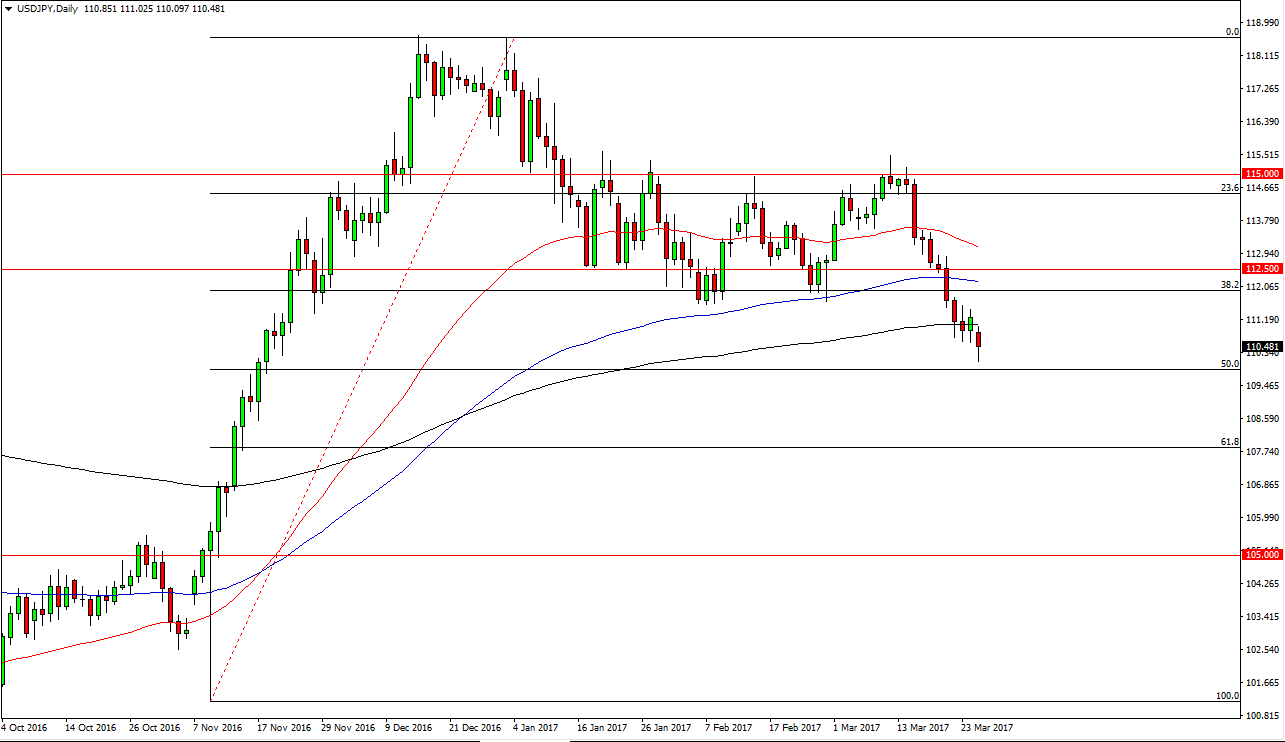

USD/JPY

The USD/JPY pair fell during the day on Monday, but found enough support just above the 110 level to turn things around and form a hammer. The hammer of course is a bullish sign and if we can break back above the top of the hammer, we would not only signal a buying opportunity based upon the candlestick, but also the fact that we have broken back above the 200-day exponential moving average. At that point, I would anticipate that the market would probably go to the 112 handle. A break above the 112.50 level would be bullish enough to send this market looking for the 115 handle. The 50% Fibonacci retracement level acted as significant support, and it now looks as if we may be ready to try and go higher.

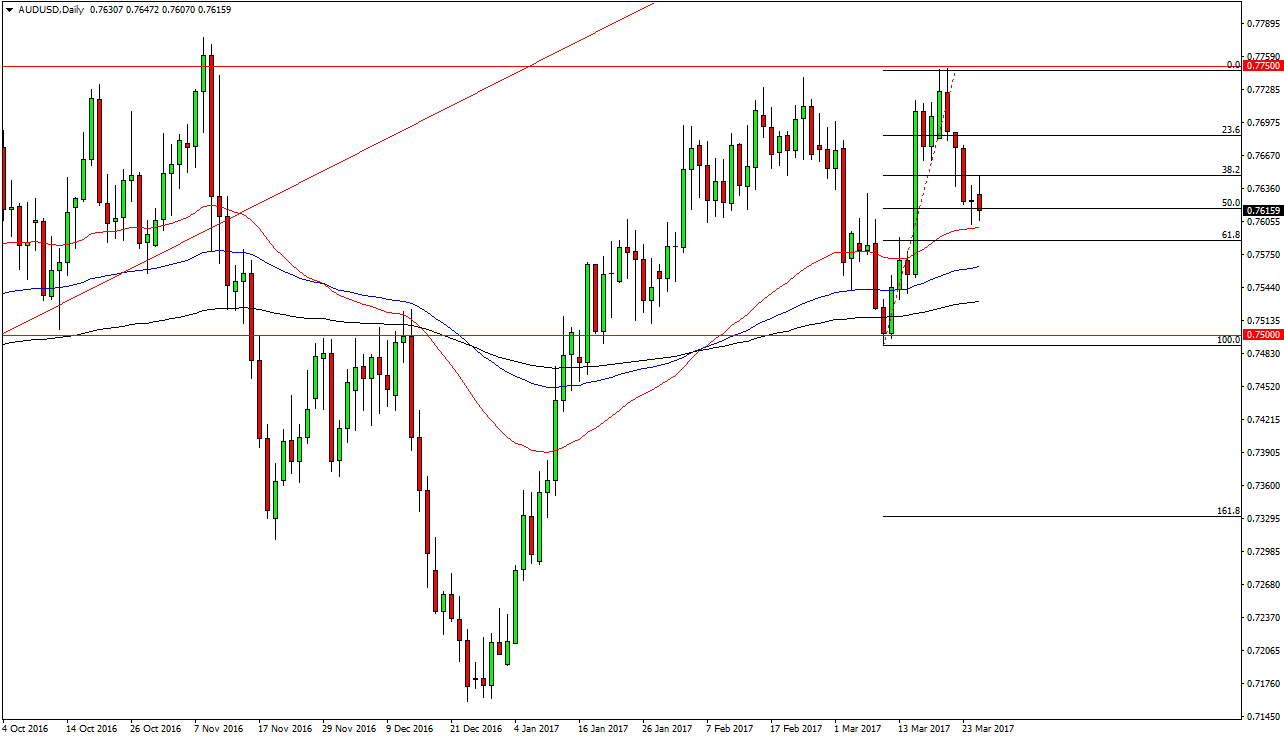

AUD/USD

The Australian dollar went back and forth during the day on Monday, showing signs of volatility again. It appears that the 50% Fibonacci retracement level has offered enough support to keep the market somewhat afloat, but the resulting price action for the day wasn’t exactly stellar. If we can break above the top of the range for the session on Monday, at that point I would be a buyer. Alternately, I believe that the 50-day exponential moving average could be a buying opportunity as well, pictured in red on the chart. Ultimately, I think the market will go reaching towards the 0.7750 level, but it may take some time to get there.

I think that the gold markets will probably have to cooperate, and at this point they seem to be. After all, we so quite a bit of strength over the last couple of days, but we have not broken out completely. There is a definite positive correlation between gold and the Australian dollar so if it breaks out above the $1260 level, the Australian dollar should take off to the upside.