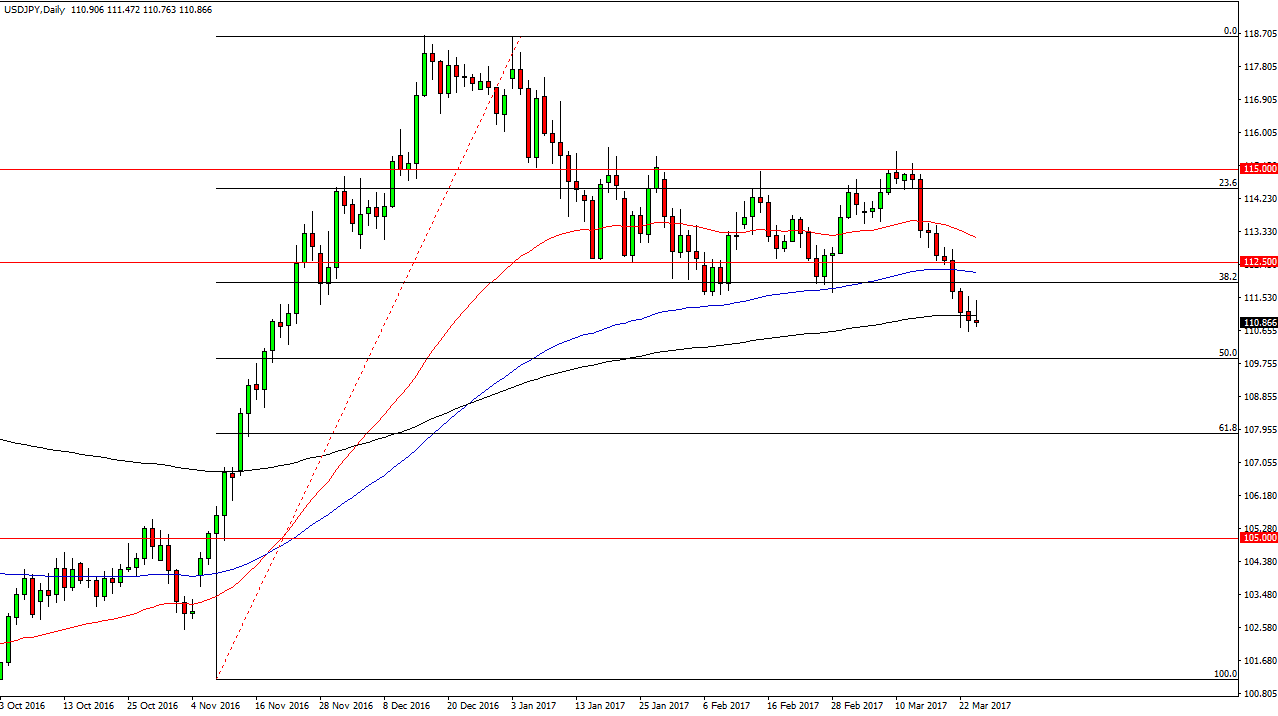

USD/JPY

The USD/JPY pair initially tried to rally during the session on Friday but found enough resistance to turn things around and form and exhaustive candle. Ultimately, if we can break down below there, the market should then reach towards the 50% Fibonacci retracement level. That is essentially the 110 level, and it does look like we may see an attempt to reach that area. That should be an area that attracts a lot of attention, and with this in mind I would not hesitate to buy some type of bounce or supportive candle in that region. Ultimately, I am a buyer of this pair longer-term, but we may need to drop a little bit to find enough value.

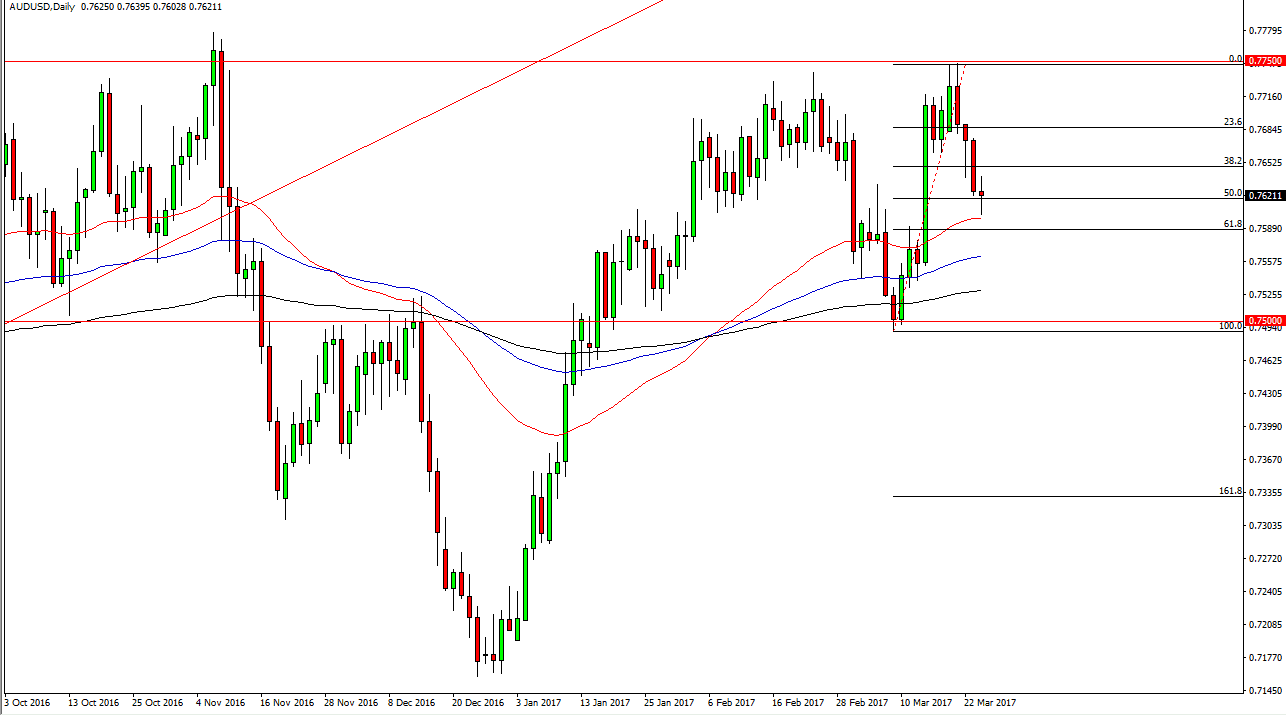

AUD/USD

The AUD/USD pair had quite a bit of volatility and it on Friday, as we found the 0.76 level supportive enough to keep the market afloat. The 50-day exponential moving average also offered support, as well as the 50% Fibonacci retracement level from the recent rally. I believe that the market will eventually try to reach towards the 0.7750 level above, which was massively resistive. The gold markets have a massive influence on this pair, but when you look at the major moving averages, it suggests that there is bullish pressure longer term. I have no interest in selling because I believe that the longer-term traders continue to find value in this market. Once we break above the 0.7750 level, the Australian dollar will more than likely make a beeline to the 0.80 handle above, which of course is an area that has attract a lot of attention over the last several decades.

Even if we do breakout from here I believe there is more than enough support at the 0.75 level to keep the market afloat. Also, gold markets look as if they are trying to find support, so that will be a knock-on effect over here.