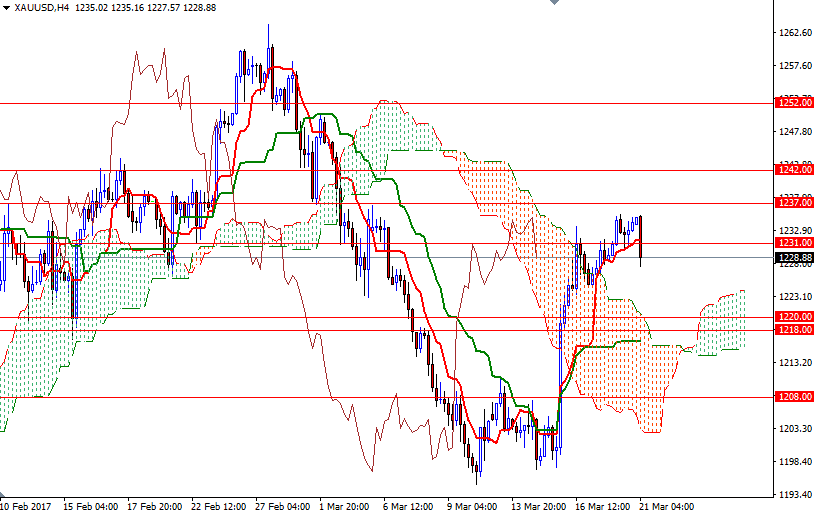

Gold prices rose $4.91 an ounce on Monday to settle at their highest level since March 3 as expectations of gradual rate hikes helped provide a lift to the metal. The XAU/USD pair traded as high as $1235.45 after the market climbed above the $1231 level, but some investors used this opportunity to take profit. As a result, prices pulled back towards the $1225/3.30 area.

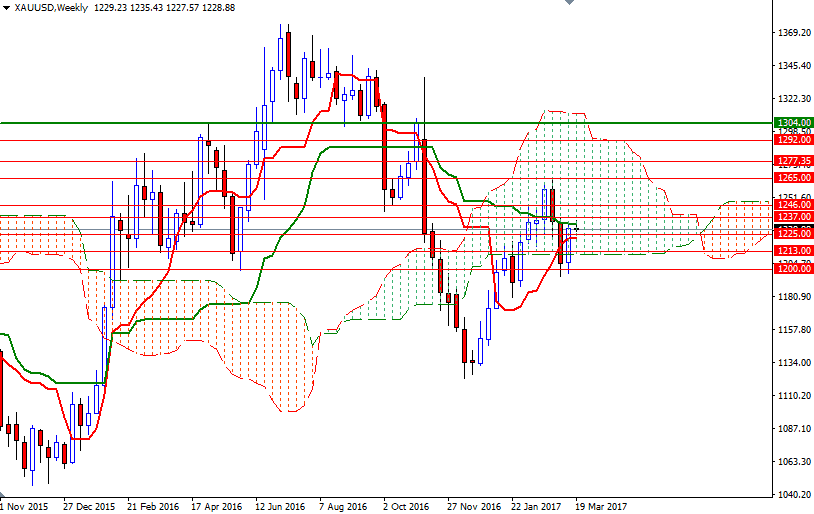

The market is trading above the Ichimoku clouds on the daily and the 4-hourly charts and this suggests that the bulls still have the near-term technical advantage - i.e. lower prices will continue to lure buyers. If prices recover and climbs back above the 1232/1 zone, where the Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) sit on H1 time frame, then the market may find another chance to approach 1238/7. Penetrating this barrier could see a push up to 1246/2.

On the other hand, falling through 1225/3.30 could increase selling pressure as Ichimoku cloud on the H1 chart will start acting as resistance. In that case, the 1220/18 area could be the next stop. The bears will have to capture this strategic support so that they can gain enough strength to challenge the bulls waiting the 1214/3 zone.