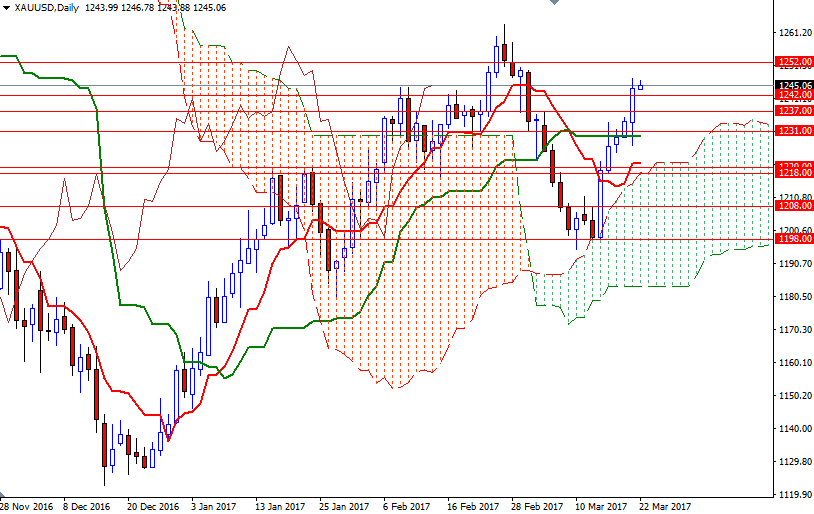

Gold prices ended Tuesday’s session up $10.33, extending their gains to a fifth straight session, as widespread falls in the global stock markets and continued weakness in the U.S. dollar fueled demand for the precious metal. The XAU/USD pair initially retreated towards the $1225 level, but bounced up from there and broke through the $1238/7 area. Consequently, the market reached the $1246/2 region as anticipated.

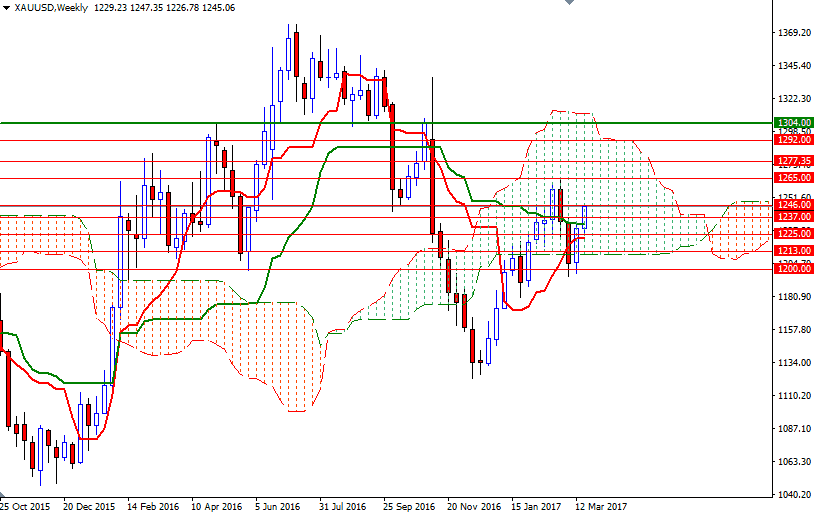

Gold’s technical picture remains bullish, with the market trading above the Ichimoku clouds on the daily and the 4-hourly charts. Adding to the bullish outlook is the Chikou-span (closing price plotted 26 periods behind, brown line) which now resides above the clouds and prices. However, also note that the market is within the borders of the weekly Ichimoku cloud. Ichimoku clouds define an area of support or resistance depending on their location and in our case the weekly cloud represents resistance. The thickness of the cloud is relevant as well, as it is more difficult for prices to break through a thick cloud than a thin cloud.

To the upside, the market will have to anchor somewhere above 1246 in order to gain enough momentum to reach the next barrier standing in the 1252/0 area. Penetrating this barrier would suggest that the market might be aiming for 1265/1. On the other hand, if the bulls run out of steam and the market can’t hold above 1242, expect a pull back towards the 1239/7 area. The bears have drag prices back below 1237, where the Tenkan-sen (nine-period moving average, red line) sits on the H4 time frame, so that they can test the support at around 1231.