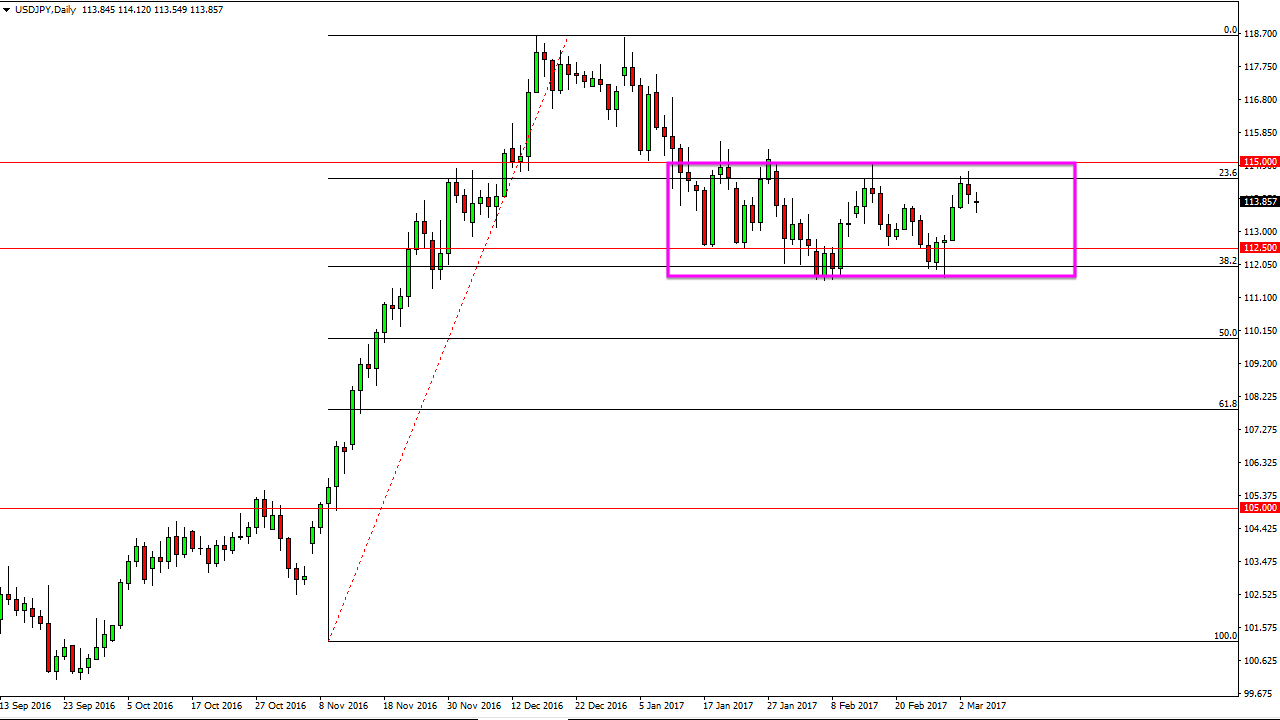

USD/JPY

The USD/JPY pair gapped lower at the open on Monday, but I believe that we are currently consolidating overall, and I believe that the bottom of the consolidation is closer to the 111.50 level. I believe that the 115 level above is massively resistive, and a break above there census market looking for the 118.50 level, which I believe happens given enough time. Short-term pullbacks are buying opportunities, but you should deal with quite a bit of volatility obviously. The Federal Reserve is likely to raise interest rate several times this year, while the Bank of Japan is light years away from going in that direction.

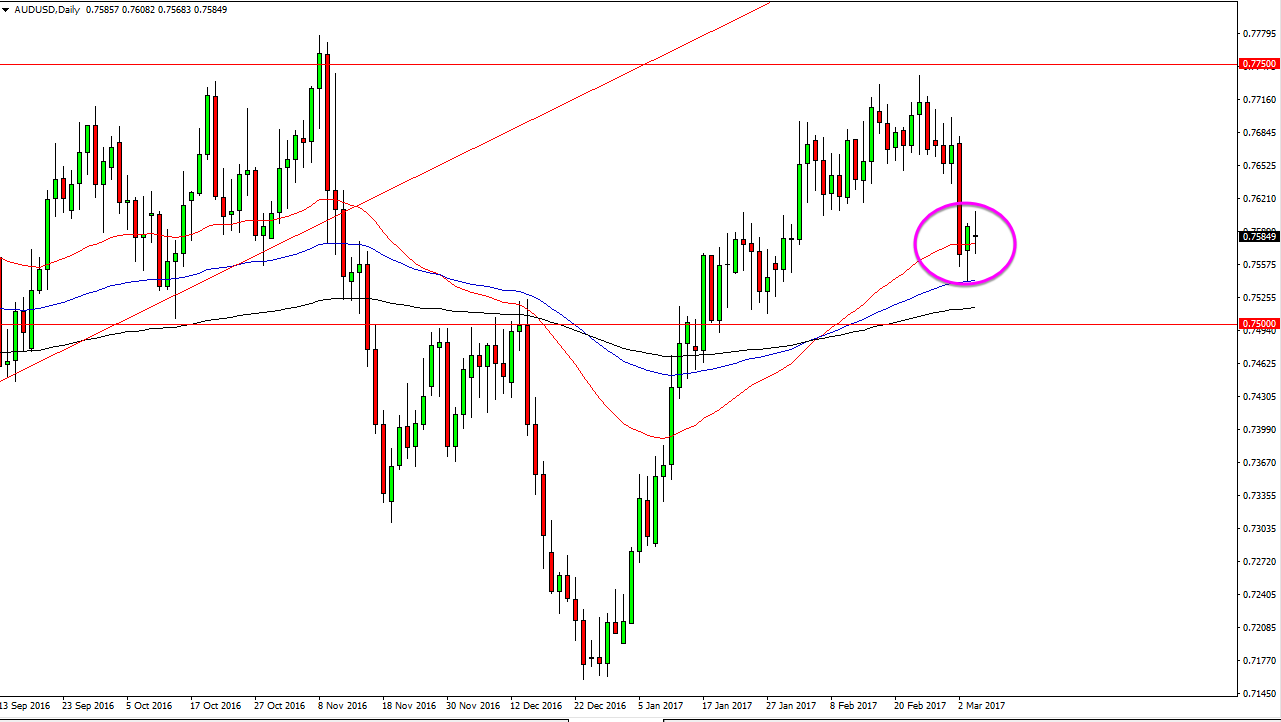

AUD/USD

The AUD/USD pair went back and forth during the day on Monday, showing signs of volatility and indecision. We formed a massive hammer on Friday, and that of course is a bullish sign. The 50, 100, and 200-day exponential moving averages all have crossed, and sit just below offering support. Pay attention to the gold markets, because quite frankly they have an extreme effect on the Australian dollar in general. If we can break above the top of the candle from the session on Monday, I’m a buyer and I believe that the Australian dollar reaches towards the 0.7650 level.

There is a lot of noise just above there, so I might be difficult to reach towards the 0.7750 level above there. That will be a significant barrier, but I think eventually we can get above it. Just below at the 0.75 level I see a massive amount of support, and not only because we have the 200-exponential moving average. Does a lot of noise previously down to the 0.74 handle, so quite frankly I believe that the market will be difficult to break down from here. Gold markets look very strong, and have shown signs of support, so given enough time I think both markets go in the same direction, higher.