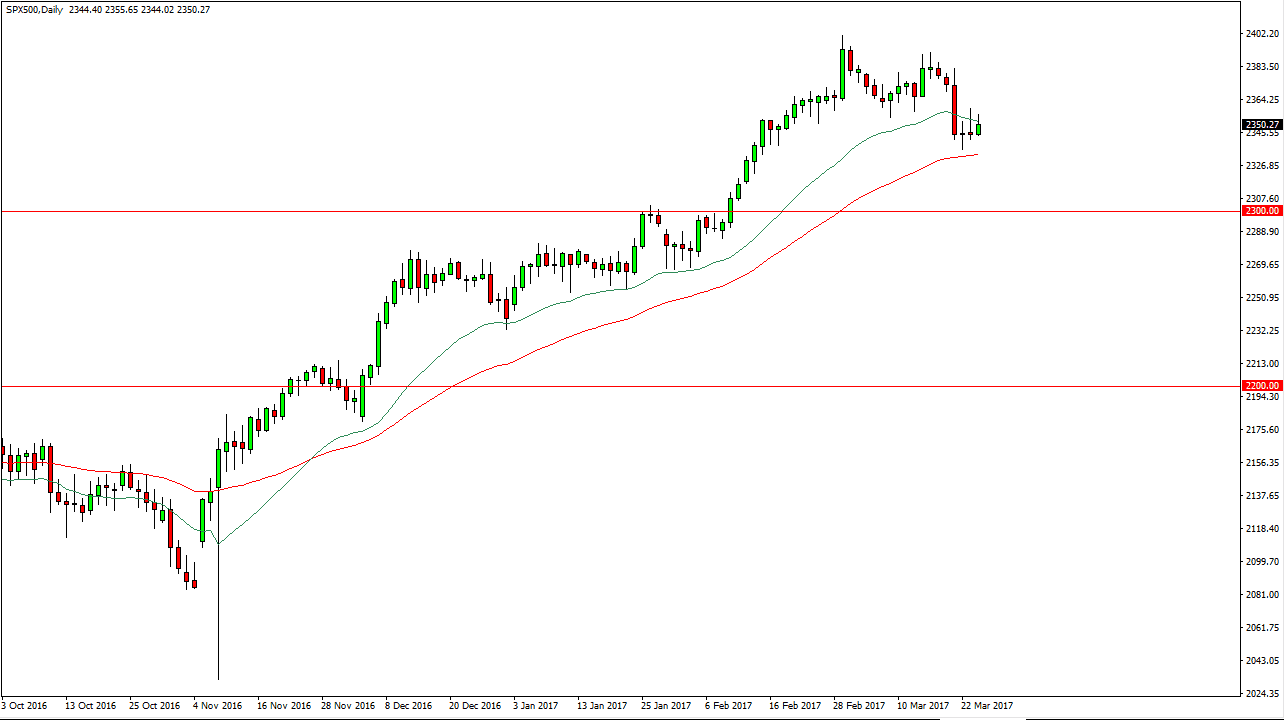

S&P 500

The S&P 500 rallied on Friday, but found the 20-day exponential moving average to be a bit resistive again. Because of this, I believe it’s only a matter of time for the market turned around reaches towards the 2300 level below. That area should be massively supportive, so I believe that a pull back to that area offers quite a bit of value. We are bit overextended longer-term, so a pullback doesn’t have me concerned, it simply has me looking for the type of value that should offer a nice longer-term opportunity. However, we can break above the Thursday shooting star, that could be a buying opportunity reaching towards the 2400 level above which was the most recent resistance. A break above there since is looking towards my longer-term target of 2500 above.

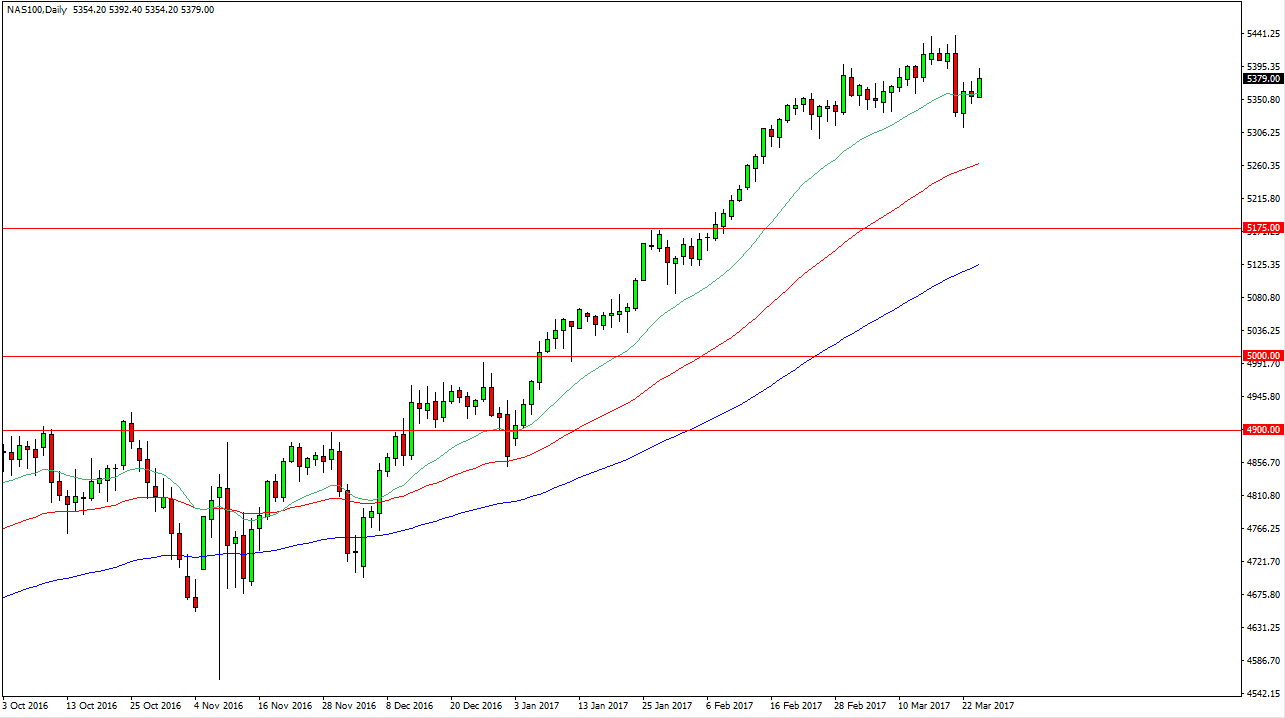

NASDAQ 100

The NASDAQ 100 rallied during the day on Friday, showing signs of strength and quite frankly looking stronger than the S&P 500. This isn’t out of the normal though, because quite frankly the NASDAQ 100 has been the strongest index in the United States for some time now. A break above the top of the range for the Friday session should be bullish, perhaps sending this market looking for the 5440 handle. Pullbacks should continue to offer buying opportunities, and I have no interest in selling because quite frankly I see the 50-day exponential moving average below as being supportive, and the 5175 level being the “floor” in the market.

I’ve had a longer-term target of 5500 for some time, and I believe that’s where we are heading. This market might be a bit choppy from time to time, but the buyers continue to return to what has been one of the more reliable places to put money to work. Because of this, I have no interest whatsoever in selling this market.