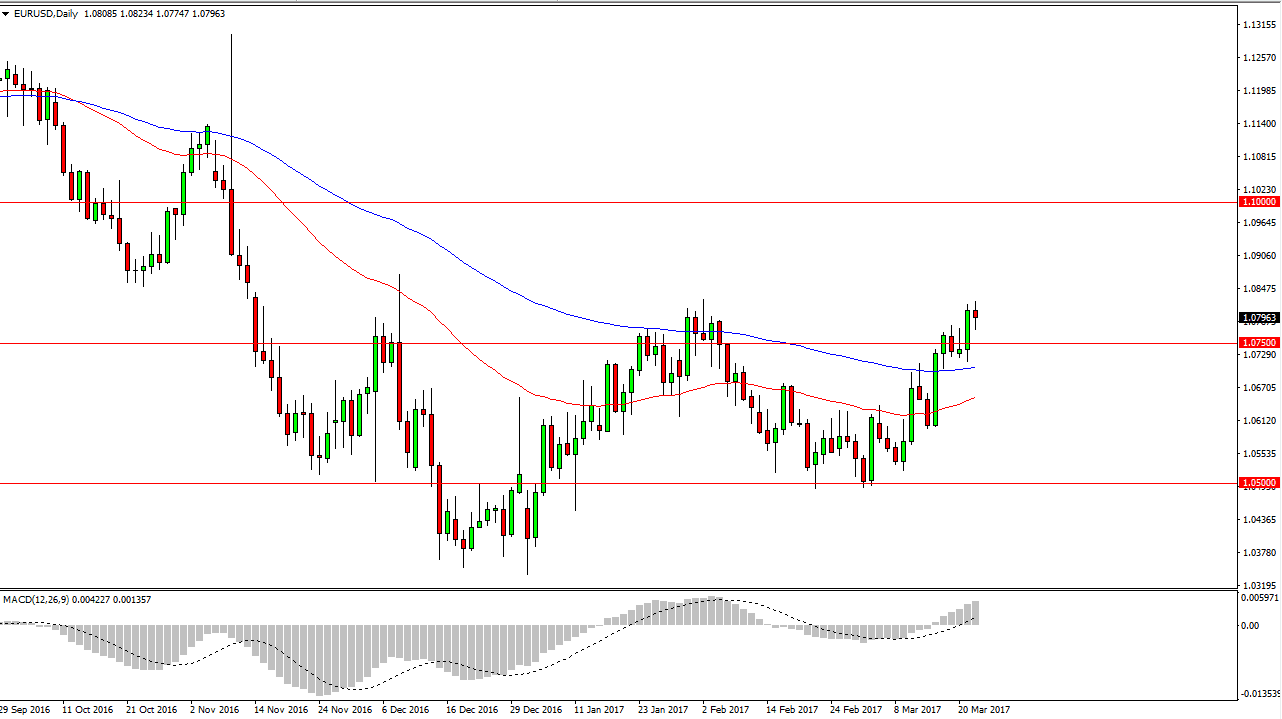

EUR/USD

The EUR/USD pair initially fell during the day on Wednesday, testing support below. The 1.0750 level has been interesting for traders recently, but I think if we can break above the top of the candle this pair is free to go much higher. We will more than likely reach towards the 1.09 handle, and then the 1.10 level above that. The market looks very bullish, and the 100-exponential moving average underneath should offer a bit of support. However, if we break down below the 1.07 handle, I would be a seller as it would show a breakdown. Currently, it appears that the market is paying attention to the ECB looking to cut back on quantitative easing, which of course is bullish for the common currency.

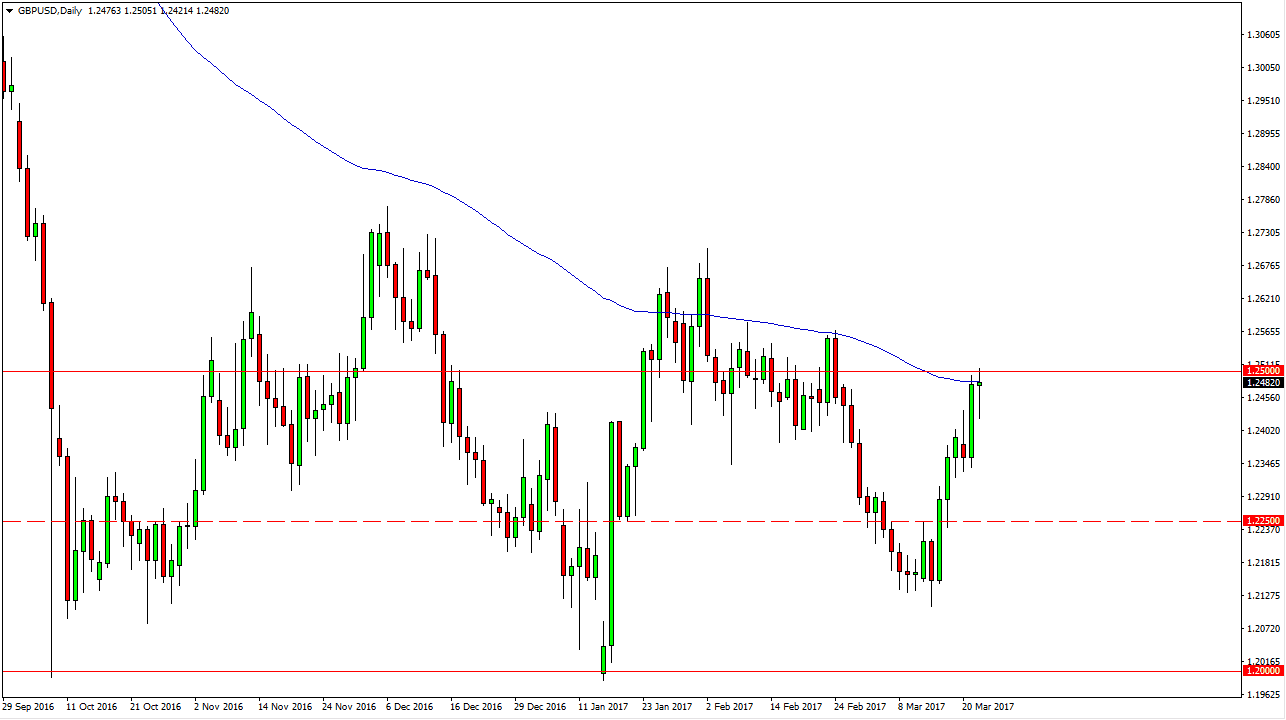

GBP/USD

The British pound had a very volatile session on Wednesday, forming a rather negative looking candle at one point, but turning around to form a hammer. The hammer sits just below the 1.25 level which of course has quite a bit of the psychological resistance attached to it. If we can break above there, I think the next test will be the 1.26 handle. A move above that would be very bullish and could send this market much higher. I think that the British pound is primed for a breakout, but it is going to be very difficult to get above the resistance. It’s going to take quite a bit of work, so you’re going to have to put up with quite a bit of volatility. However, I think the longer-term trade is positive for the British pound as it has already priced in the so-called “Article 50”, and it should not be a surprise anymore. If the US dollar continues to soften in general, the British pound might be the place to start buying as it has been beaten up so severely after the vote to leave the European Union. Longer-term, I think this is a very nice trading opportunity.