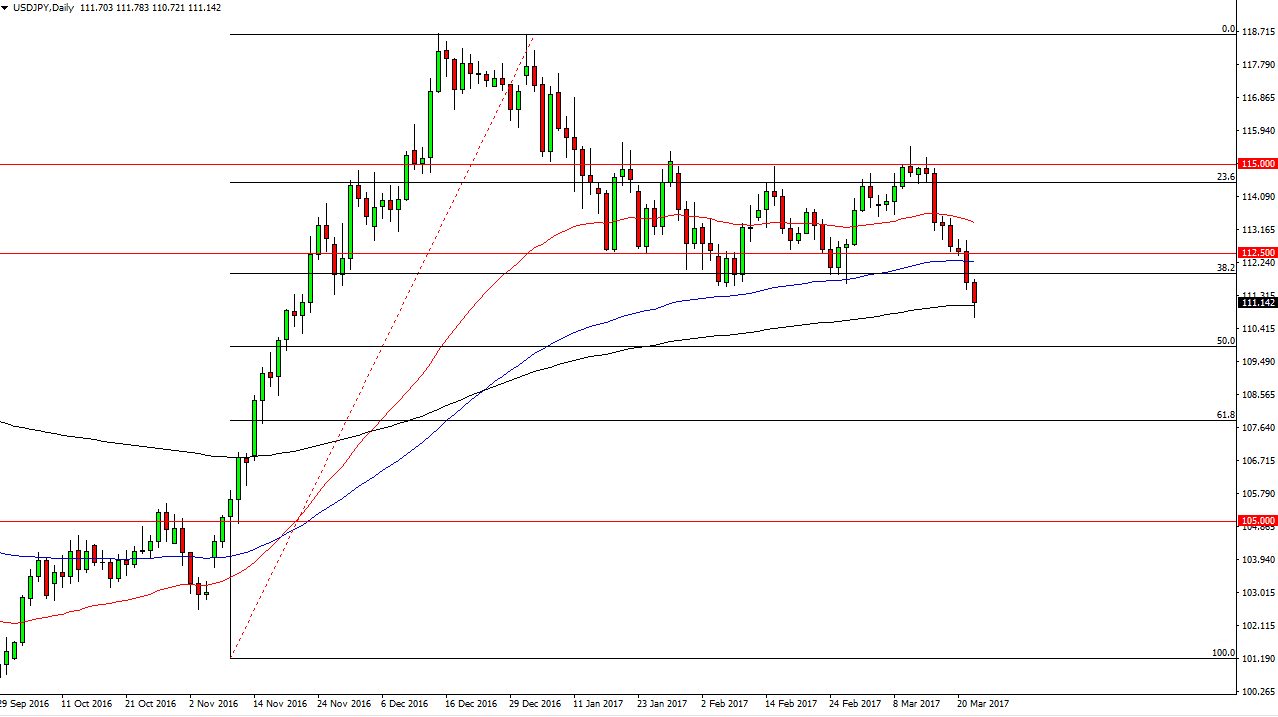

USD/JPY

The US dollar fell significantly during the day on Wednesday against the Japanese yen, but found enough buying pressure towards the end of the day to form a bit of a supportive looking candle right at the 200-day exponential moving average. If we can break above the 112 handle, at that point I’m willing to go long. However, a breakdown below the bottom of the candle since this market looking for the 110 level rather quickly. It will be interesting to see how this plays out, but I must admit that the sellers are starting to look a little bit stronger now. I have my parameters, nouns only a matter of time a following what the market does. Nonetheless, I still believe in the longer-term bullish story.

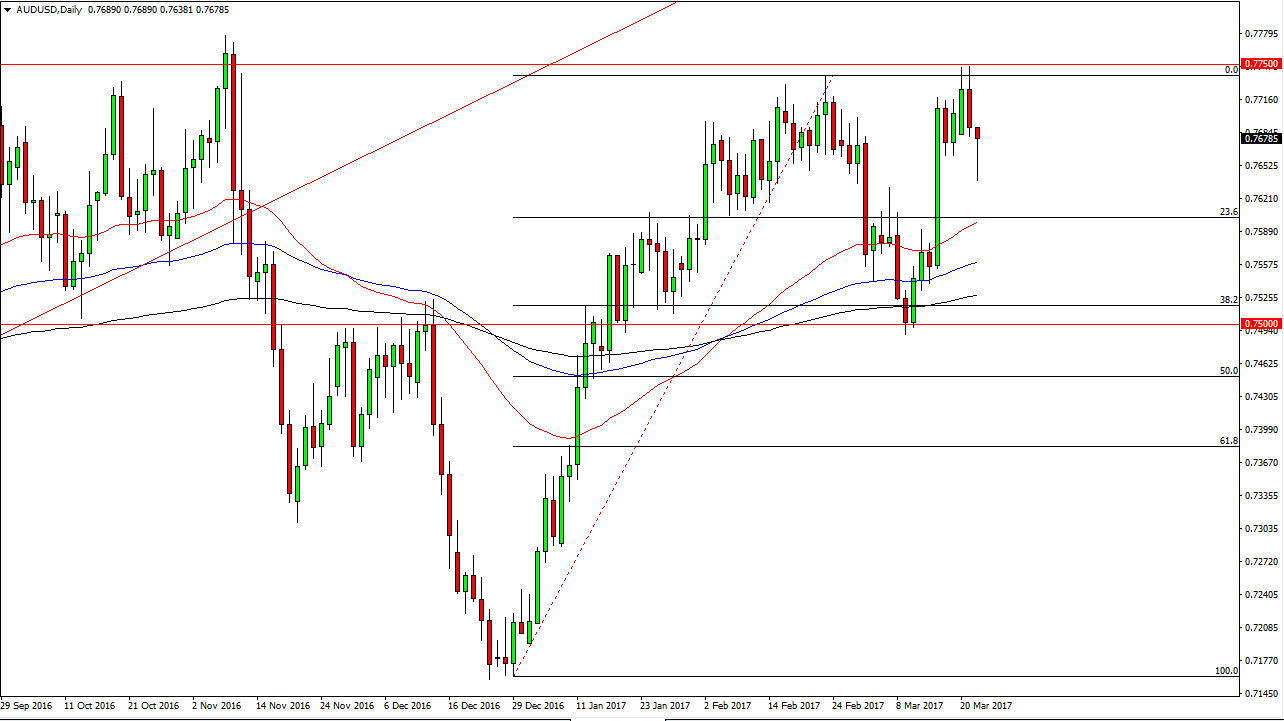

AUD/USD

The Australian dollar fell significantly during the day on Wednesday as well but found enough bullish pressure underneath to turn things around and form a hammer. The hammer of course is a bullish candlestick and if we can break above the top of that I think we will go reaching towards the 0.7750 level. That’s an area that is resistive, but a break above there could be rather interesting as I believe the market will then reach towards the 0.80 level above. This is an area that has been very interesting for longer-term traders over the last several decades, so I believe it will act as a magnet for price.

Gold markets are starting to show signs of strength, and the US dollar has been a bit soft over the last couple of days. Both things make me think that the Australian dollar will continue to go higher and will eventually break out to the upside. However, it’s likely been easy breakout so be prepared for volatility going forward in this pair, which is quite typical. I have no interest in shorting now.