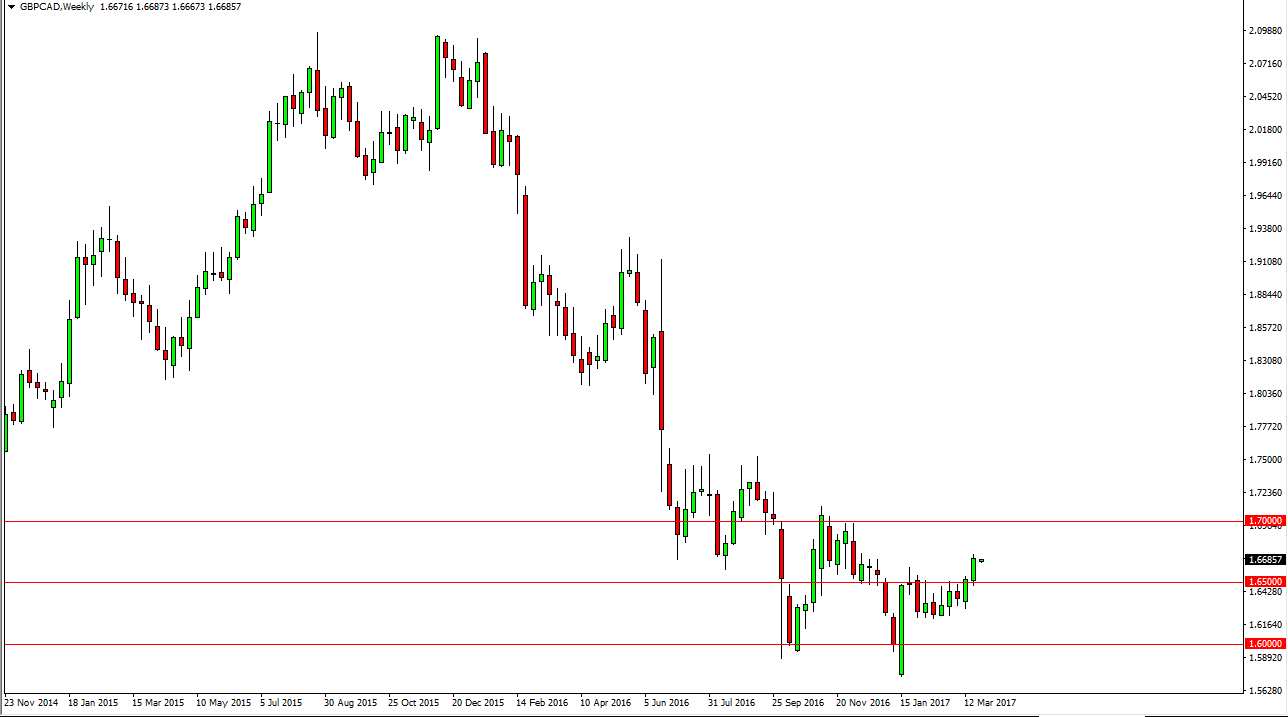

The British pound has rallied against the Canadian dollar as of late. As we broke above the 1.65 handle, the market showed just how strong it was during the back half of March. Keep in mind that the Canadian dollar is highly sensitive to the oil markets, and of course the oil markets have struggled quite a bit as of late.

Concurrently, the British pound is probably seeing the end of the downtrend overall, as the Article 50 will be triggered. The markets have already priced in all of this, so even if we pull back, I believe that the British pound will eventually find buyers based upon value. Currently, it looks as if the 1.65 handle should offer support as it was such significant resistance.

1.70 target

I have a target of 1.70, which had previously been so resistant. I also recognize of the 1.75 level above there should be a target as well, given enough time. It could be very choppy and volatile, but I believe that the buyers will continue to jump into this market, especially if the oil markets continue to struggle. I believe that the oil markets will cause quite a bit of bearish pressure on the Canadian dollar as the oversupply continues. Yes, it looks as if the OPEC coalition is going to extend its production cuts, but quite frankly that hasn’t worked yet, and I don’t see that it’s going to anytime soon. American drillers continue to bring more rigs online, this course will continue to send supply of crude oil into the market.

I believe the pullbacks will be supported repeatedly, and most traders will look at those pullbacks as potential value in a market that has a long way to go. I believe that April will be positive, but quite frankly I think the next several months will be very positive.