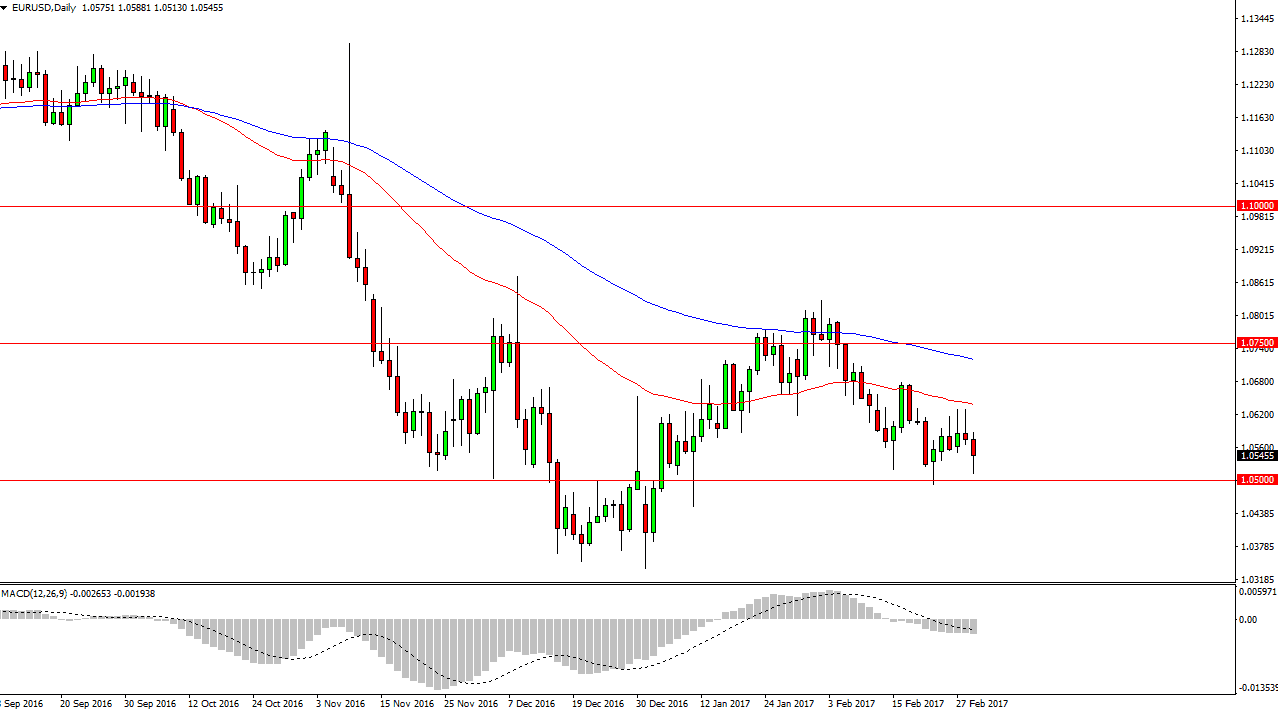

EUR/USD

The EUR/USD pair fell during the day on Wednesday, testing the 1.05 level for support. This is a market that continues to press against the 1.05 level and try to break down that barrier. If we do, the market should then reach down to the 1.0350 level. Anytime we rally, I believe that the market should start selling off, and I will have no hesitation whatsoever in shorting this market on exhaustive candles. I also recognize that the 50-day exponential moving average has been resistance, and as a result I believe it’s only a matter of time before the sellers react to any rally that comes close to that level. I recognize that the 1.05 level has been extraordinarily supportive, but we’ve seen 3 shooting stars in a row, and that typically shows that there is a massive amount of downward pressure.

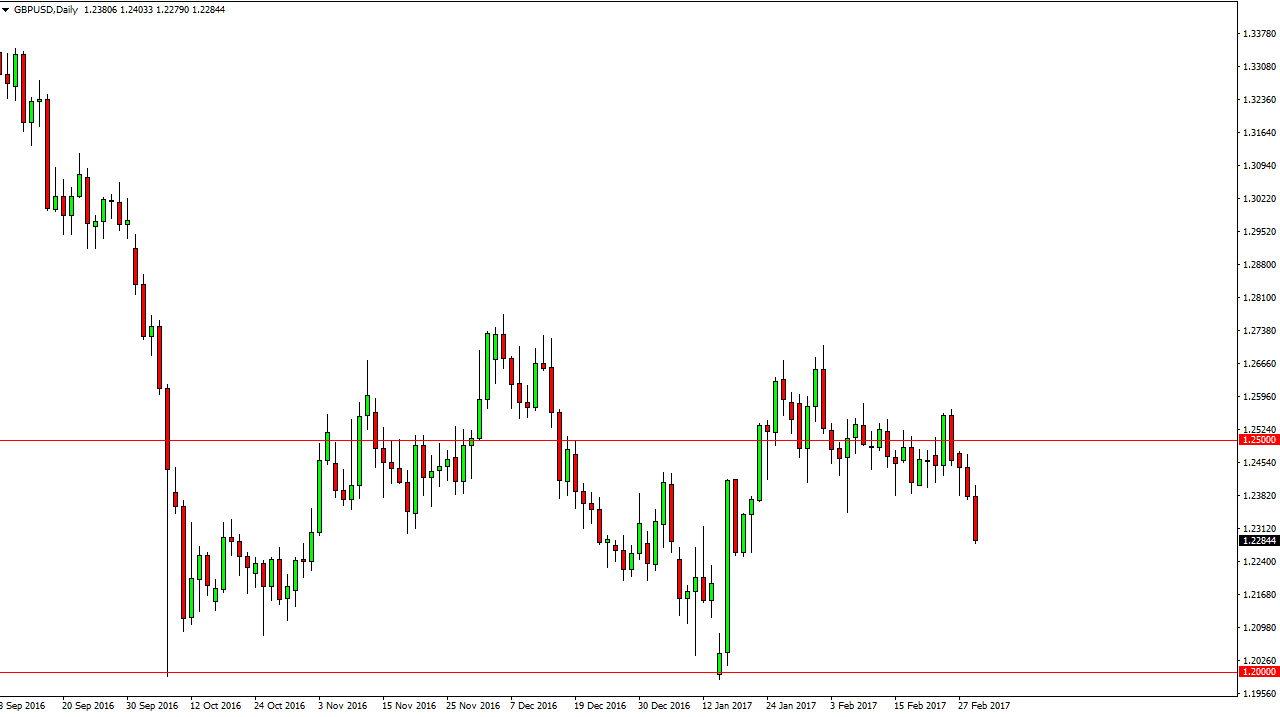

GBP/USD

The GBP/USD pair broke down during the day on Wednesday, slicing below the 1.24 level significantly. I see that there is some support at the 1.2250 level underneath, so a bounce from there is possible. However, this is a market that looks like it’s trying to roll over and I believe that this has more to do with the Federal Reserve and interest rate expectations out of the United States than anything going on in Great Britain. Because of this, it’s likely that we will see continued negativity, but it’s only a matter of time before we see a bounce as the British pound has been doing well lately.

There is the possibility of the “article 50” being triggered soon, and that of course will be negative for the British pound. At this point, my favorite trade in this market is to wait for that to happen, the subsequent massive selloff in the GBP, and then start buying hand over fist. In the meantime, it’s going to be very choppy with a slightly negative bias.