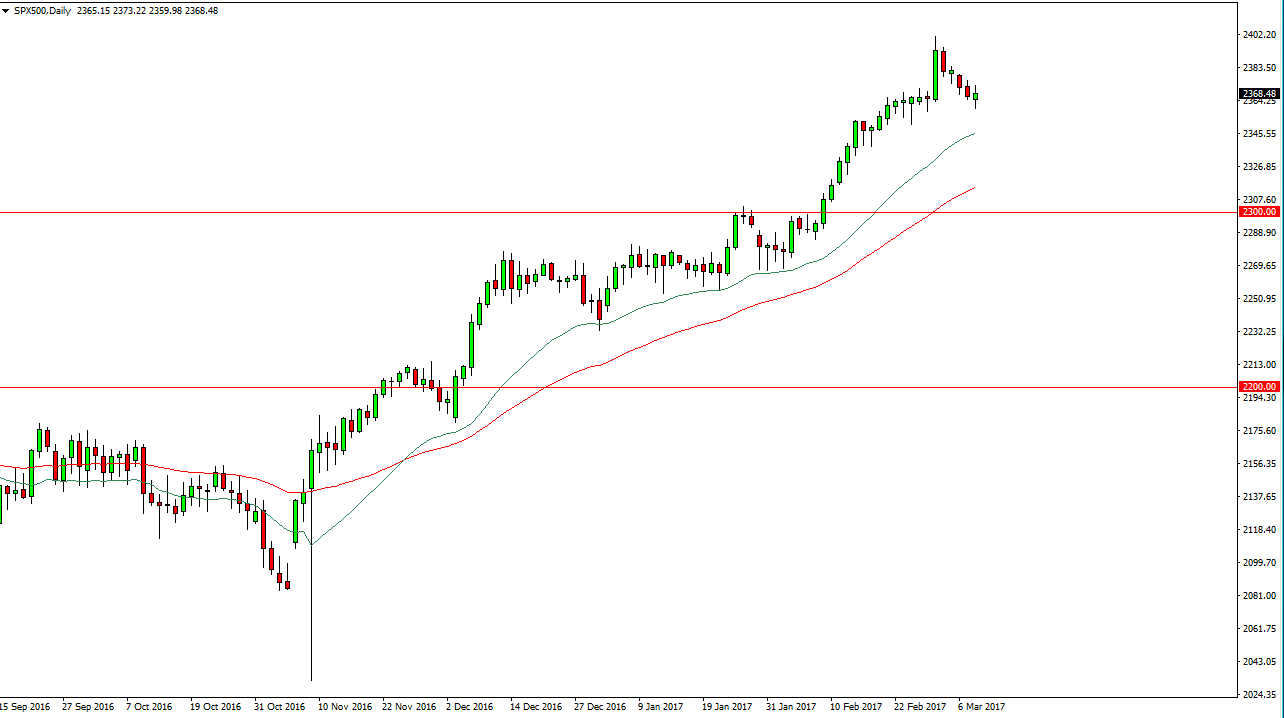

S&P 500

The S&P 500 fell during the session on Wednesday, but we continue to find support near the 2350 handle. Because of this, I have no interest in shorting this market and I see a couple of moving average is that are coming into play every time we dip. The 20-day exponential moving average, pictured in green on my chart, continues to be reliable, and of course the 50-day exponential moving average is one that a lot of longer-term traders follow anyway. Because of this, I’m looking for bounces or supportive candle that I can take advantage of. I believe that the 2300 level below is massively supportive, and the 2400 level above is the first target. After that, the market should then go to the 2500 level. Either way, I’m bullish and will not sell.

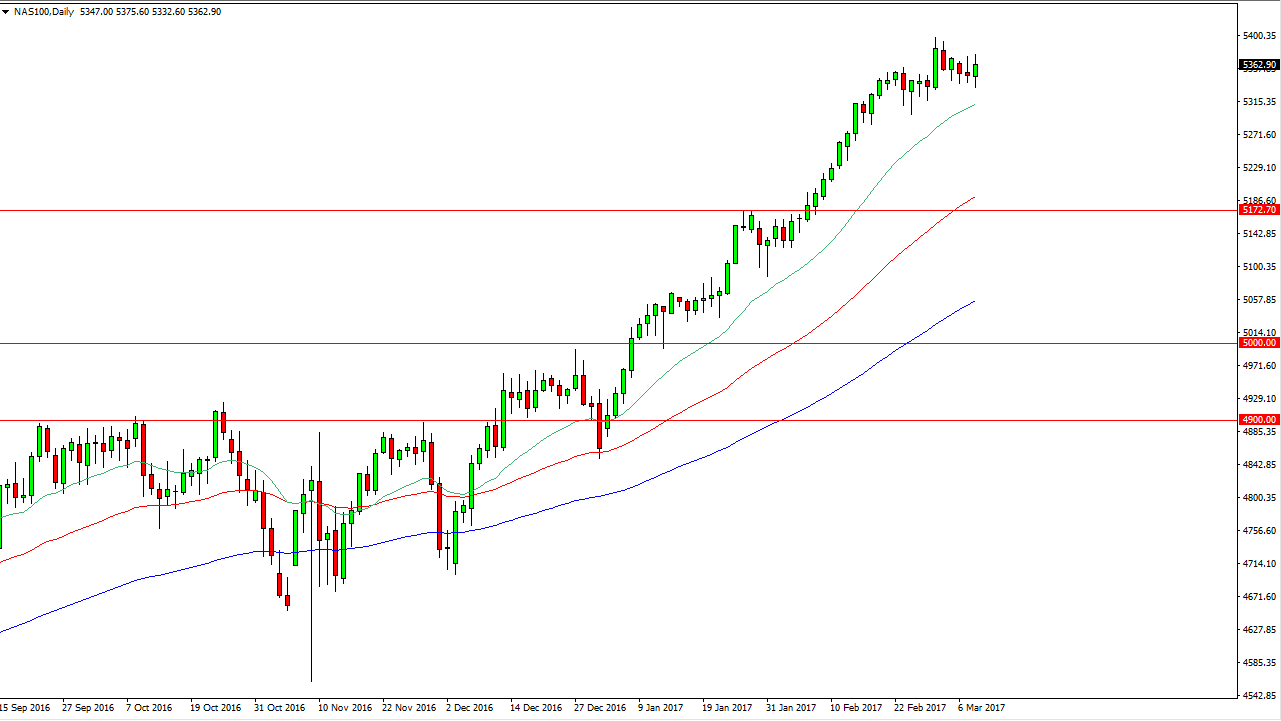

NASDAQ 100

The NASDAQ 100 initially fell as well, but found enough support to form a relatively positive looking candle. I believe that the NASDAQ 100 will continue to lead the rest of the indices higher, and thus this is probably the “canary in the coal mine” when it comes to US indices. I believe that the 5300-level underneath continues to be massively supportive and we should eventually reach towards the 5400 level. A break above there should send this market to the 5500 level after that. I believe that the 20-day exponential moving averages supportive in this market as well, and that the US indices should continue to lead stock markets around the world higher.

I have a target of 5500 above, but I believe that we break well above there and continue to see bullish pressure. We may need to bounce around a little bit to build up momentum, but I cannot make an argument whatsoever for the idea of selling the NASDAQ 100, or any other stock index in the United States for that matter.