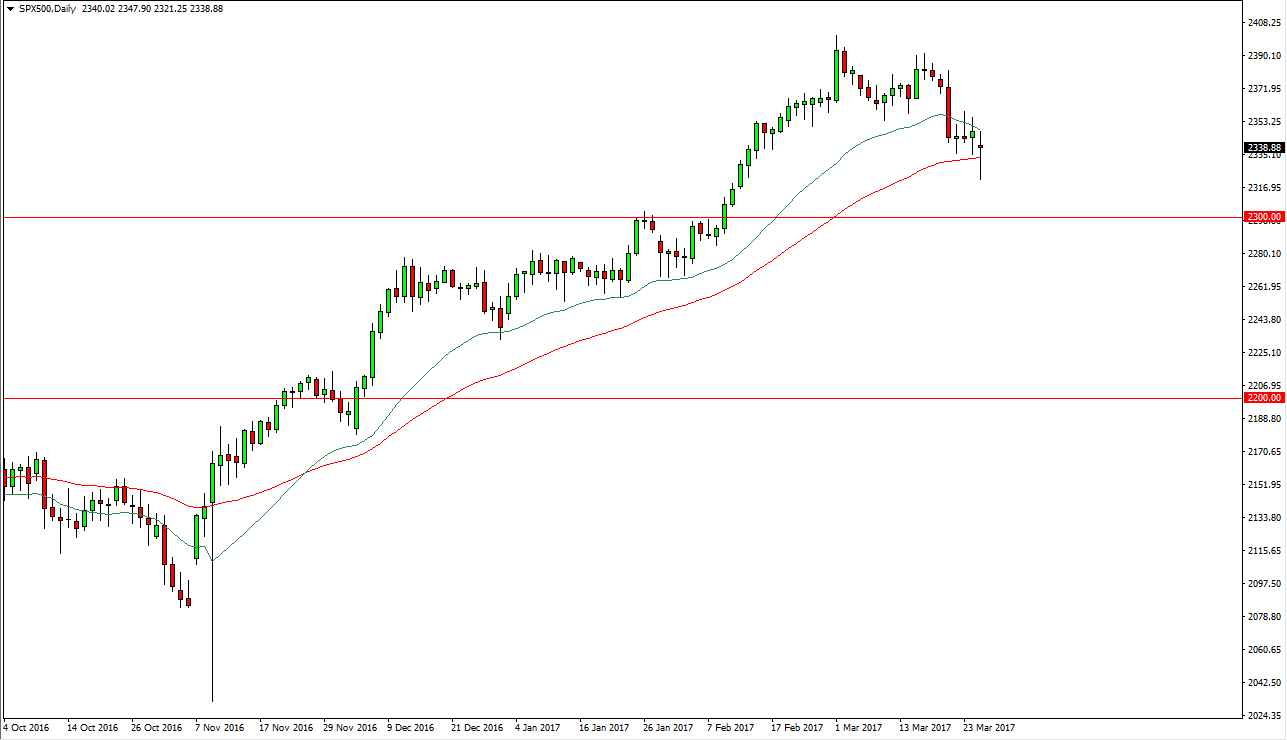

S&P 500

The S&P 500 fell significantly during the day on Monday, but found enough support underneath the 50-day exponential moving average to turn things around and form a massive hammer. If we can break above the top of the hammer, the market could rally from there and go reaching towards the 2400 level. I believe that the 2300 level underneath current levels will continue to offer support as well, and essentially be the “floor” in this market. Longer-term, I’m still very bullish of this market and believe that even if we pull back, the buyers will return to pick up value going forward. I believe that eventually we will reach towards the 2500 level as it is my longer-term target and has been for some time. However, we did get a little ahead of ourselves so a short-term pullback is good.

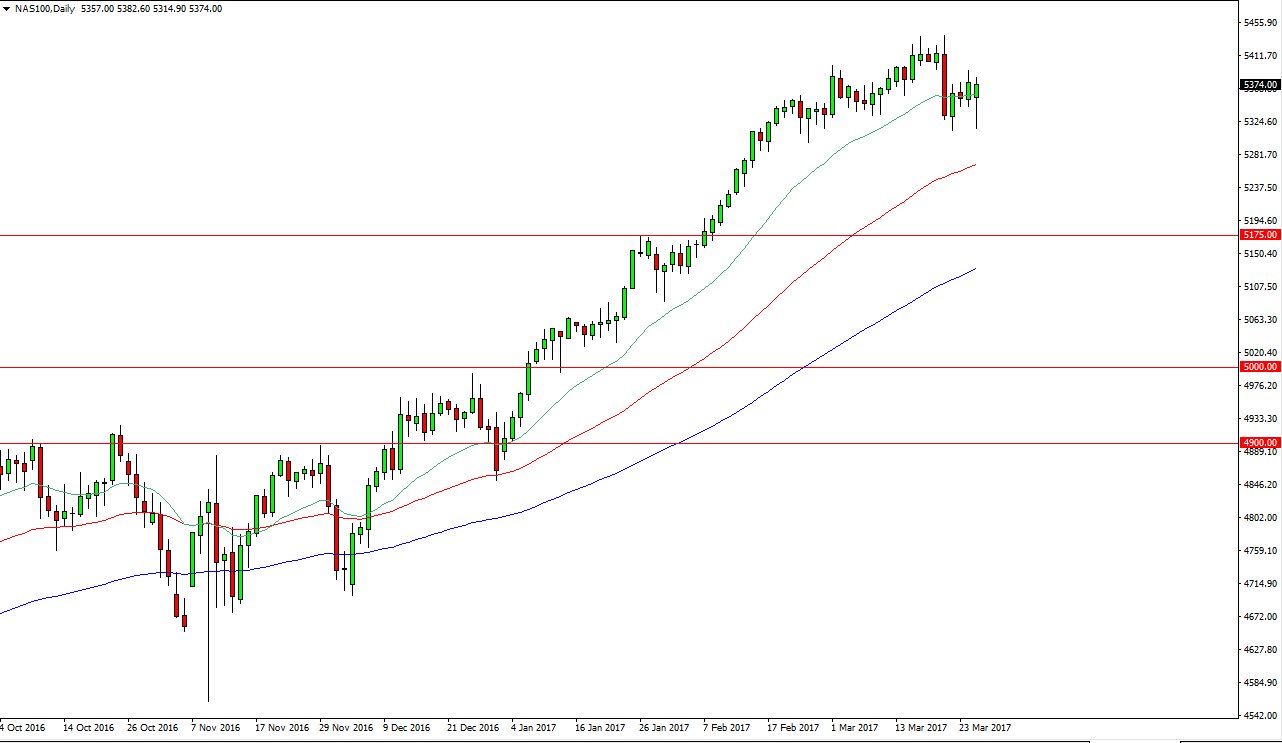

NASDAQ 100

The NASDAQ 100 initially fell during the session on Monday, but turned around to form a hammer. A break above the top of the hammer would be a bullish sign and should send this market looking towards the 5450 handle. A break above there house us testing the 5500 level which is my longer-term target, but I recognize that we are bit overextended so I think a pull back to the 50-day moving average could happen, which is the red moving average on the chart.

I believe that there is a “floor” in the market at the 5175 handle, and quite frankly I would be quite surprised if we found the market at that low level. I believe longer-term the buyers return and we continue to break out to the upside but the pullback is necessary to build up enough momentum to continue to go higher and eventually break out to the upside for the longer-term move. US indices continue to lead the rest around the world, and I think that’s going to continue to be the case.