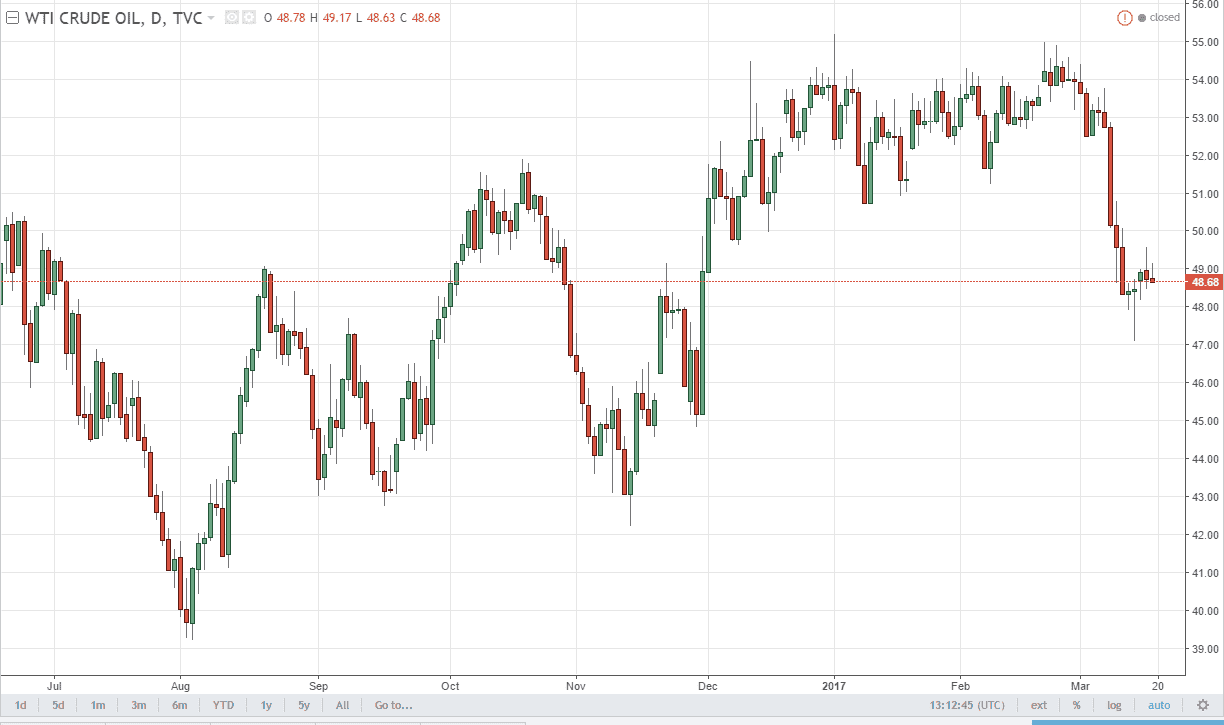

WTI Crude Oil

The oil market simply cannot get out of their own way. On Friday, we tried to break above the $49 level to turn around and form a shooting star just as we did on Thursday. I believe that the market is currently going to consolidate, but eventually we will break down below the $47 level and go reaching towards the psychologically significant $45 level. I have been bearish on oil for several months now, and it appears that the market has finally caught up with the idea of oversupply. Now I think we go much lower and therefore return we rally, signs of exhaustion invite more selling. With the oversupply and quite frankly glut in oil, it’s hard to imagine where this market gets its legs again.

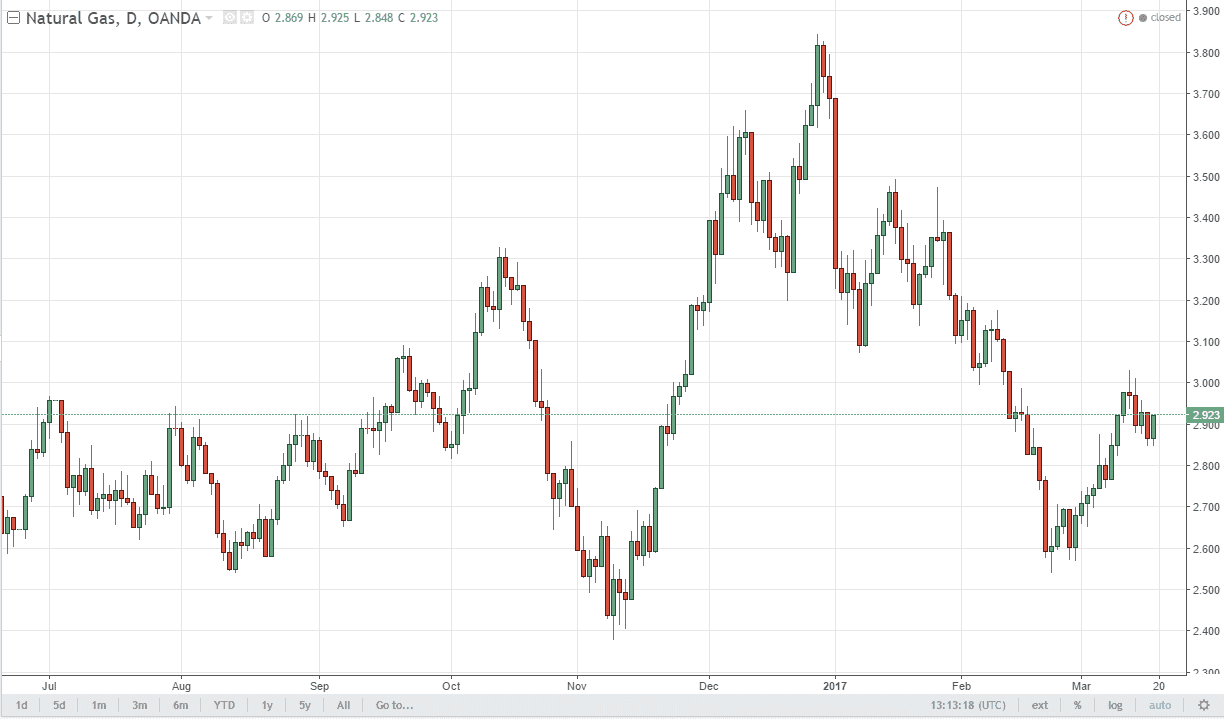

Natural Gas

Natural gas markets rallied on Friday, but I believe this is a simple retest of the psychologically important $3 handle. If we can break above there, yes we can then go higher but ultimately I think we will more than likely find sellers in that region. Exhaustive candle has me selling, just as a breakdown below the bottom of the range for the Friday session, as there is so much in the way of bearish pressure on the natural gas sector right now. Oversupply is obviously a major concern, but so is a serious lack of demand as warmer spring temperatures work the way into the northeastern part of the United States.

Natural gas is readily available and hugely oversupplied, so this is just like the Gold markets in the 1980s, he simply sell every time it rallies and collect your profits. I don’t even have a scenario in which I am willing to put money to work in this market to the upside.