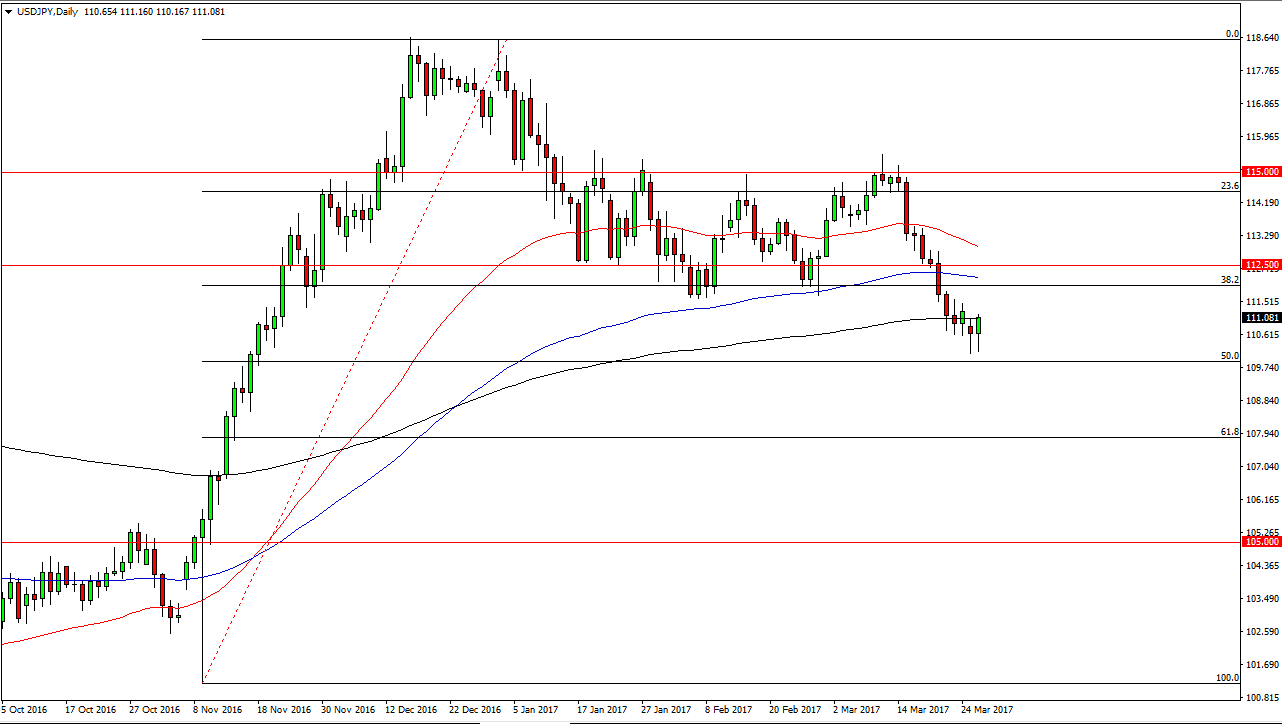

USD/JPY

The USD/JPY pair initially fell during the day on Tuesday but found enough support off the 50% Fibonacci retracement level to turn things around and form a very strong candle. Strengthening equities also help the pair as the 2 tend to move in the same direction. It now appears that the 200-day exponential moving average is going to offer quite a bit of support, so I have started to place a small position to the upside now. I believe that the market is can reach towards the 112.50 level next. It could be a bit choppy, but longer-term I still believe in the uptrend, as the Federal Reserve is likely to raise interest rates several times over the next year or so.

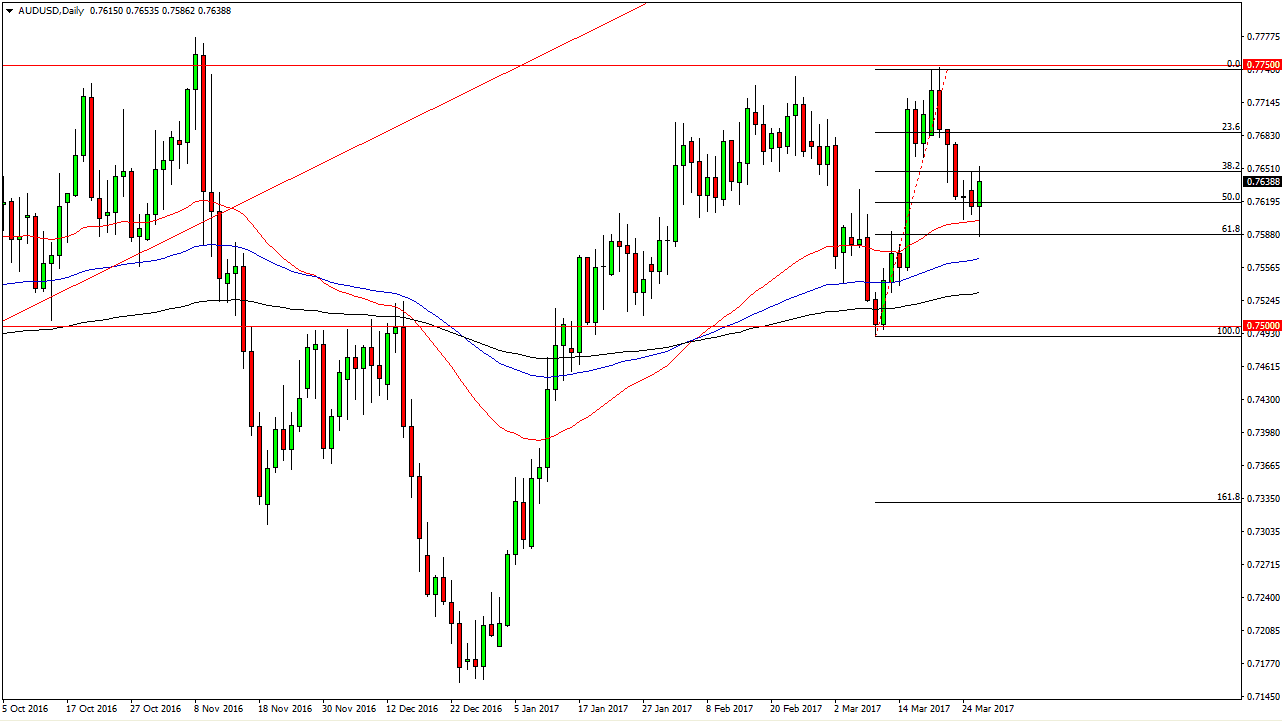

AUD/USD

The Australian dollar had a wild session during the day, at one point in time breaking down significantly but finding enough support at the 61.8% Fibonacci retracement level to turn things around and bounce. The bounce was short-lived though, as the 0.7650 level offered resistance. In the end, we showed quite a bit of confusion but I think there is more support than bearish pressure here. If the gold markets can break out to the upside, then this market will simply follow. A break above the top of the candle is a buying opportunity as far as I can see, but I believe that a breakdown below the bottom of the candle is not a selling opportunity mainly because of the major moving average is just below. The 100-exponential moving average is just below the bottom of the candle, and I believe that the longer-term uptrend is still in effect. Because of this, I believe that there will be a lot of volatility but given enough time I do believe that the Australian dollar will flex its muscles and continue to go much higher.