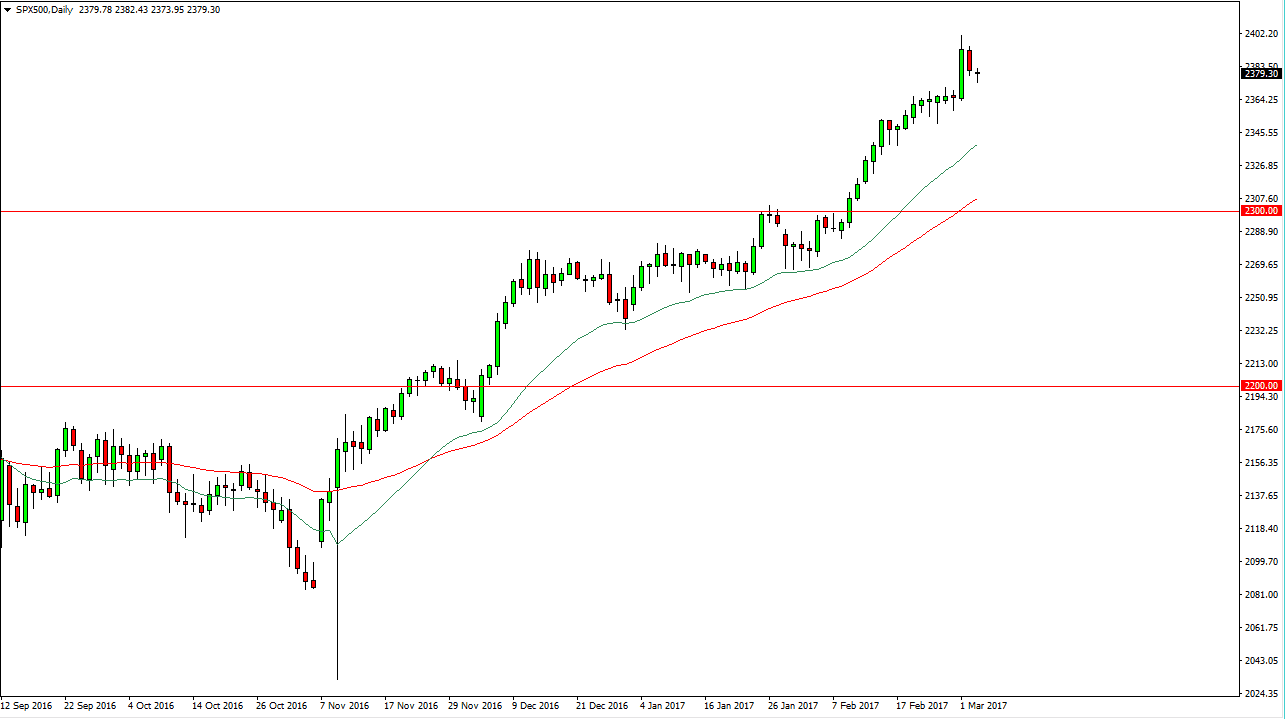

S&P 500

The S&P 500 had a quiet session on Friday, as we continue to look bullish overall. This pullback should be a buying opportunity, and I believe that there is a significant amount of support near the 2350 handle. On a pull back to that area and a bounce, I am more than willing to go long as we continue to see buyers favor the upside. I have a target of 2500 currently, but it may take a while to get there. The 2400 level has offered significant resistance, but there’s nothing about that number that makes me believe it will be the end of the uptrend. I believe currently that the 2300 is the absolute floor in this market.

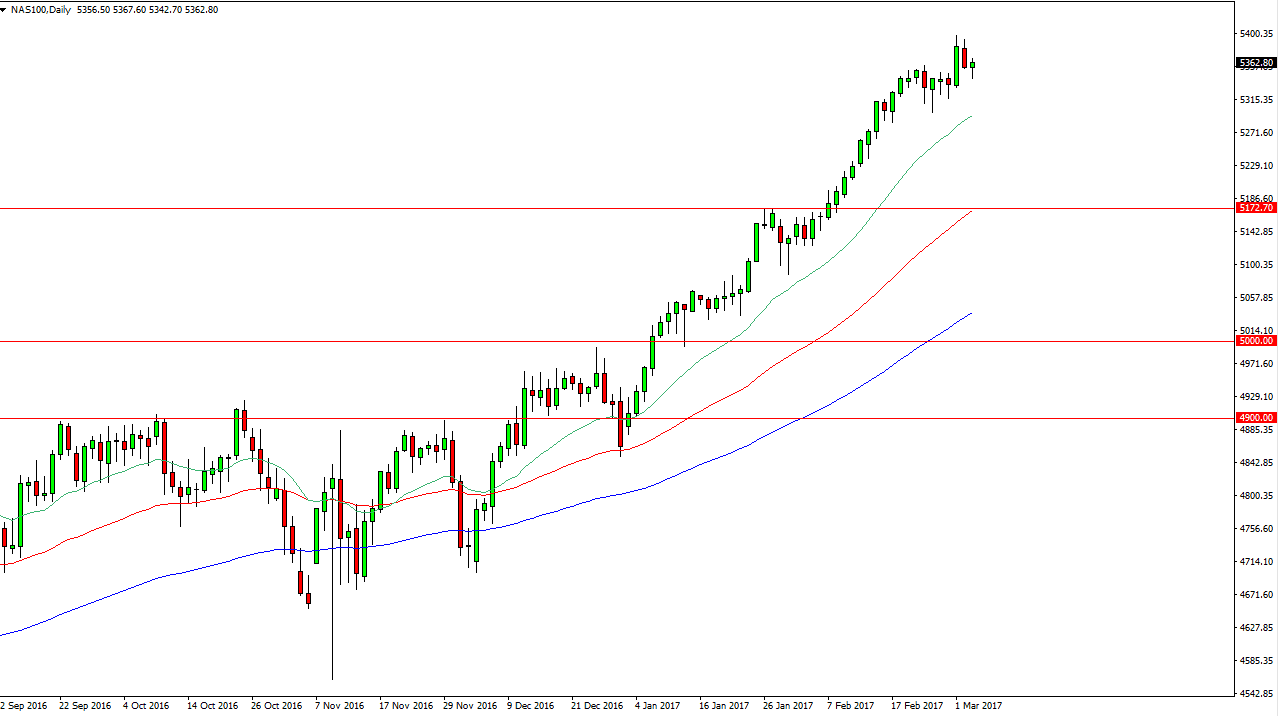

NASDAQ 100

The NASDAQ 100 fell during the day, but found enough support near the 5350 level to turn around and form a hammer. A break above the top of the hammer since this market higher, which is obviously very bullish. You can see that I have the green 20-day exponential moving average just underneath on the chart and it has been rather reliable since last Christmas. Because of this, I believe that the market will continue to have buying opportunities present themselves on pullbacks.

Ultimately, I believe that the market will reach towards the 5500 level, which is a longer-term target. That’s a large, round, psychologically significant number that the market will course be attracted to. The 5300 level below is a bit of a floor, so I have no interest whatsoever and shorting because of that. The NASDAQ 100 has led the other indices higher over the longer term, and I believe that it will continue to be one of the leaders of world indices around the markets.

US indices continue to be my favorite markets, so therefore given a choice between Europe and the US, I choose America first.