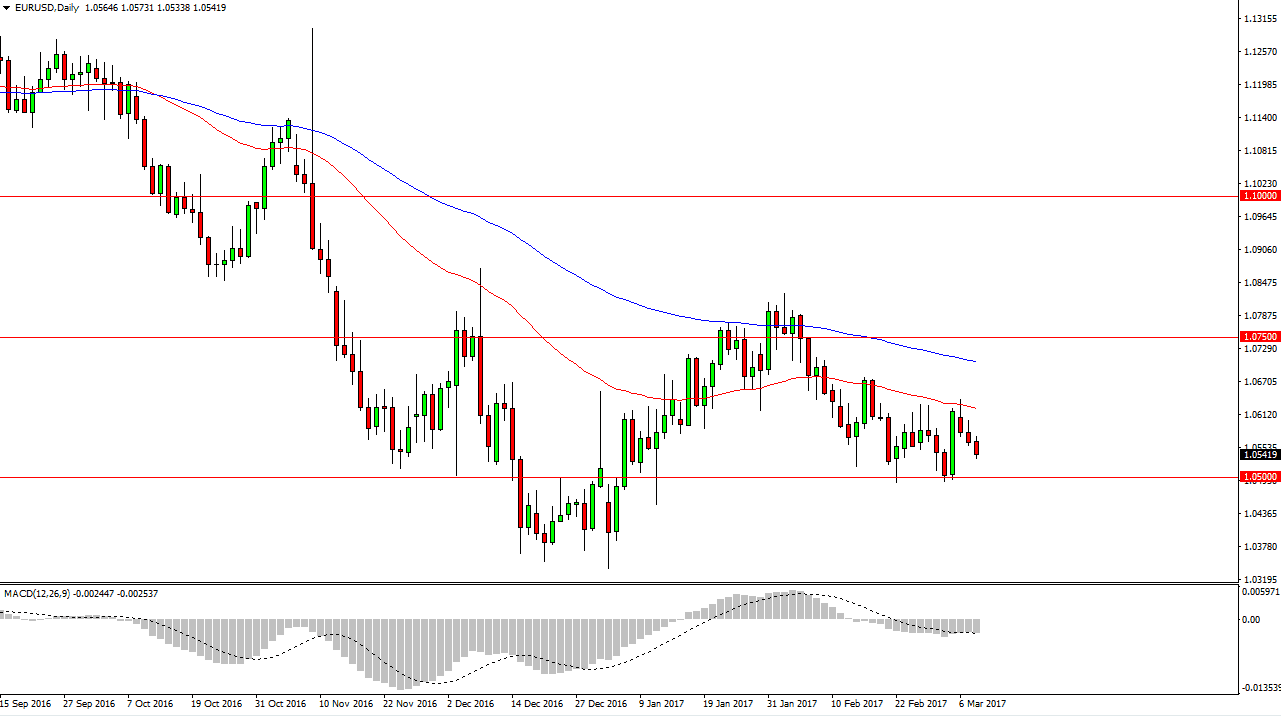

EUR/USD

The EUR/USD pair continues to struggle overall, as we drifted lower during the day on Wednesday. I believe that the market is going to test the 1.05 level again, as it is so important. I find it interesting that today we have a press conference coming out of the ECB, which of course will be highly influential as far as his currency pair is concerned. The stronger than anticipated jobs market in the United States continues to work in favor of the US dollar, and I believe that should continue to push this market lower. Once we break below the 1.05 level, the market should then go to the 1.0350 level underneath. Rallies that show signs of exhaustion should continue to be selling opportunities.

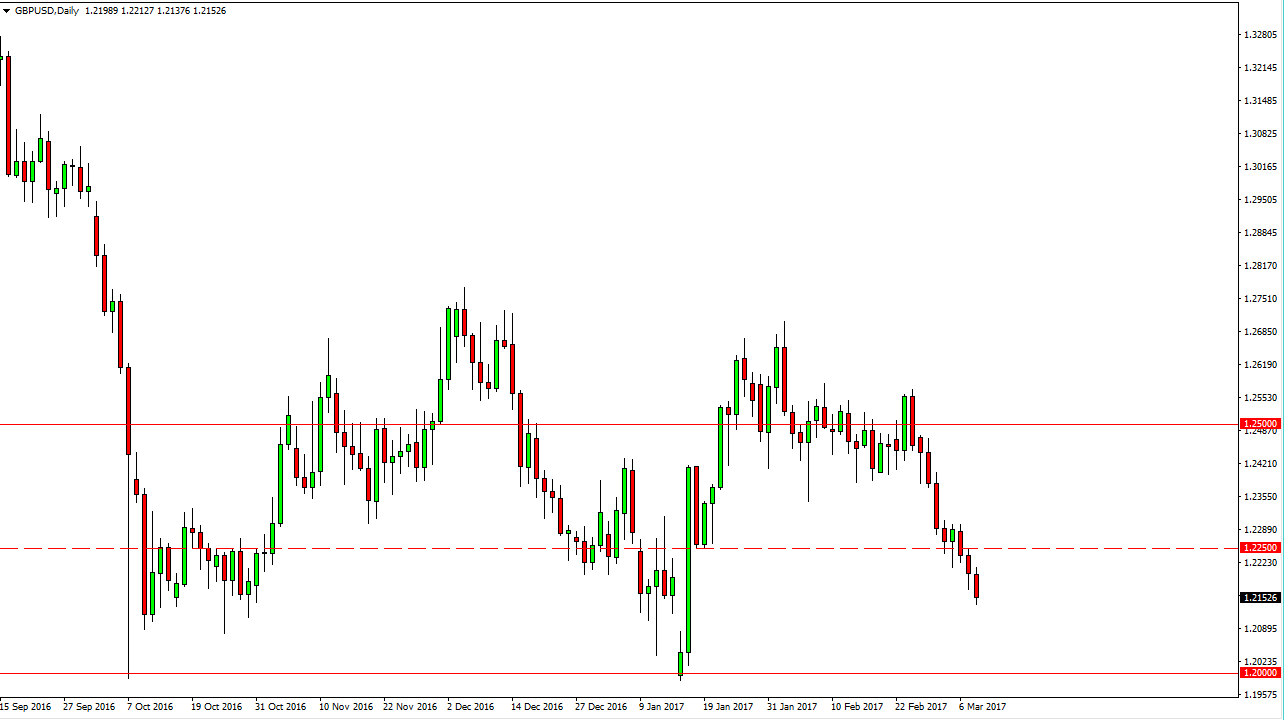

GBP/USD

The GBP/USD pair fell again during the day on Wednesday, as we continue to drop in this pair. The 1.2250 level now should be resistive, and I think we’re going to try to fill the gap from the previous trading, somewhere near the 1.2050 level underneath. Rallies that show signs of exhaustion will continue to be selling opportunities, and a breakdown below the bottom of the range of course would be as well. With the Article 50 coming soon, I think that the British pound will have one major selloff, and then that could be the absolute bottom of the market. The 1.20 level is massively supportive on longer-term charts, but even more supportive is the 1.15 level, which extends back decades. Because of this, we could breakdown, but I think that only sets us up for a stronger uptrend move over the longer term. Currently though, I believe that the sellers are in control and that basically the way you’re going to have to play this market overall.

If we do break above the top of the hammer from Friday, the market should extend much higher, reaching towards the 1.25 level, but right now that doesn’t look very likely.