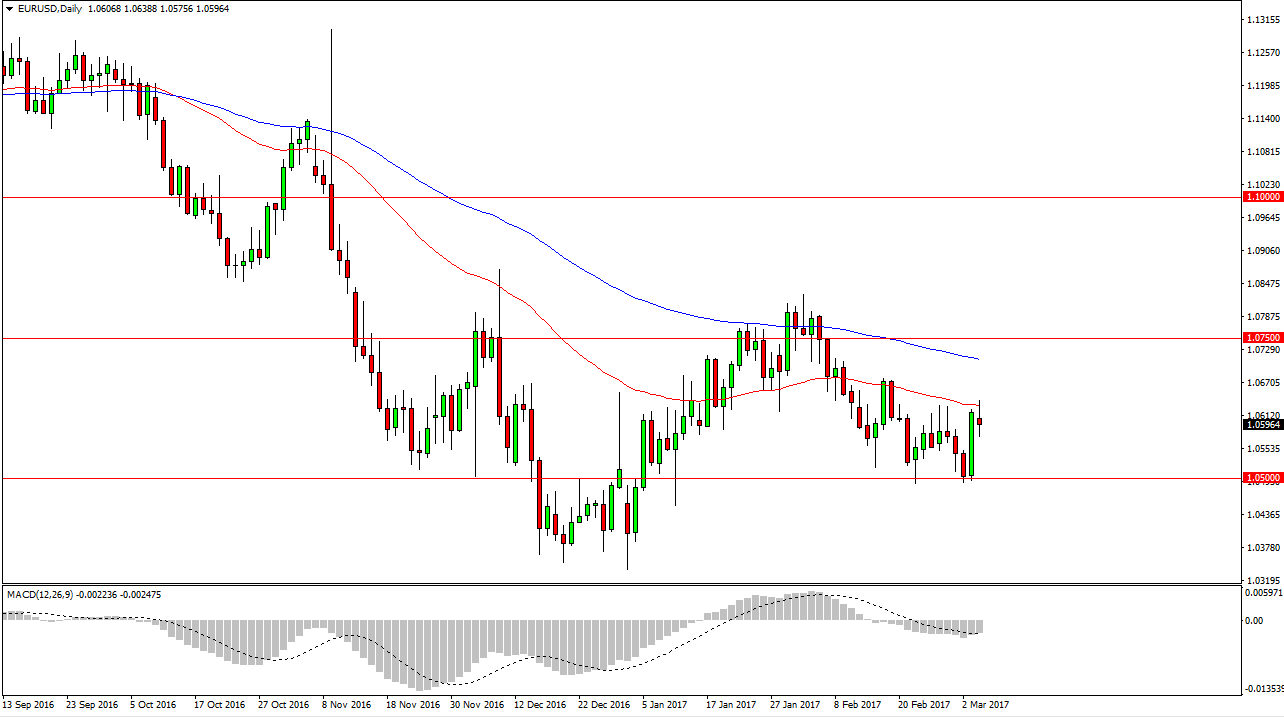

EUR/USD

The EUR/USD pair rallied initially during the day on Monday but continues to find trouble just above the 1.06 level at the 50-day exponential moving average. Because of this, I believe that the turnaround signals the sellers will continue to press the issue. There are a lot of concerns when it comes to European elections, and of course we have been in a downtrend longer-term for several months. The 1.05 level underneath continues to be massively supportive, so it’s probably going to be very difficult to break down. In the meantime, though I think we have a short-term back and forth type of market with a negative bias overall. Because of this, I think the short-term selling opportunities will continue to present themselves, but I would not expect too much in the short term.

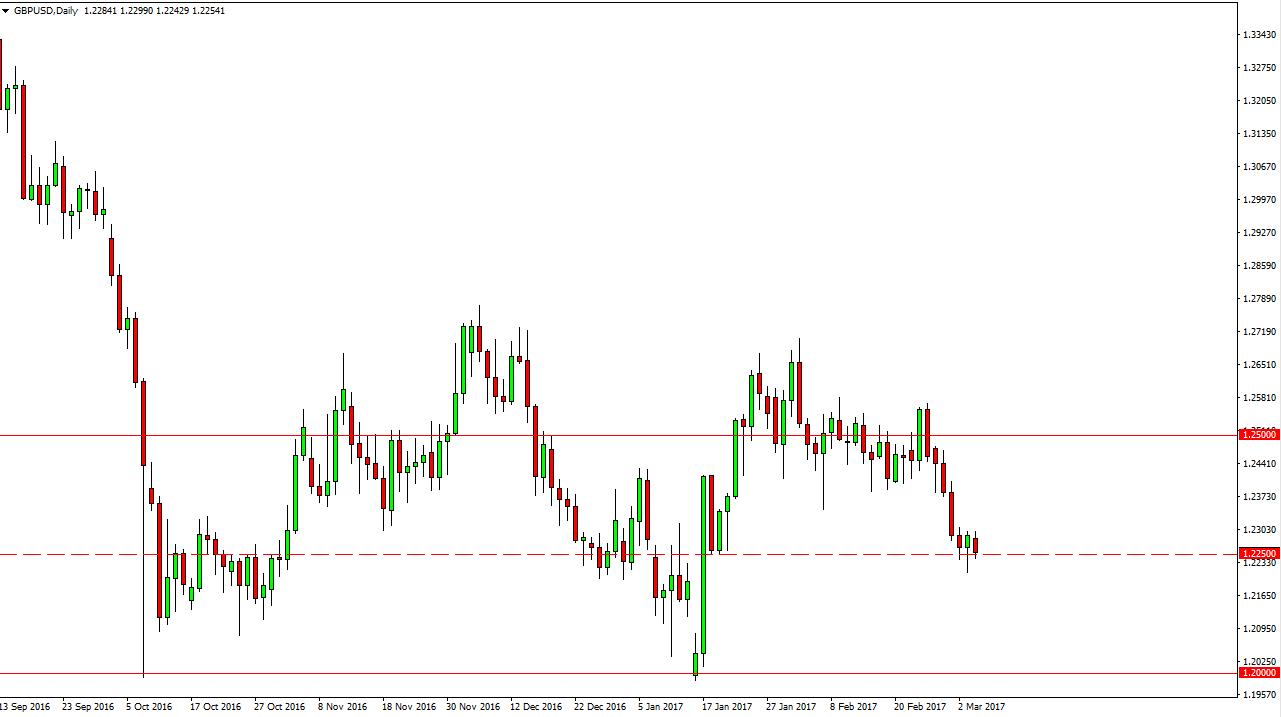

GBP/USD

The British pound fell during the session on Monday as we continue to test the 1.2250 level below. That’s an area that has caused a bit of support, and the fact that we ended up forming a hammer on Friday suggests that the buyers are going to continue to be aggressive in this area. If we can break above the top of the hammer, I believe that the market reaches towards the 1.24 level and the short-term. If we break down below the bottom of the hammer, it’s likely that the market will reach towards the 1.2050 level underneath.

I think you could continue to see quite a bit of volatility in the way, but certainly the 1.2250 level looks likely to cause a bit of buying pressure short-term. Either way, what I prefer is to buy or sell based upon a break above the hammer from the Friday session as it was perfectly placed. If we fall, the market could get aggressive to the downside, and part of this could be concerns with the soon to be announced triggering of Article 50. However, that very well could be the end of the downtrend for the British pound.