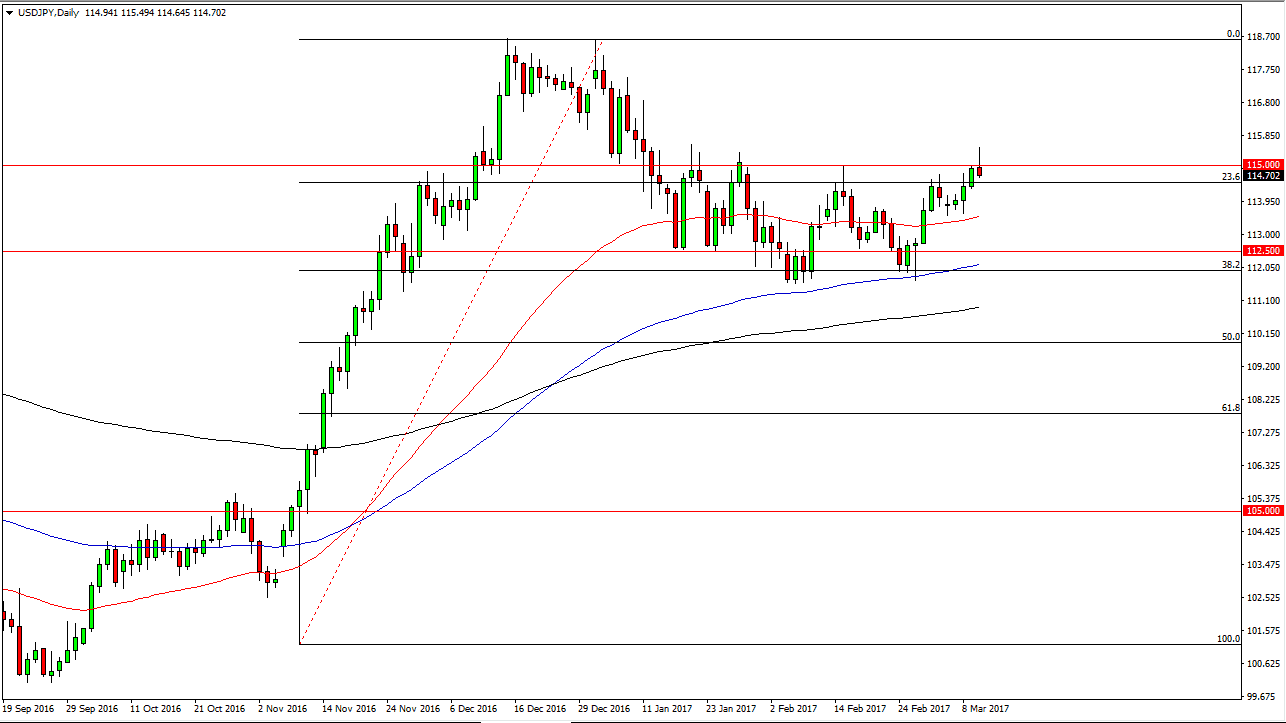

USD/JPY

The USD/JPY pair rallied initially during the day on Friday after we had a very strong jobs number. However, it looks as if there is a significant amount of resistance above the 115 level, and the fact that we turned around to form a shooting star suggests that we are not ready to go higher. If we pull back from here, I think there’s plenty of support underneath, and that there will be reason enough to go long sooner rather than later. However, we could also break above the top of the shooting star and that would be a very bullish sign as we should then reach towards the 118.50 level above. The Federal Reserve looks likely to raise interest rates repeatedly over the next couple of years, and thus it makes sense that we continue to go higher.

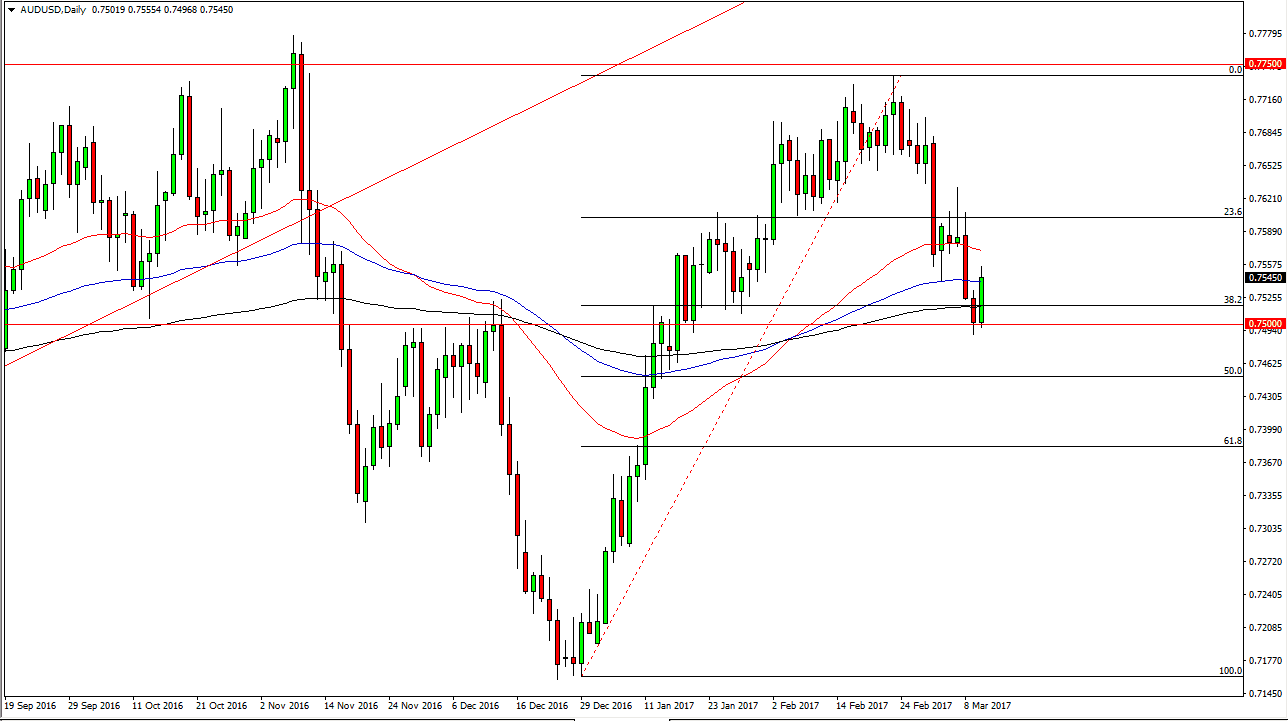

AUD/USD

The Australian dollar rallied during the day on Friday, testing the 0.75 level and finding massive support. The fact that we form this large green candle suggests to me that we are getting ready to bounce significantly, and a break above the top of the range should send this market higher. I think it’s going to be rather choppy, but the positivity in this market should continue. If you can handle the volatility, this might be a pair to own, but currently one of the things that you should pay attention to more than anything else will be the gold market.

I believe that the gold market is finding bits of support near the $1200 level suggests that we will have a move higher in both markets relatively soon, but currently I don’t think were quite ready to make a longer-term. I think that we get choppiness with just a slight upward bias overall, and that the 0.75 level should be massively supportive.