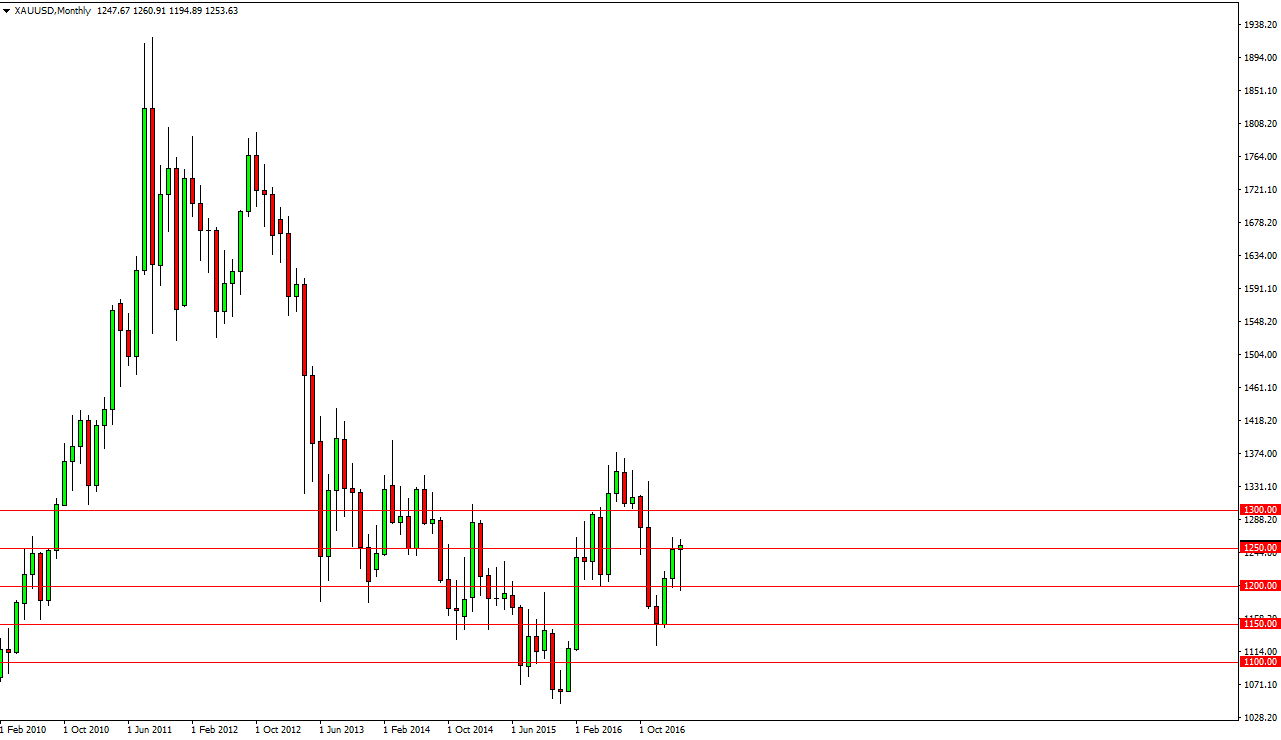

Gold markets had a very interesting couple of months, as we have bounced off the $1150 level, fell significantly during the past month, but found enough support at the $1200 level to turn things around and form a hammer. The hammer of course is a very bullish sign and a break above the top of the range for the month of March should send the gold markets looking for $1300 at the very least. If we can break above there, then the market is free to go to the $1380 handle after that. Ultimately, I think that short-term pullbacks will continue to be buying opportunities as gold looks very healthy. Not only have we formed a hammer for the month of March, we also have formed a “higher low” this last dip.

Longer-term buy-and-hold

Depending on your timeframe, this could be a longer-term buy-and-hold, because quite frankly if we can clear the $1400 level, the market has dead air going quite a bit higher. That would give us an opportunity to run rather quickly, and at this point I don’t have any interest in shorting gold, least not until we break significantly below the $1200 level which would negate the hammer from the March session. Typically, a monthly hammer being broken is a very negative sign.

Pay attention to the Federal Reserve, interest rate expectations a course have quite a bit of influence on gold, and currently it looks as if the market is starting to question whether the Federal Reserve can raise interest rates more than twice. I personally don’t think they can, and a lot of that may already be baked into the price. However, the Federal Reserve blanks and looks likely to pause on raising interest rates, gold’s going to go through the roof. Silver markets have already cleared the psychologically significant $18 level, and I think gold markets are going to follow suit rather soon.