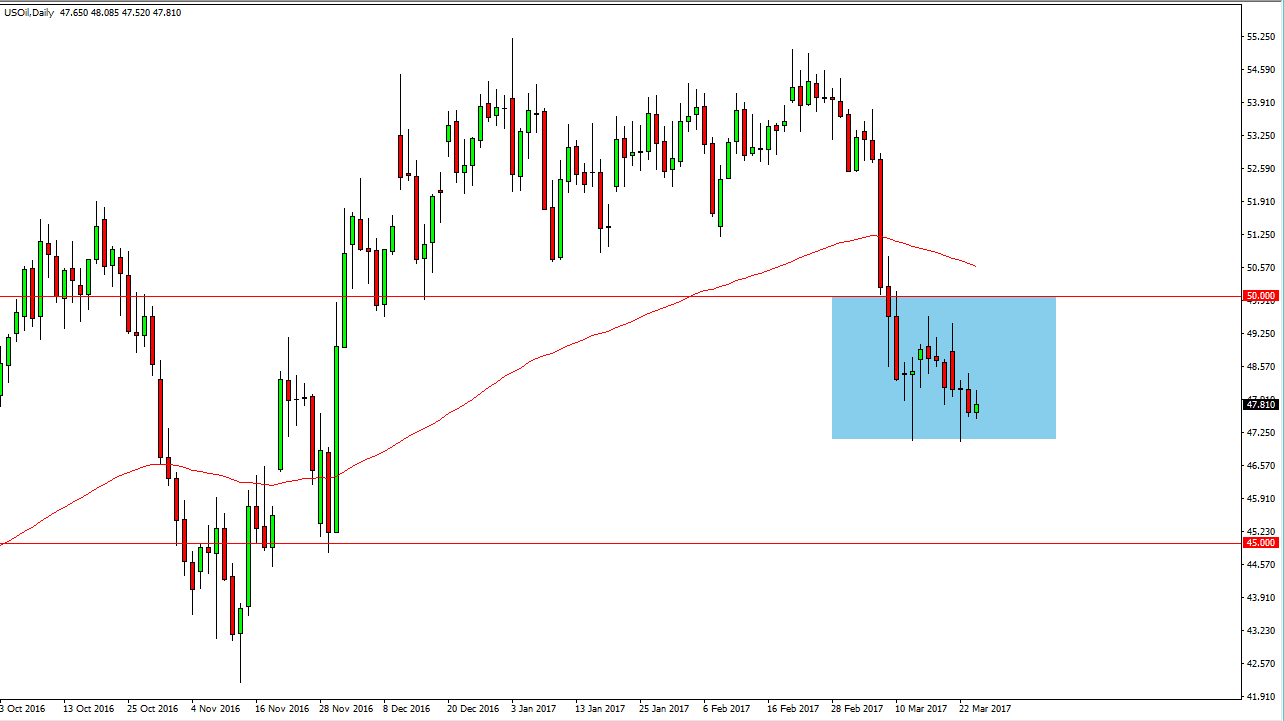

WTI Crude Oil

The WTI Crude Oil market initially rally on Friday, but turned around to form a shooting star. The shooting star suggests that the market simply cannot pick up enough momentum to rally for any real length of time. However, I do see a significant amount of support at the $47 level just below, which of course is the bottom of the overall consolidation. Once we break down below there, the market will more than likely go reaching towards the $45 level underneath, but I do recognize that we could rally from here. If we rally from here, I believe that a short-term buying opportunity may present itself, but the $50 level above there should be the absolute ceiling in this market.

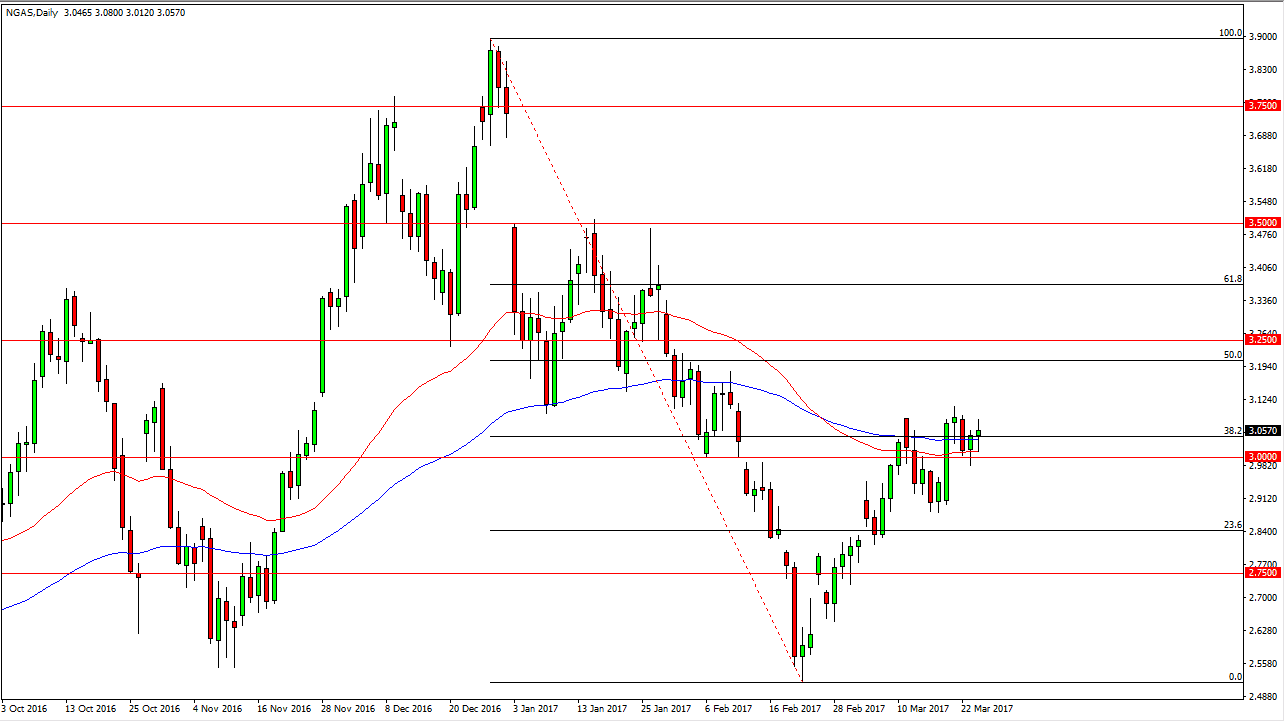

Natural Gas

The natural gas markets went back and forth during the day on Friday, testing the 50-day exponential moving average for support. We found it there, and more importantly the $3.00 level. However, I am still very negative in this market and I believe that it’s only a matter of time before breakdown. If we can clear the bottom of the Thursday candle, I believe that point in time the market should then go to the $2.90 level underneath. If we break above the highs from the session on Friday, the market could rally but I look at that as a potential selling opportunity from higher levels once we finally see exhaustion. The oversupply will continue to weigh upon this market, so therefore I just don’t have any interest in going long.

Once we get below the $2.90 level, I think the next area of support will be near the $2.75 level. A breakdown below there should send this market down to the $2.50 level after that. We are starting to head towards warmer weather in the United States, and that will drive down some of the demand which is already a bit soft.